Record imported wheat stocks held in February: Grain market daily

Thursday, 8 May 2025

Market commentary

- Yesterday, May-25 UK feed wheat futures gained £1.05/t from Tuesday’s close, settling at £162.05/t. The Nov-25 contract closed at £183.05/t, also up £1.05/t over the same period. A weaker sterling against the US dollar provided key support.

- In contrast, domestic wheat markets moved differently from their Chicago and Paris counterparts, where May-25 futures declined by 0.2% and 0.9% respectively. Pressure came from improved weather conditions across the US wheat belt, though concerns over dry conditions in China’s key wheat areas helped limit further losses.

- Nov-25 Paris rapeseed futures closed at €473.50/t yesterday, down €5.00/t from Tuesday’s close. Rapeseed followed the wider vegetable oil markets down yesterday amid signs of easing tensions in the US-China trade war. Chicago soyabean oil futures (May-25) declined by 2.2%.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Record imported wheat stocks held in February

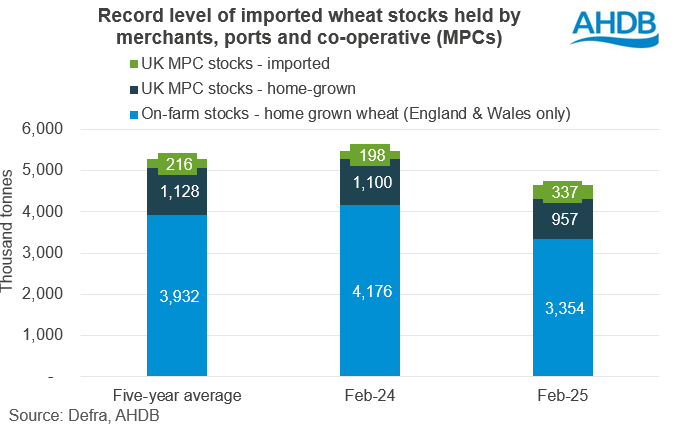

This morning, Defra released figures showing cereal stocks held on farm in England and Wales at the end of February 2025. AHDB also published data on cereal stocks held by merchants, ports and co-operatives (MPC) in the UK at the same point in the season. So, what are the key takeaways?

Wheat

Defra estimates that 3.35 Mt of home-grown wheat was held on farms in England and Wales at the end of February. This is down 20% (822 Kt) from last year, and 15% below the five-year average. It is also the lowest in recent history, with only 2021 lower at 2.7 Mt. Though this is perhaps unsurprising given the much smaller domestic wheat crop in 2024.

AHDB’s survey results shows merchants, ports, and co-ops (MPCs) held 957 Kt of home-grown wheat, down 13% year-on-year, again reflecting the smaller crop. However, imported wheat stocks show a very different picture, at 337 Kt, up 71% on the year and the highest on record (since 2008). This reflects the record level of imports this season to date, with a particular firm pace throughout the first half of the marketing year.

In March, AHDB forecast end of season wheat stocks in 2024/25 to reach 2.72 Mt, a 9% drop compared to the end of 2023/24.

Barley

At the end of February 2025, farmers in England and Wales held 1.11 Mt of home-grown barley on farm, up 28% from a year earlier, reflecting the slightly larger crop and steady export demand. Meanwhile, UK stocks of home-grown barley held by MPCs were up 1% year-on-year, at 762 Kt.

Oats

Defra estimates higher on-farm stocks of home-grown oats in England and Wales at 196 Kt, up 90 Kt on the year.

Stocks of home-grown oats held by MPCs across the UK are up 56% on the year at the end of February 2025.

AHDB’s next UK cereals supply and demand estimates are due out at the end of this month, and will give an update on what is expected for stocks at the end of this season, as we approach the new marketing year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.