Rising sterling adds to tariff worries: Analyst’s insight

Thursday, 3 April 2025

Market commentary

- Global grain and oilseed markets generally drifted yesterday, due to uncertainty ahead of the US tariff announcements which took place last night at 8pm (UK time).

- In contrast to Tuesday, yesterday old crop UK feed wheat futures prices lifted while new crop prices declined. The May-25 contract gained £2.05/t to settle at £167.95/t, while the Nov-25 contract lost £1.70/t to settle at £184.45/t.

- Paris rapeseed futures for May-25 fell €1.75/t to settle at €524.75/t, while Nov-25 prices gained €3.25/t to close at €494.00/t.

- The US President announced new tariffs on all imports into the US last night, with most rates around 10-20% (more below).

Rising sterling adds to tariff worries

UK feed wheat futures are trading lower today, pulled down by fears in global grain and oilseed markets about the impact of new US tariffs and stronger sterling.

The US government announced new tariffs for products imported into the US last night at 8 pm UK time. The UK will face tariffs of around 10% on all products and these take effect from 5 April, though many countries will face much higher rates from 9 April. Along with potential retaliation by trading partners, the tariffs are likely to impact global trade patterns and could reduce global economic growth. For more on the new US tariffs and their potential impacts on agricultural trade overall, read today's article from AHDB's Jess Corsair.

Chicago grain futures traded lower in the overnight sessions with soyabeans falling the most. This is being reflected in European futures markets this morning.

As 1 pm today (3 April) May-25 UK feed wheat futures are trading at £164.45 /t, down £3.50/t from last night’s close. Meanwhile, May-25 Paris rapeseed futures were trading at €518.00/t, down €6.75/t from yesterday’s close.

Sterling rising

Sterling reached an almost five-month high yesterday against the US dollar (£1 = $1.3005) in response to the announcements and has gained further so far today. As of 1 pm, £1 was trading at $1.3171 (LSEG) due to concerns about how global trade, which is dominated by the US dollar, could be impacted.

Meanwhile, sterling is down against the euro as the euro is up considerably against the US dollar.

These rises make sterling and euro priced goods more expensive in the global market which often trades in US dollars. As a result, domestic and European prices may need to reduce to maintain export demand into a global market. However, if maintained, the falls in sterling against the euro could offer some relative insulation for UK prices compared to wider European levels.

Nonetheless, without notable risk to global production, the demand worries, and rising sterling are likely to keep pressure on UK prices or at least limit gains in the short-term.

Risk for malting barley

One area where the US tariffs could impact the UK industry and growers is in malting barley markets as the US is the top export destination, by value, for Scotch whisky. The Scotch Whisky Association reports the value of Scotch exports to the US stood at £971 million in 2024 or 18% of the total value of Scotch whisky exports. The US was also the third largest destination by volume (behind India and France) in 2024.

The value exported to the US was down 0.7% from 2023 due to inflation reducing consumer spending in the US. Further increased costs for US consumers due to the increased tariffs pose a further risk to the export levels. In turn this could further hamper domestic malting demand, which is already under pressure.

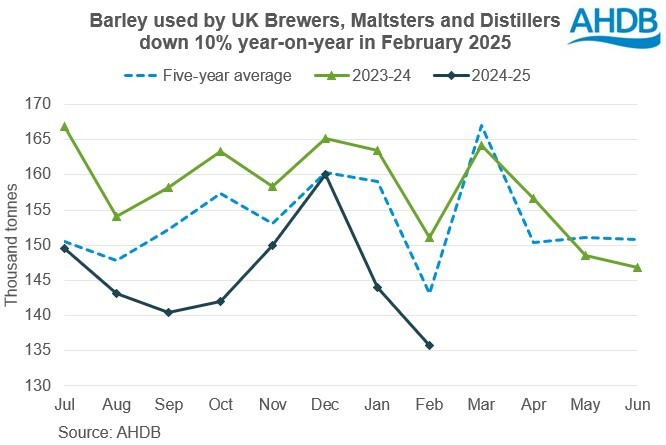

Data from AHDB released this morning shows that in February 2025, Brewers, Maltsters and Distillers (BMD) used just 135.8 Kt of barley. This is 10% lower than February 2024 and the lowest monthly total since February 2022 (134.3 Kt).

Total July 2024 – February 2025 usage is down 9% on the same period last season (2023/24). Demand is under pressure due to the cost of living impacting spending within the UK and trends for younger people to drink less alcohol. This decline, and sluggish malting demand across Europe, are part of why malting premiums have fallen sharply this season.

While 2025/26 premiums will also be influenced by the quality and size of the 2025 crops at home and wider, the demand picture is not encouraging. We will need to monitor this situation, and it may be useful to stay in contact with your preferred merchant(s) and trader(s) to help maximise potential options. These top tips on contracts for cereal sellers, also known as the cereal sellers checklist, could also help.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.