Slowing price increases keep the SPP short from cost of production

Thursday, 15 September 2022

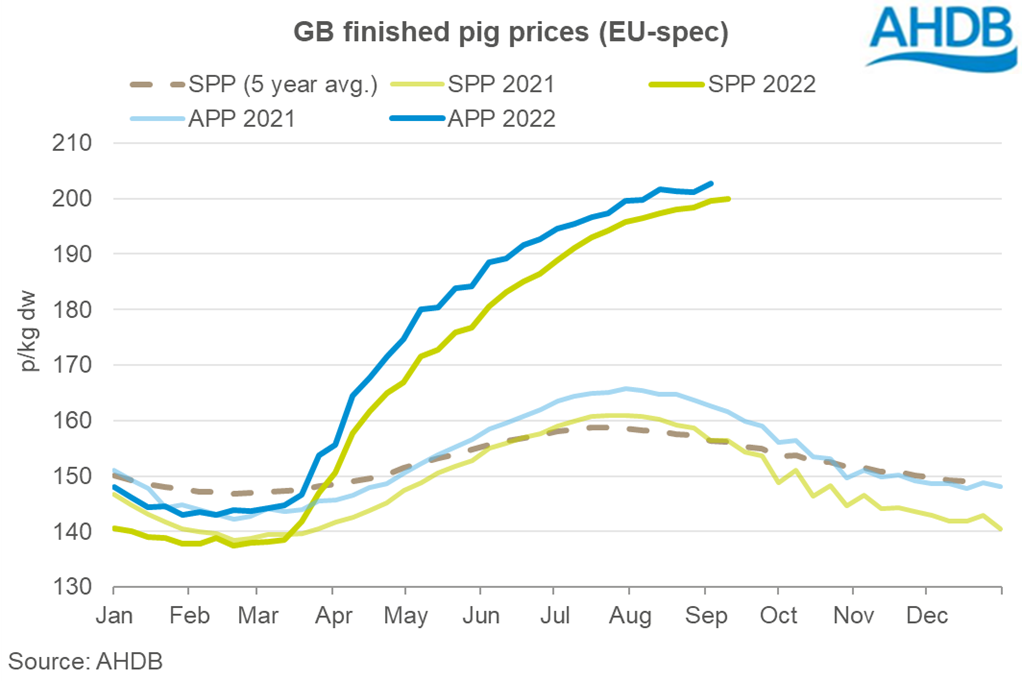

GB finished pig prices have been rising since late March. However, the rate of increase has tailed off in recent weeks compared to the spring. Prices still remain some way off covering the estimated cost of production for many farmers, leaving the industry in an incredibly challenging situation. Processors have also been struggling with issues including staffing brought on by Brexit and the pandemic, which reduced slaughter capacity creating a backlog of pigs.

In the week ending 10 September, the EU-spec SPP reached 199.93p/kg. This brings the average for the four weeks ending 10 September to 198.98p/kg, 3p up from the average price for the previous four-week period. The EU-spec APP has been following the same trend, and in the week ending 3 September reached 202.79p/kg, bringing the four-week average to 201.71p/kg. Despite deadweight pig prices now being significantly higher than the 5-year average, inflation has driven up input costs, especially for feed and energy.

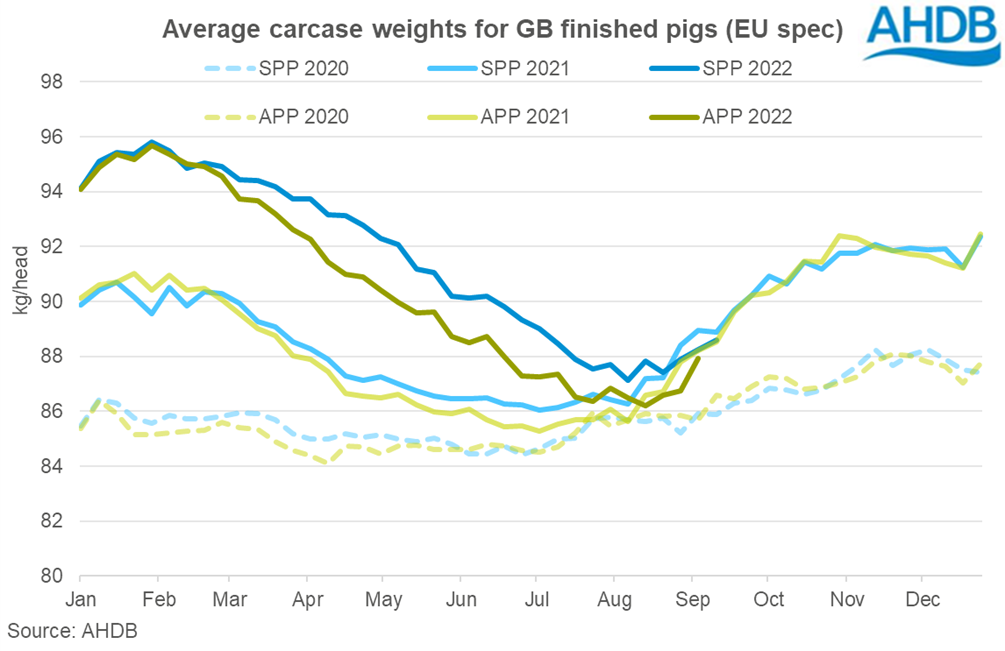

Carcase weights averaged 88.61kg in the week ending 10 September, bringing the average for the four week period to 88.04kg, an increae of 490g compared to the previous four weeks. Weights peaked at the end of January when they sat 10kg above the 5 year average, due to the backlog. Since then, carcase weights have been gradually decreasing as processors made progress on the backlog. Weights steadyied at the end of July and through August, and are now sitting below the recorded weights from this time last year.

Estimated clean pig slaughter for the four weeks ending 10 September was 654,300 head, down 8,400 head compared to the previous four weeks. Year-to-date slaughter (02 Jan- 10 Sep) stands at 6.39 million head, down 1% compared to this time last year.

Defra figures show that the English breeding herd contracted 18% year on year as of June 2022, and our summer forecast anticipates we will see a 6% fall in pig meat production by the end of 2022, weighted on a 15% drop in clean pig slaughter in the second half of the year. As winter draws closer and seasonal demand picks up, we will be looking closely at the impact on the pork sector, especially with potential CO2 shortages on the horizon.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.