Sterling collapses, but is a further fall on the way? Grain Market Daily

Wednesday, 16 September 2020

Market commentary

- UK feed wheat futures (Nov-20) closed at £174.50/t yesterday, a fall of £1.95 /t. The new crop (Nov-21) contract also lost ground, closing at £153.10/t, down £0.90/t.

- Sterling recovery was a key contributor to the decline in values, gaining strength against the dollar. Read more on the drivers for sterling and where it may go next below.

- Global wheat and maize futures were also in decline yesterday, undoing some of the gains made in past weeks. Following significant gains in recent weeks, and growth in long positions on maize futures, it is likely that profit taking has played a part in the fall.

- The AHDB skills team has released a webinar focussing on “negotiating for success”. Click here to give it a listen.

Sterling collapses, but is a further fall on the way?

The path of currency has been pivotal to the value of domestic agricultural prices in recent weeks. The 4.4% devaluation in the value of sterling against the dollar between 1 Sep and 11 Sep, pushed UK feed wheat futures (nearby) up £7.65/t.

Since Friday, the value of sterling has recovered slightly as it begins to retrace its steps. But, where sterling goes next will have significant ramifications for the value of agricultural products and inputs. The path for the currency is not exactly plain sailing either, with a number of upcoming political and economic drivers that could have a very large sway upon agriculture prices.

The technical picture

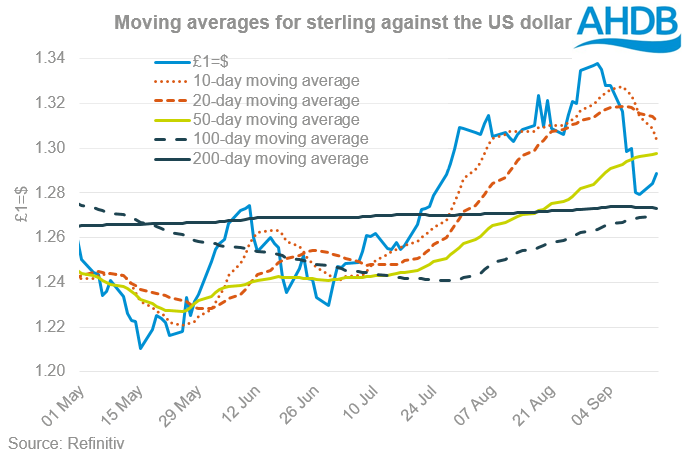

While sterling may have devalued significantly over the course of September, it is worth highlighting that its peak of £1=$1.3382 on 1 Sep, was the highest point since June 2018, and followed a period of significant growth.

As such from a technical standpoint, the shorter term moving averages (20-day and 50-day) are still significantly above the longer term averages (100-day and 200-day). We are beginning to see a directional shift in the 20-day moving average, and combining that with a 10-day average a bearish trend still looks set to continue.

Sterling has ticked up for the past two days but could still move lower to July levels in the mid £1=$1.20s.

What could change this direction?

As I mentioned there are a number of key political and economic drivers for currency in the coming months. We have the picture with Brexit, the economic fallout from coronavirus and the US election to contend with before the end of November.

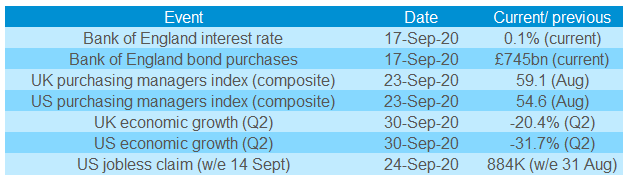

Before the end of September the following economic events could be crucial for the path of sterling against the dollar;

The impact that these reports have on currency will depend on how they perform against market expectations.

With UK wheat trading at or close to import parity, currency will be a key driver for prices. Any continued weakness in sterling would support prices, but also make imported inputs such as fertiliser and fuel more expensive.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.