Straw market outlook: Grain market daily

Thursday, 15 February 2024

Market commentary

- UK feed wheat futures (May-24) closed at £165.70/t yesterday, down £2.55/t from Tuesday’s close. New crop futures (Nov-24) fell £2.90/t over the same period, ending the session at £184.35/t.

- Competitive Black Sea supplies continue to impact EU export demand, contributing to expectations of heavy wheat stocks. FranceAgriMer estimated yesterday that French soft wheat ending stocks for the 2023/24 season would reach 3.5 Mt, up from last month’s estimate of 3.44 Mt and up 37% on the year (LSEG).

- Paris rapeseed futures (May-24) were down €0.50/t yesterday, closing at €424.50/t. The Nov-24 contract, ended yesterday’s session at €428.75/t, up €0.25/t over the same period.

- Old crop rapeseed futures followed the US soyabean market down yesterday. Pressure came from ongoing expectations of abundant South American supplies, as plentiful rain across key growing regions in Argentina supported current production estimates.

Straw market outlook

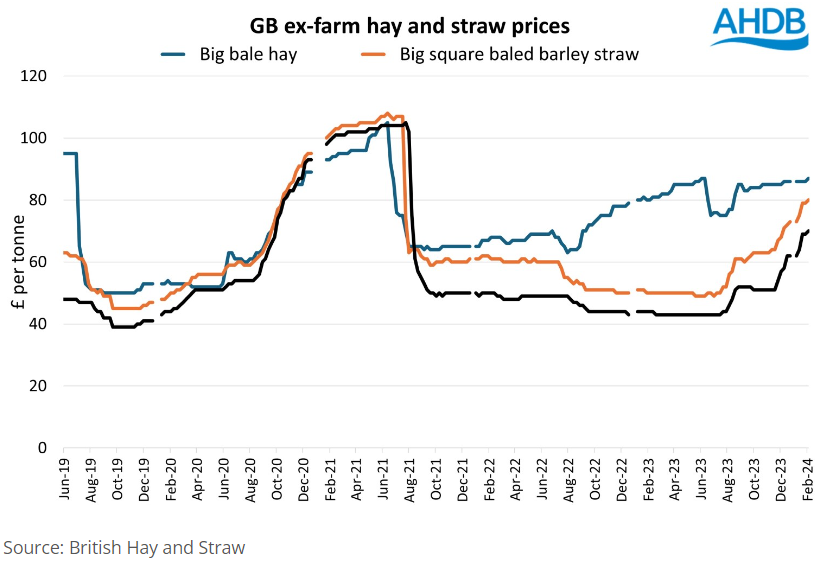

Through 2022 and the first half of 2023, straw was an unusual farm input – it did not see any inflation while other key raw materials were setting price records. Now though, the wet summer, autumn and winter of 2023 are reshaping the straw market. This creates an issue for businesses using straw for either bedding or feeding, with prices in 2024 set to return to higher prices that were last seen in 2020/21.

Remember the dry harvest of 2022?

Harvest 2022 was the perfect year for arable farmers to bale straw. A dry harvest enabled straw to be moved off fields swiftly, with reduced risks of soil compaction. Dry weather also meant that wet straw waiting to dry in the field wasn’t delaying establishment of the following crop. This created an increased incentive for farmers to bale and sell their straw, creating a glut in the market.

Tightening supplies expected through 2024

Weather wise, 2023 couldn’t have been more different to 2022. The incentive of a dry summer to give arable farmers the confidence to bale straw simply didn’t materialise. Instead, wet soils (less able to support balers and trailers) and wet straw waiting to be removed delayed establishment of the following crop. Understandably, some farmers weren’t willing to embrace the risks, and instead would have decided to chop the straw and return it to the soil.

Also in 2023, the realisation of higher fertiliser costs was starting to be felt on the ground. With limited increases in straw prices by harvest 2023, this meant that arable farmers were less able to recover the value of crop nutrients being lost when straw was moved off the farm.

The market is now reflecting the reality, with barley straw at £80 per tonne and wheat straw £70 per tonne for the first time since mid-2021. It must be stressed that these are ex-farm prices: haulage costs have to be accounted for, which are driven by journey distance, fuel prices and labour costs.

Straw prices are increasing relative to broader forage costs – illustrated in the chart above by what is happening to hay. This will challenge farmers that are using straw as a bulking ingredient in feed rations to find alternative materials. This might not be an immediate issue given that forage feed crops would have benefitted from the wetter year in 2023 and produced more bulk. Depending on locality, this should create some alternatives to straw in feed rations.

Significant risks on the horizon for harvest 2024

The wet weather in 2023 created a double whammy for the straw market – less straw from the current harvest and reduced crop areas for 2024. The wet autumn in 2023 limited the ability of arable farmers to plant winter cereal crops. As a result, crop areas are expected to be much reduced for harvest 2024. We will update crop area estimates for harvest 2024 in mid-March.

In a wet autumn, farmers typically plant less winter and more spring cereal crops. However, spring-sown crops are more susceptible to spring and summer weather (especially dry conditions) so straw yields can be more variable. Also, high seed costs and low grain prices don’t provide much of an incentive to max out spring crop areas.

However, the increasing straw price may well act as an incentive for higher spring barley acreage – especially in more mixed farming areas where haulage costs are less erosive to arable farm straw prices.

Conclusions

Straw prices have been later to suffer from inflation compared with other farm inputs. However, prices are now rising quickly and will result in the highest bedding costs seen for several years – this is not good news for businesses that are significant users of straw. The weather of the last six months has not only reduced the current supply, but it also casts doubt over the scale of the 2024 harvest.

In line with history, a period of high straw prices will likely challenge livestock businesses to consider alternative materials. However, without significant change in farm infrastructure (including manure management) this is easier said than done.

Thankfully, escalation in straw prices didn’t come in 2022 when other costs were inflating massively. But the fall in other costs, such as feed, will be offset to an extent by the need to pay higher straw prices through 2024.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.