Strengthened sterling stalls price push in line with Paris: Grain market daily

Wednesday, 6 April 2022

Market commentary

- May-22 London feed wheat futures closed yesterday at £305.25/t, up £1.85/t on the day before. The Nov-22 (new-crop) contract gained more (+£4.80/t), to close at £267.05/t.

- London futures movement followed US markets. Chicago wheat (May-22) futures gained $12.85/t, to close at $384.02/t. Whilst the new-crop contract (Dec-22) closed at $377.41/t, up $11.85/t from Monday. Much of the move is on the back of a bearish USDA crop conditions report, pegging just 30% of winter wheat in good/excellent condition.

- Paris rapeseed (May-22) jumped €15.50/t yesterday, closing at €959.75/t. The Nov-22 contract continued the upwards trend, closing yesterday at €802.00/t, up €12.50/t from Mondays close.

Strengthened sterling stalls price push in line with Paris

Markets have been very sensitive to new news in recent weeks, with escalations in Ukraine providing underlying support. Increased sanctions on Russia from the West, coupled with poorer than expected US crop conditions have heightened supply concerns. In turn, this offered extra support to grain markets yesterday including European markets.

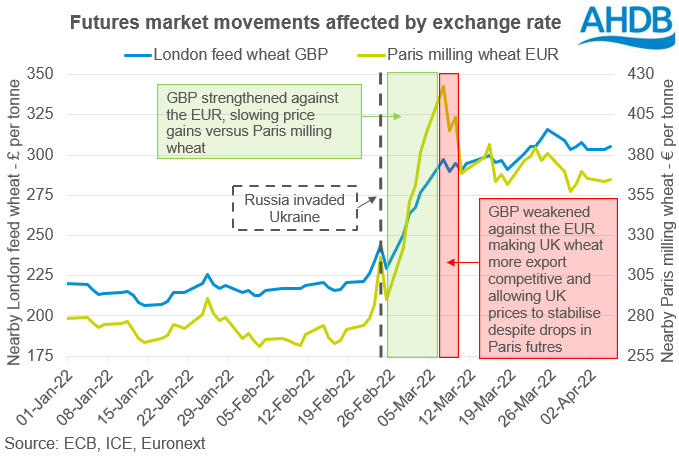

Since Wednesday last week (30-Mar), nearby Paris milling wheat futures have gained value. At the same time, UK feed wheat futures have lost value. When the UK supply and demand situation is tight it could come as a surprise that the UK didn’t track Paris. But this is where exchange rates play a part.

The power of exchange rates

Shortly after the invasion of Russia on Ukraine we saw sterling gain strength versus the euro. When wheat markets jumped up, London futures didn’t record as strong gains as those seen in Paris futures because of the strengthening pound.

In the past week, we have seen a similar effect. Price gains have been limited in the UK as again, sterling has strengthened against the euro.

This said, the US dollar has strengthened against both the euro and the pound, but Chicago wheat futures (nearby) have gained greater value than both European contracts. You could expect European markets to have stronger gains than the US if based on the effects of exchange rates alone. However, Chicago contract movement is stronger on the back of US specific news in the past week. Last Thursday (31-Mar), US old-crop wheat stocks were pegged lower (as at 1 March) than trade expectation. At 27.9Mt, these are the lowest wheat stocks at this time of year since March 2008. And on Monday (04-Apr) the first official US crop conditions report of 2022 showed winter wheat conditions were one of the lowest this century. This news allowed US markets to move higher at a greater rate than other markets.

Considering the UK is following global markets, wider news and indeed exchange rates will continue to impact moves.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.