The focus of grain and oilseed prices is on US acreage: Grain Market Daily

Tuesday, 1 July 2025

Market commentary

- Nov-25 UK feed wheat futures fell £2.40/t (1.4%) yesterday to close at £175.25/t. The May-26 contract fell £1.90/t over the same period, to close at £187.25/t. Yesterday, sterling reached its highest level against the US dollar since October 2021, with £1 = $1.3733 (LSEG).

- Chicago wheat and Paris milling wheat futures (Dec-25) decreased by 0.5% and 0.7% respectively. Global wheat futures are under pressure due to harvesting progression in the Northern Hemisphere and the current lack of factors supporting prices. The stronger euro against the US dollar is putting pressure on Paris futures, with the exchange rate approaching the strong resistance level of €1= $1.2000.

- Nov-25 Paris rapeseed futures fell €3.75/t (0.8%) to €482.50/t. However, Winnipeg canola futures for November 2025 increased by 2.4%. Better prospects for rapeseed production in the EU are putting pressure on Paris futures.

The focus of grain and oilseed prices is on US acreage

Following yesterday's USDA Acreage and Grain Stocks reports, wheat and maize prices finished the day mixed. Prices for the 2024 crop increased, while those for the 2025 crop fell.

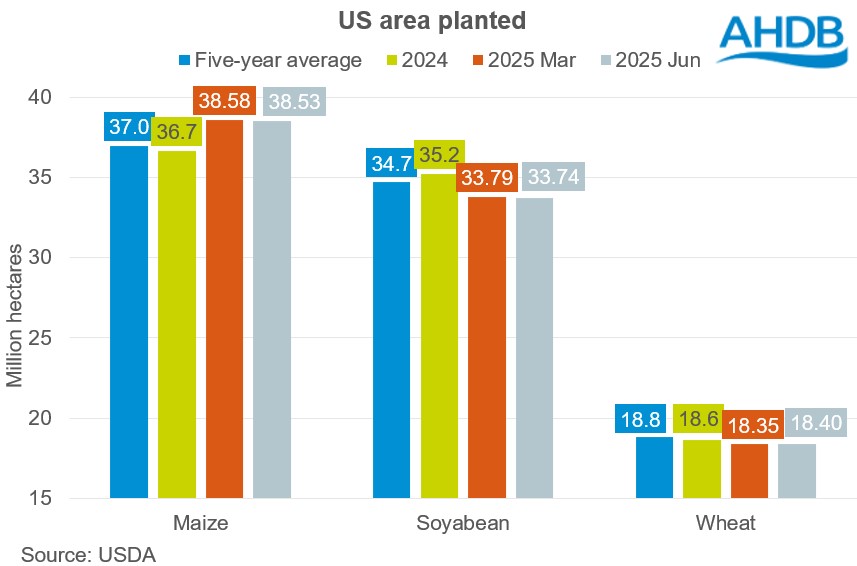

The USDA showed higher-than-average trade estimates for wheat in the planted area, while the estimates for maize and soybeans were lower than average.

Total US wheat acreage decreased by 1.3% compared to 2024 and by 2.2% compared to the five-year average. However, it is important to be aware of the increasing trend in US wheat yields, and the final production forecast is higher. Yesterday's USDA crop progress report showed that, as of 29 June, the percentage of winter and spring wheat in good and excellent condition in the US decreased by 1% compared to the previous week's figures. Meanwhile, 37% of winter wheat has been harvested in the US, which is below the five-year average for this time of year (42%).

Corn planted US acreage was up 5.1% from 2024 and 4.2% from the five-year average. The latest estimates for maize area in the US represent the third highest planted acreage since 1944. Moreover, as of 29 June, the percentage of US maize in good and excellent condition increased by 3% compared to the previous week's figures. This combination exerts pressure on the maize market for feed grains overall.

US soybean acreage is down by 4.2% compared to 2024, and by 2.7% compared to the five-year average. There were no significant changes in soyabean crop conditions in the US compared to the previous week.

Where next?

It can be concluded that there is little difference between the figures for area planted in the US in March and yesterday's estimates. Market participants will now turn their attention to crop progress estimates.

Bearish sentiment is reflected in the net short positions of speculative traders in Chicago and Paris wheat futures. There will be less trading in Chicago this week due to the US Independence Day national holiday. It will be interesting to see how the grain and oilseed markets perform in the run-up to the long weekend.

From a technical perspective, wheat futures prices in Chicago and Paris must first cross strong support levels before they can decline further.

The global trend is having an increasingly influencing on the domestic market, largely due to the growing import of wheat and maize.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.