Tighter wheat and barley balance sheets in 2024/25: Grain market daily

Thursday, 24 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £184.05/t, down £0.55/t from Tuesday’s close. The May-25 contract ended the session at £196.80/t, down £1.20/t over the same period.

- Domestic wheat futures and Paris milling wheat futures were under pressure yesterday despite a climb in Chicago wheat futures. Paris wheat prices faced pressure from a slower pace of EU exports compared to the same period last year. Wheat prices are also faced with uncertainty from Russia's recent efforts to regulate its grain trade.

- Nov-24 Paris rapeseed futures closed at €509.75/t yesterday, losing €1.75/t from Tuesday’s close. The May-25 contract declined by €1.75/t over the same period, ending at €510.50/t.

- European rapeseed futures prices fell yesterday after two days of support. However, Chicago soyabeans futures gained yesterday on support from export demand and as commodity funds were net buyers of soyabeans on Wednesday.

Tighter wheat and barley balance sheets in 2024/25

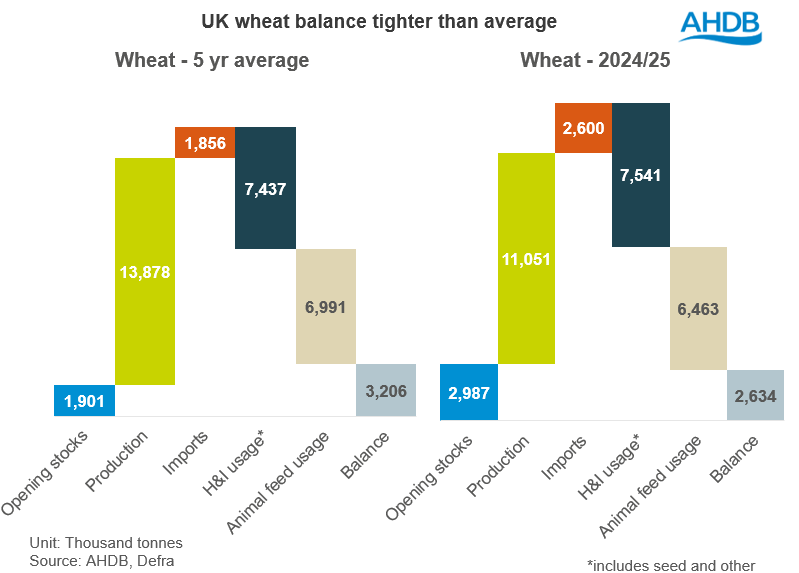

Earlier today, AHDB published the 2024/25 Early Balance Sheets for wheat and barley, giving a first look at supply and demand for the season ahead.

For wheat, reduced supply outweighs an estimated decline in demand. Whereas for barley, a significant climb in consumption outweighs increased availability. Below is an overview of the key drivers of supply and demand, and areas to watch as the season progresses.

Wheat

Availability

- In 2024/25 availability of wheat is estimated at 16.638 Mt, down 9% on the year. This is largely due to an estimated 21% reduction in the UK 2024 wheat crop compared to a year earlier.

- The decline in wheat supply is despite the heaviest opening stocks since at least 1999/00, as well as increased imports (up 163 Kt year-on-year).

Usage

- This season, total domestic consumption of wheat is estimated at 14.005 Mt, down 6% on the year.

- Wheat for Human and Industrial (H&I) consumption is forecast down 3% on 2023/24, with usage for both flour milling and bioethanol production down on the year. Lower ethanol prices are disincentivising production, with a shift to increased maize usage also expected due to its relative price. Wheat usage by flour millers was off to a slow start, and industry reports suggest that a steady pace will continue.

- Wheat used in animal feed production is expected to fall by 9% this season compared to last, with compounders minimising usage in favour of more competitively priced cereals. The amount fed on farm is also forecast to decline due to tighter availability and the higher selling price of wheat over other grain.

Balance

- The balance of supply and demand in 2024/25 is estimated at 2.634 Mt, down 23% on the year and well below the five-year average.

Barley

Availability

- This season, availability of barley is expected to increase 1% year-on-year to 8.497 Mt. This is due to a 3% rise in production, despite a 4% and 60% decline in opening stocks and imports respectively.

Usage

- Total domestic consumption of barley in 2024/25 is forecast up 4% on 2023/24.

- Barley used for H&I consumption is estimated down 4% on year earlier levels, with both brewing and distilling experiencing sluggish demand.

- On the other hand, usage of barley in animal feed is expected to rise 8% on the year. As mentioned above, wheat is expected to drop back in rations due to its relative price, while barley and maize demand will likely remain firm. Barley fed on farm is also expected to be historically high, with a surplus of domestic grain available, and a poor price for farmer selling when compared to other cereals.

Balance

- This season, the barley supply and demand balance is estimated at 1.921 Mt, down 9% on the year, and below the previous five-year average of 2.301 Mt.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.