UK 2025 wheat area recovery but lower bread wheat share: Grain market daily

Wednesday, 11 June 2025

Market Commentary

- Nov-25 UK feed wheat futures fell again yesterday by £1.65/t (-0.9%), to close at a contract low of £176.85/t

- Domestic feed wheat futures followed global prices, with Paris milling wheat (Dec-25) and Chicago wheat futures (Dec-25) both down by 1.3% and 1.6% respectively. Pressure came largely from better-than-expected crop condition scores for spring and winter wheat in the US this week

- Paris rapeseed futures fell €2.75/t (-0.6%) yesterday, closing at €492.25/t. This followed Winnipeg canola futures (Nov-25) which fell (-0.4%) due to favourable weather conditions providing a good start for seeded crops. Meanwhile, Chicago soya bean oil futures (Dec-25) gained 0.8%

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

UK 2025 wheat area recovery but lower bread wheat share

AHDB’s newly released Planting and Variety Survey results provide cropped area estimates for the 2025 harvest, with regional and variety details.

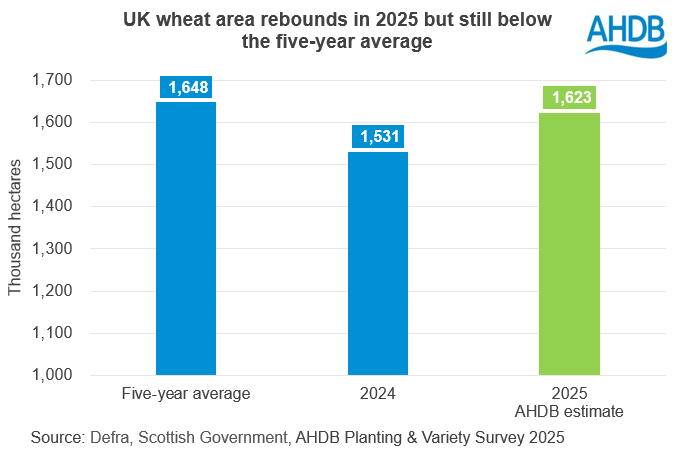

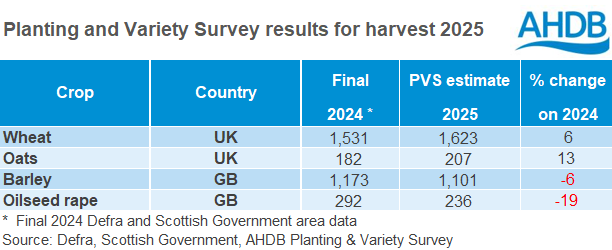

The survey estimates the UK wheat area for harvest 2025 at 1,623 Kha, up 6% on last year. This is slightly more than growers had planned in the AHDB’s Early Bird Survey, likely helped by improved autumn weather in parts of England and Wales. However, this is still slightly below the five-year average (2020–2024) of 1,648 Kha.

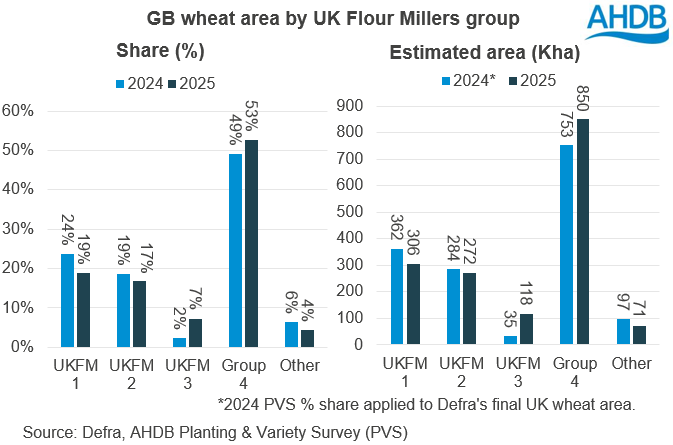

However, the area planted with bread-making suitable wheat varieties (UK Flour Millers group 1 and 2 varieties) has decreased compared to last year. Group 1 varieties now make up 19% of the wheat area in Great Britain, down from 24% in 2024, while Group 2 varieties have fallen from 19% to 17%.

In total, the combined area of Group 1 and 2 varieties is estimated to have decreased in terms of hectares in 2025.

The reduction in wheat area suitable for bread-making suggests potentially tighter production in 2025. A notable increase in final yields and/or quality compared to 2024 could potentially compensate. However, given the poor condition of the crop at the end of May, there is uncertainty over both final yields and quality.

In contrast, the area planted with Group 3 wheat varieties has risen from 2% to 7%, which may reflect the availability of a new, higher-yielding option. Group 4 varieties, including both hard and soft types, now represent 53% of the total wheat area, the highest proportion recorded since 2016.

The key findings from other crops are summarised below.

- The UK oat area is estimated at 207 Kha for harvest 2025, up 13% on the year and the highest level since 2020

- The total GB barley area for harvest 2025 is estimated at 1,101 Kha, down 6% on the year. The GB spring barley area is estimated at 750 Kha, down 6% year-on-year, while the GB winter barley area is estimated to be 7% lower at 352 Kha

- The GB OSR area is estimated at 236 Kha; this is 19% lower than 2024 levels

- For harvest 2025 KWS Dawsum is the most popular wheat variety, with 15% of the total GB wheat area. For barley, Laureate is the most popular variety, accounting for 43% of the total GB barley area

For more details and regional breakdowns, please visit the Planting & Variety Survey webpage.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.