UK barley exports remain slow: Grain market daily

Friday, 24 January 2025

Market commentary

- UK feed wheat futures (May-25) ended yesterday at £191.50/t, up £1.00/t from Wednesday’s close. The Nov-25 contract fell £0.10/t over the same period to close at £195.40/t.

- Domestic wheat futures rose yesterday mainly due to supported maize markets. Chicago wheat futures (May-25) were up 0.1% and Paris milling wheat futures (May-25) were unchanged at yesterday’s close. Chicago and Paris maize futures (Mar-25) were up 1.1% and 0.7% respectively at yesterday’s close. The Argentina government announced yesterday that it would temporarily reduce taxes on grain exports, which weighed on the Chicago market this morning.

- May-25 Paris rapeseed futures closed at €528.50/t yesterday, up €1.50/t from Wednesday’s close.

- Chicago soyabean futures (May-25) were up 0.9% on yesterday’s close, supported by news of quality issues (phytosanitary requirements) with Brazilian soybeans shipped to China. Also, the USDA said yesterday that direct payments to farmers would be an option to offset losses from proposed tariffs (LSEG). This news has added some pressure to markets, especially for soyabeans.

UK barley exports remain slow

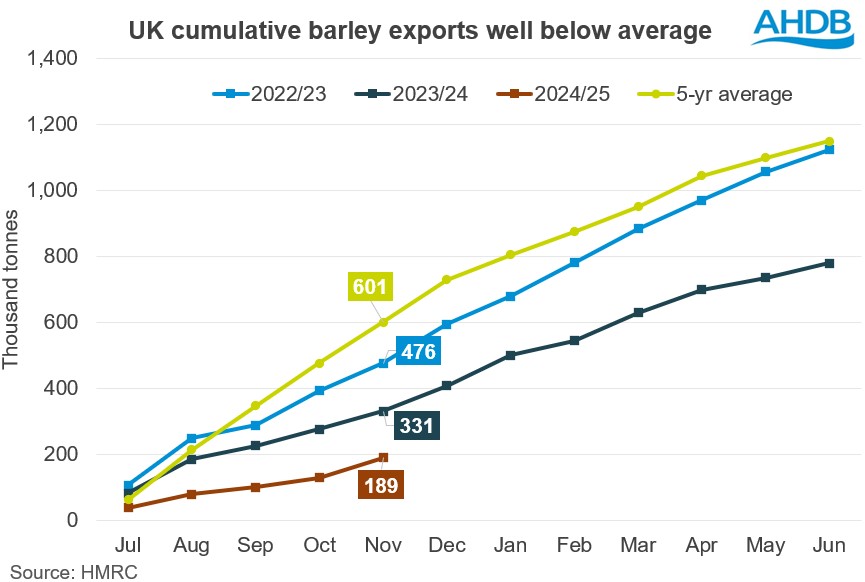

From the start of the current marketing year, UK barley exports have been at a significantly low level. The key reason for this is falling demand from EU countries, on the back of a stronger sterling and increased production in the EU. Slightly lower nitrogen levels in the domestic crop this season have also limited export potential in some cases.

On average, over the last 5 years, 88% of all UK barley exports have gone to EU countries. In the 2024/25 marketing year (from July to November) barley exports were 68 % lower than the five-year average for this period at 189.3 Kt. Compared to the same period last season when exports totalled 330.9 Kt, exports in the 2024/25 season are down 43%.

While UK exports are less competitive on global markets due to a stronger sterling, sluggish demand also plays a part. According to the EU commission, barley imports into the EU this season up to 19 January were down 41% on year earlier levels. As mentioned above this is likely due to the 5% rise in EU barley production, and increased maize imports in the EU on the back of more competitive pricing.

What does this mean for UK growers?

In our November supply and demand estimates, the balance of UK supplies versus forecast usage suggests a tighter than average barley balance this year of 2.051 Mt. From this balance, there is an additional operating stock requirement of 800 Kt (the amount of old crop grain needed in the new season until new crop can be utilised). As such, there is 1.251 Mt of barley available for either export or free stock, again below average. Therefore, even with a low level of UK barley exports, it’s likely that we will end the season with lower than usual ending stocks.

Despite this, while base feed barley prices have been supported while tracking global markets, domestic premiums have been under pressure due to steady demand from brewers, maltsters and distillers, and a decent quality malting crop.

Looking further ahead, the UK barley area is forecast to decline for harvest 2025, and along with potentially lower opening stocks next season, we could see some overall support moving forward. However, any potential support in malting prices specifically will be limited by doubts over domestic demand for the higher quality grain.

Look out for our next update on UK supply and demand estimates due out at the end of this month.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.