UK cropping intentions move back to wheat: Grain Market Daily

Friday, 27 November 2020

Market commentary

- May-21 UK wheat futures closed unchanged from Wednesday, at £193.00/t. While the Nov-21 contract gained £0.35/t, closing at £159.95/t.

- IKAR consultancy sees Russia’s 2021 grain crop at 125Mt. The Russian wheat harvest in 2021 may decline to 78Mt, from 84Mt this year. Russian weather will be a focus throughout this marketing year.

- 96% of French soft wheat crop is rated good or excellent (at 23 November) according to FranceAgriMer.

- The Early Bird Survey (EBS) has been released today, providing the industry with the first look into UK cropping intentions for 2021 harvest.

UK cropping intentions move back to wheat

The Early Bird Survey (EBS) has been released today, providing the industry with the first look into UK cropping intentions for 2021 harvest.

Better weather than last year during this year’s drilling campaign, resulted in the land becoming more accessible for many. This has led to intentions shifting back to conventional winter cropping.

Oilseed rape (OSR) continues to see an area decline, with growers intending to plant the lowest area since 1986. Successive challenging years with pest damage and poor weather, could well be driving this change. In addition, the EBS shows an increase in other break crops.

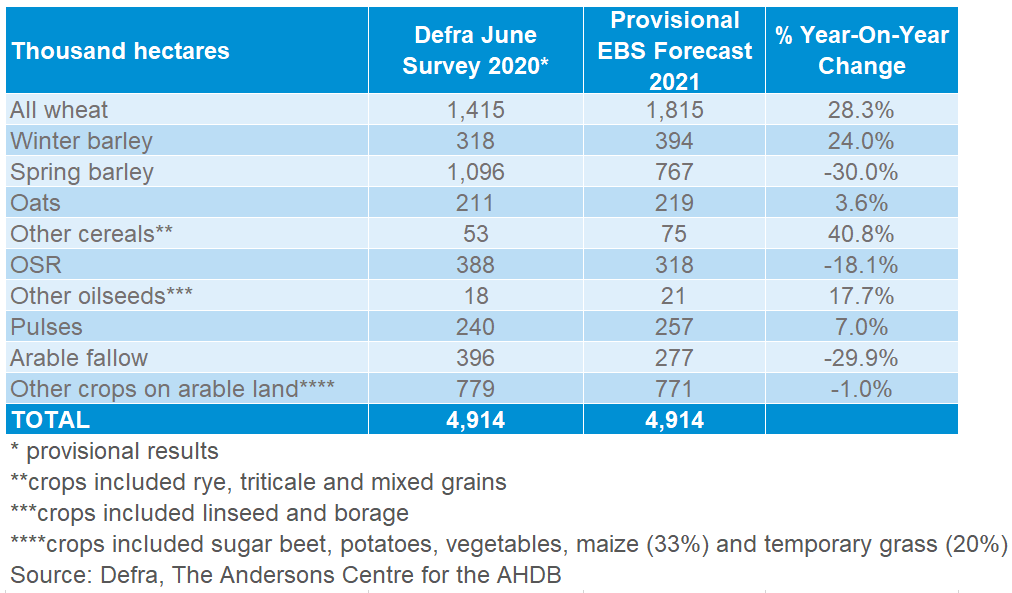

Key highlights of the provisional Early Bird Survey results include:

- Wheat area is estimated to increase by 28.3%, with intended cropping area at 1,815Kha.

- Winter barley is estimated to increase by 24%, with intended cropping area at 394Kha.

- OSR area estimated at 318Kha, a decrease of 18.1% year-on-year to the lowest area so far this century.

- Oats continue to grow in area, estimated to increase by 3.6%, with the area intended at 219Kha.

- Arable fallow is down 29.9%, with more favourable weather this autumn.

The total wheat area intended to be planted this year is in line with the 5-year average (exc. 2019/20) of 1,802Kha (2015-19). The start of autumn was significantly better than last year which has allowed winter plantings to progress better. With better weather forecast over the coming week, it is anticipated that planting will be able to continue.

Improved drilling conditions have resulted in winter barley area intentions increasing by 24%, to 394Kha. A significant proportion of winter barley will have been sown already. Despite this increase, winter barley intentions are down on the 5-year average of 429Kha (exc. 2019/20).

The uptick in winter intentions has led to a decline in spring planting intentions on the year. Last season saw a heavy reliance on spring drilling, given the challenges of the weather during the autumn window.

Better conditions this year have seen that behaviour largely reversed. The intended spring barley area has reduced to 767Kha. Excluding 2019/20 spring barley area is still above the 5-year average of 711Kha, as growers increase their reliance on spring cropping. The area of both winter and spring barley remains over 1,100Kha.

Back in September, Helen and James gave some insight into what planted areas could look this season. Helen stated that should more “normal” conditions prevail, we’d see the UK wheat area to recover for harvest 2021. Further to that, James showed that wheat was top of the gross margins.

The more detailed regional breakdown of the EBS will be released following the publication of final crop areas by Defra in December.

The Early-Bird Survey (EBS) is undertaken each autumn to assess national cropping intentions. It is carried out by The Andersons Centre with the help of the Association of Independent Crop Consultants (AICC) and other agronomists. Over 80 agronomists took part in the survey contributing over 615Kha of arable land stratified across all regions of Great Britain to establish cropping changes on individual farms as a representation for the national change in cropping.

The survey is based on measuring cropping change from the harvest just completed to the current growing season and plans for spring drilling. Rotational area surveyed is selected as those with no net change to their arable area, or where there is change, it can be reconciled within the rotation. In other words, because the survey measures the percentage change of each crop, the total crop area has to remain unchanged overall. Using the provisional results from DEFRA’s UK June Survey, it is then possible to predict crop areas for harvest 2021.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.