UK dairy trade balance back into deficit

Thursday, 17 March 2022

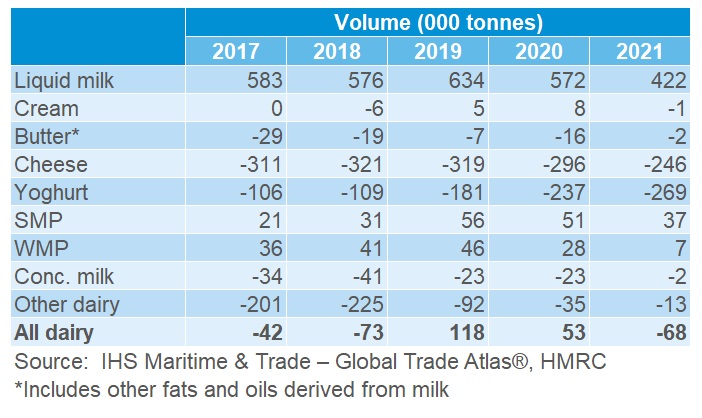

The UK trade balance for all dairy products[1] was negative in volume terms in 2021, following two years of a small surplus[2]. Including shipments of unprocessed milk, there was a deficit of 68k tonnes in 2021, which compares to a surplus of 53k tonnes in 2020. The ongoing pandemic continued to disrupt both domestic and international markets in 2021. Additionally, our exit from the EU at the start of 2021 brought new export regulations, bringing further disruption, while import regulations were deferred.

Liquid milk has a big influence on the dairy trade balance, but the volume mostly comes from raw milk crossing the Irish border for processing. This category has the largest trade surplus, but this shrank in 2021, mainly due to higher imports. This was a key influence on the shift in trade balance.

Liquid milk aside, the largest contribution in the shift from surplus to deficit was in yogurt. The trade deficit in yogurt increased, driven by lower exports and higher imports than in 2020. Additionally, cream went back into a slight trade deficit in 2021, having been in surplus in 2020.

Milk powders (SMP and WMP) maintained a trade surplus, but it was lower than in 2020. This was driven by lower exports, especially to the EU, which were likely hindered by post-EU-exit regulations.

On a more positive note, the volume trade balances of butter, cheese, and concentrated milk all improved, with smaller trade deficits in 2021 than in 2020. Cheese had the most notable improvement, reducing the trade deficit by 49k tonnes. Both imports and exports of cheese fell compared to 2020, but imports more so. This was most likely due to the foodservice sector still dealing with lockdowns and low demand through the year.

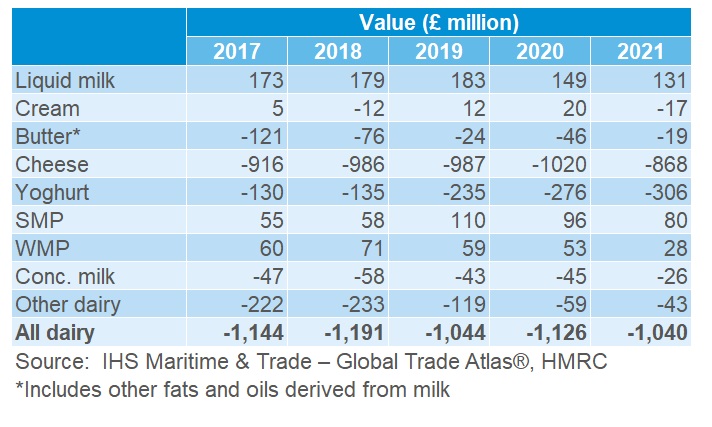

Value trade deficit improves

In value terms, the UK remained in a trade deficit for dairy products, but this did reduce. The trade deficit totalled £1.04 in 2021, £87m less than in 2020. While the total value of exports fell, the value of imports fell more notably, improving the net trade position for 2021.

Cheese was a key contributor to the change in the value trade deficit, as the category trade deficit shrunk considerably. As well as imports volumes falling further than exports, average export prices (in £/tonne) rose by more than import prices, giving extra swing to the value (£) trade balance.

[1] HS codes 0401-0406. Includes shipments of unprocessed milk/raw milk crossing the border for processing.

[2] Note that all back data has been revised by the source since the March 2020 trade balance was calculated, but overall trends haven't changed.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.