UK feed barley domestic demand over the next few months: Grain Market Daily

Friday, 12 February 2021

Market Commentary

- UK feed wheat futures increased yesterday to close above £200/t again for old crop contracts. May-21 prices ended the day at £200.15/t, a gain of £0.50/t. Global grain markets bounced after falling to technical support levels, suggesting buyers are present at these levels.

- Though wheat markets declined following the February WASDE report, freezing temperatures across key US wheat producing regions offered some support. Snow cover is lacking in some fields, with winter-kill risks present at forecast temperatures.

- The Brazilian soyabean crop is estimated at 133.82Mt following much-needed rainfall, according to the latest Conab report. This is up from a 133.69Mt forecast in January and the 124.84Mt harvested in 2019/20. If realised, this would be a record Brazilian production figure. Markets expect Chinese purchases of this crop to appear shortly.

UK feed barley domestic demand over the next few months

Other feed grain usage in animal feed production has been incentivised this season, due to the lack of wheat availability. Barley and maize usage in animal feed production are at digital record highs in the season to December. Barley usage has increased 34% from last season, owing to domestic production again over 8.0Mt. A strong discount to feed wheat has further incentivised usage. This discount sat at record levels in December, although this has started to narrow since January.

UK barley exports are at their second highest level in the last ten years. An estimated 685Kt had been shipped by the end of November, with exporters keen to avoid potential no-deal tariffs in January. However, this was below last season’s record 1.1Mt figure (Jul-Nov), which had been affected by the then October Brexit deadline. Now a deal has been agreed, January export trade has been reportedly busy.

Looking ahead, UK barley exports could struggle to clear out required volumes with the presence of Australian barley on global markets. Australian exports have chosen to look beyond China due to an ongoing trade spat, with 1.3Mt shipped in November and December alone. China accounted for almost two thirds of Australian barley exports in 2018/19, which frees up a large portion of their forecast 5.0Mt exports this season.

As I have mentioned, domestic feed demand for barley has been strong this season. Poorer weather prevented some out-wintering and abattoir backlogs have kept livestock in housing for longer. However, it can be expected that, as with previous seasons, feed production will decline once weather permits spring grazing. Feed compounders are reportedly covered with supply until April/May.

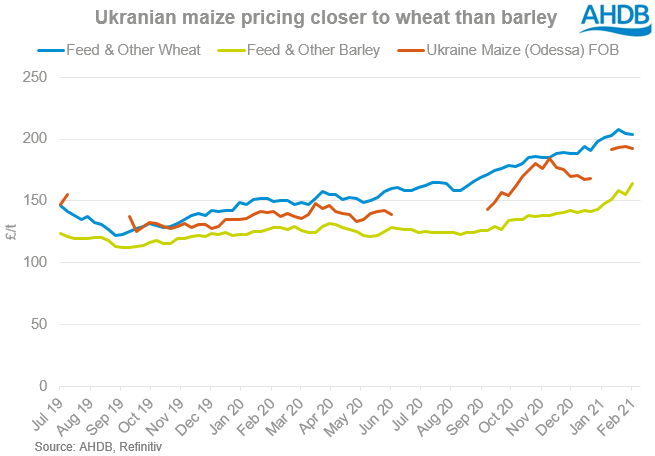

This could impact on maize import volumes, which have reached 1.2Mt in the season to Nov. Back at the start of December, Ukrainian maize (FOB - Dec) was quoted at $232-$233/t (£173 - £174/t). Yesterday, the spot price (FOB - Feb) had risen to $258-$259/t (£186 - £187/t). UK feed barley was quoted at £163.9/t in AHDB corn returns as of 4 Feb.

Barley prices will likely remain below imported grain levels with pressured export demand and reduced feed demand looking forward. If the discount remains significant enough, domestic demand opportunities into industrial purposes such as bioethanol could be incentivised.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.