UK feed wheat futures down 10% since start of 2025: Grain market daily

Friday, 7 March 2025

Market commentary

- UK feed wheat futures (May-25) closed at £176.05/t yesterday, gained £1.45/t from Wednesday’s close. The Nov-25 contract also up £0.85/t over the same period, to close at £190.20/t.

- Domestic feed wheat futures followed the correction in the global grain markets after falling earlier in the week. Chicago wheat and Paris milling wheat futures were up 1.1% and were down 0.1% respectively. The euro strengthened against the US dollar to a three-month high.

- Paris rapeseed futures (May-25) closed at €503.50/t yesterday, up €4.00/t from Wednesday’s close. The Nov-25 contract also up €3.25/t over the same period, to close at €484.75/t.

- Paris rapeseed and Winnipeg canola futures May-25 were up 0.80% and 0.33% respectively on yesterday’s close. Chicago soyabean futures (May-25) also increased supporting weaker the US dollar. The price of crude oil is now a very important point to watch in the near term.

UK feed wheat futures down 10% since start of 2025

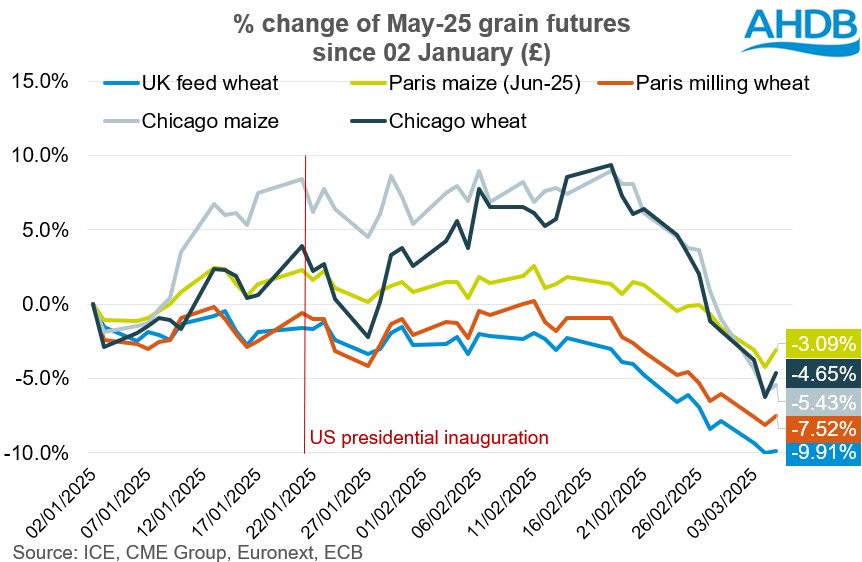

From the beginning of 2025, UK feed futures May 25 fell the most in percentage terms compared to Chicago wheat and maize and Paris wheat and maize futures. Domestic futures were under additional pressure from lower internal demand and strengthening of sterling against the euro.

Globally, cereals and oilseeds markets are falling on concerns about US tariffs. Higher tariff tensions increase trade risks, including for commodity prices, and growers will receive lower prices. Weather risks are diminishing for winter wheat in the northern hemisphere and for maize in South America, which is also putting pressure on prices.

The delay in the start of the tariffs led to a rise in Chicago corn and wheat futures. The main reason for this rise was the acceleration in US export demand. However, prices fell sharply as the date of the potential start of import tariffs approached. At the same time, domestic feed wheat and Paris futures moved sideways, but also fell with Chicago.

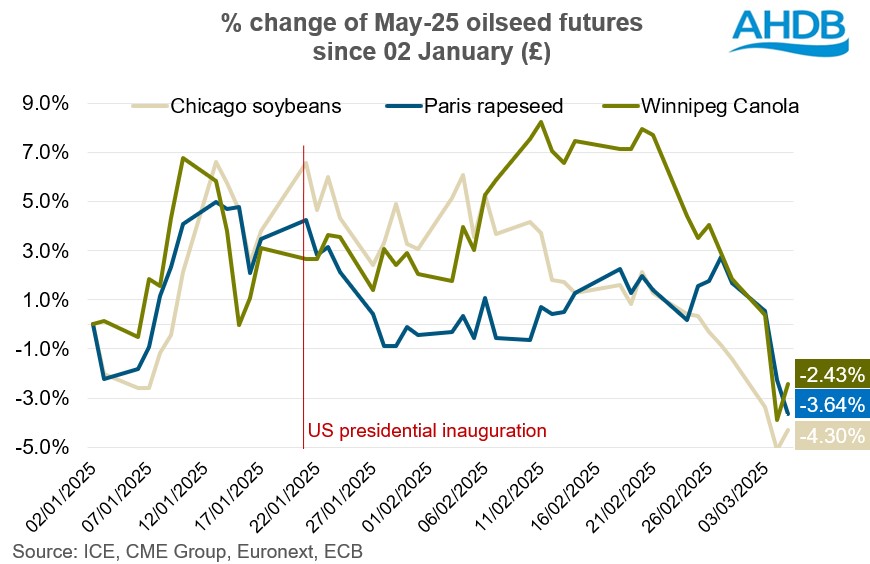

UK feed wheat also fell more than Chicago soyabean, Paris rapeseed and Winnipeg canola. Winnipeg canola like Chicago wheat and maize increased in the middle of February but fell sharply as the date of the potential start of import tariffs approached. Paris rapeseed followed Winnipeg canola in the recent downward movement.

Looking ahead

Tariff concerns are the main driver of global grain and oilseed prices, and any easing of these concerns could support prices. In addition to the global situation, UK feed wheat futures are influenced also by seasonal trends and lower domestic demand. Updated 6 March data on UK human and industrial cereal usage and GB animal feed production confirms this.

The recent correction in sterling from its high levels against the euro may provide some support to UK domestic feed wheat prices in the near term.

The next possible major influence on US and global grain and oilseed prices could come after the next USDA WASDE report on 11 March 2025. It'll be interesting to see how the USDA adjusts US wheat, corn and soybean exports due to the unpredictability of tariffs.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.