UK feed wheat prices remain well below last year despite wet autumn: Grain Market Daily

Thursday, 2 January 2020

Market Commentary

- Both old-crop (May-20) and new-crop (Nov-20) UK wheat futures dropped slightly week-on-week to Tuesday 31 December, although there has been limited trade due to bank holidays.

- From November-end to December-end however, both contracts have risen with Nov-20 gaining most (£4.70/t).

- Oilseed markets have also seen some gains over the past month. US soyabeans (nearby) have risen $26.64/t since 2 December to Tuesday’s close.

- This has also fed through to Paris rapeseed futures (nearby), closing Tuesday at €411.50/t, up €23.25/t since 2 December. The US-China trade deal (phase-one), due to be signed this month, has driven this rise.

UK feed wheat prices remain well below last year despite wet autumn

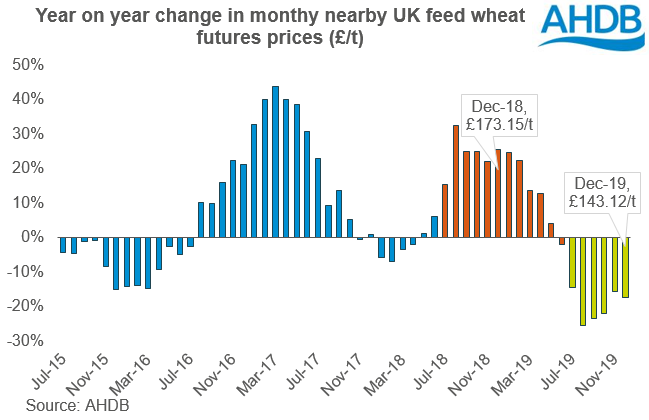

Unsurprisingly, 2019/20 UK wheat prices (nearby futures) have sat below the same time last year when supply was relatively tight in comparison. The average price for December 2019 was £143.12/t, which is 17% below the December 2018 price of £173.15/t.

The supply and demand situation from harvest 2018, to harvest 2019 is very different, driving this change in pricing. Wheat production is up 19.7% (2.67Mt) year-on-year in the UK and is the 5th highest since 1999.

The first official balance sheet shows a huge difference in supply and demand year-on-year. The estimated surplus available for export or free stock for 2019/20 is 2.98Mt compared to 0.72Mt the previous year.

The increased supply has generally weighed on the market, as the need to be export competitive was present. Exports of wheat have been relatively high so far this season at 378.6Kt from July-October compared to 95.4Kt last season. Weak sterling at the beginning of the season also helped with competitive pricing but this has strengthened 10% since the low in August to yesterday’s close (against both the euro and US dollar).

Since September UK feed wheat prices have seen some support on the back of adverse weather. The nearby contract for UK feed wheat has risen 13% from 2 September to 31 December.

This autumn has been one of the wettest on record and on a national level the wettest since 2000. This has caused significant problems for autumn drilling and could drive the winter wheat area lower for harvest 2020. However, at £146.50/t this is still £26.10/t lower that the same point last year.

The more favourable weather currently experienced could allow farmers to plant their winter wheat throughout January but the re-run of the Early Bird Survey due for release in February could help shed more light on the situation for 2020 harvest.

If farmers manage to plant much of the intended area of wheat then the market will likely be under pressure again. However, if further wet weather is experienced over the next few months, new rises could be recorded for the latter part of the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.