UK produced AN falls back below £500/t, but how low can it go? Grain market daily

Tuesday, 18 April 2023

Market commentary

- On Monday, old crop (May-23) UK feed wheat futures closed at £201.55/t, up £4.10/t from Friday’s close. New crop futures (Nov-23) gained the same amount over the same period to settle at £216.00/t. UK markets followed global markets up yesterday, on the back of continued concerns over any further renewals of the Ukraine export corridor and continuing poor US winter wheat crop conditions.

- May-23 Paris rapeseed futures gained €21.25/t from Friday’s close, to settle at €460.50/t yesterday. New crop futures (Nov-23) gained €18.25/t over the same period to settle at €466.50/t. Strong crushing demand for US soyabeans and upticks in palm oil prices, boosted rapeseed markets yesterday.

UK produced AN falls back below £500/t, but how low can it go?

In March, UK produced ammonium nitrate (AN) (34.5% N) for spot delivery averaged £465/t, according to the latest AHDB GB fertiliser prices. March’s average is down £166/t on the month and £374/t lower than levels recorded in March 2022. That said, the latest price remains £181/t higher than levels recorded in in March 2021 – pre-war times.

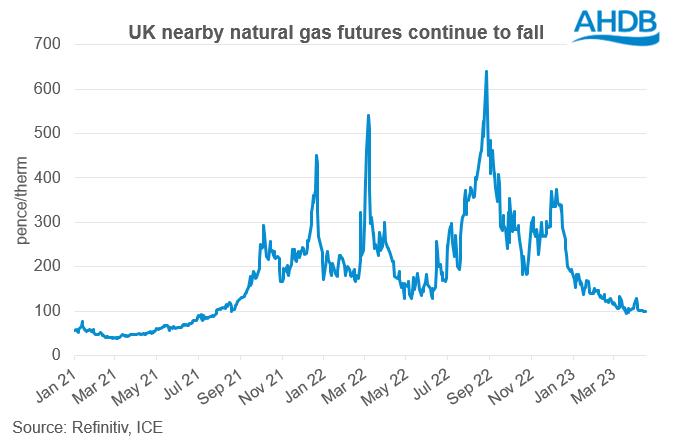

Over the past few months, fertiliser prices have been following the downward movements in natural gas prices (with natural gas making up c.60-80% of fertiliser production costs). European natural gas prices have been falling since their peak in August, with UK natural gas futures now at around the 100p/therm mark, levels last seen in the summer of 2021.

A relatively mild winter across Europe, along with replenished stocks has led to the decline in natural gas prices. Over the winter the UK also became more reliant on alternative sources of energy, which is thought to have replaced more than a third of the UK’s yearly gas demand for power generation, according to the Energy and Climate Intelligence Unit.

In terms of price movements going forward, it appears that Europe have ample reserves of natural gas, as supplies are being replenished ahead of next winter. As at 16 April, Europe’s gas storage was 57% full, which is 21 percentage points higher than the previous five year average of 36% full for this point in the year. However, over the coming week, the weather across Europe is expected to get cooler, which will likely limit any great falls in natural gas prices.

Looking further ahead and while it is currently unlikely, we will see natural gas prices go back up to the highs we saw last August, it’s uncertain to when prices will drop back to pre-Covid levels. This is because Europe has now become more dependent on liquid natural gas (LNG) since the outbreak of war in Ukraine, with Asia also having a demand for LNG. It’s been reported that Europe are yet to face competition from Asia for LNG. However, if/when Asian demand becomes strong, its likely we will see more volatility in natural gas prices.

What does this all mean for fertiliser prices going forward? With natural gas continuing to come down over recent months, its likely fertiliser prices will follow suit. However, with volatility likely to remain in natural gas markets, it’s unlikely we will see fertiliser prices come back down to pe-war levels in the short term anyway.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.