UK trades less pig meat in August

Thursday, 20 October 2022

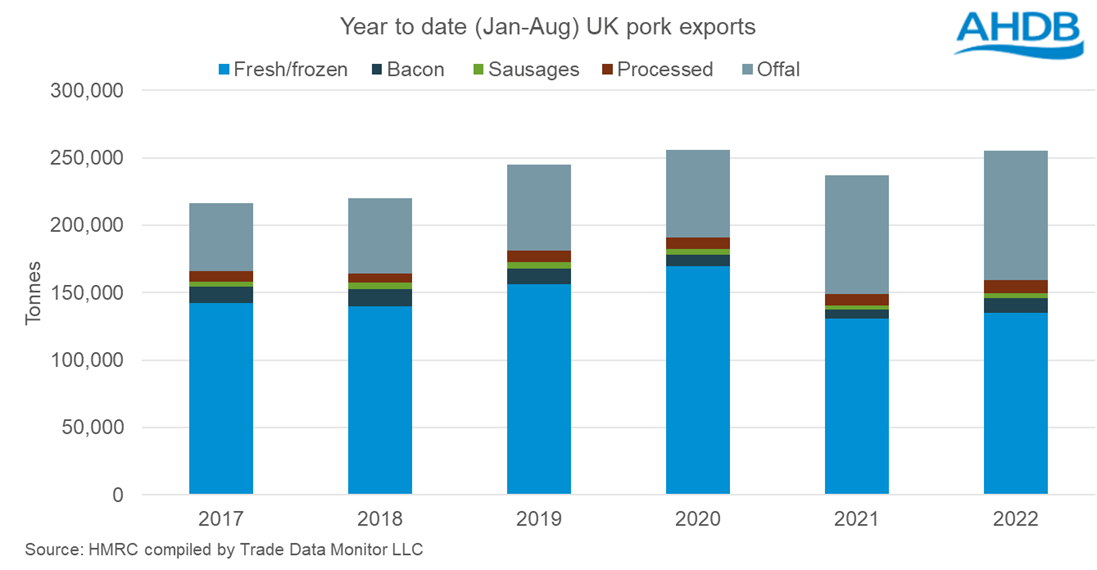

Total exports of pig meat from the UK totalled 28,600 tonnes in August, a 3% (1,000 tonnes) decrease compared to July and down 9% (3,000 tonnes) year on year. This brings year to date (Jan – Aug) export volume to 255,100 tonnes, 8% (18,000 tonnes) higher than in the same period last year and almost level (-500 tonnes) with the same period in 2020.

Processed pig meat was the only product category to see in month on month growth in August. When compared to August 2021, processed pig meat and bacon have seen an increase of 30% in export volumes, while all other product categories recorded declines.

So far this year (Jan-Aug), year on year growth in shipped volumes has been seen for all key product categories. Fresh/frozen pork remains the largest product category for exports, with a 53% market share, which has increased from 48% last year. Total exports of fresh/frozen in the 8 months of 2022 were up 4,300 tonnes (3%) on the year, while total bacon exports so far this year have grown by almost the same amount (4,300 tonnes). This represents a 68% increase in bacon exports year on year and brings them just 1,100 tonnes shy of their pre pandemic volumes. Exports of processed pig meat and sausages total 9,900 and 3,600 tonnes respectively for the year so far, both up on the year.

Offal exports have seen the largest growth in cumulative volume terms, up 7,700 tonnes (9%) to 95,800 tonnes. Their market share of exports has however remained at 38%. Exports of offal have seen good growth in the past 5 years, increasing by 44,900 tonnes since 2017. Although offal is not the most lucrative product in terms of value, its exports are highly important in regards to carcase balance.

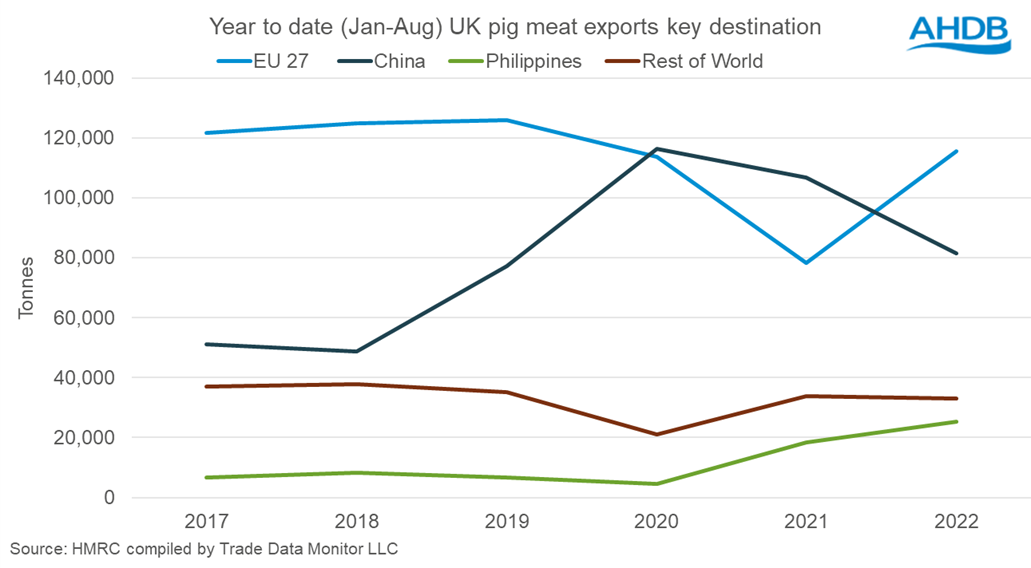

While exports overall have grown, shipments to China continued to decrease as the nation’s pig population recovers from ASF. However, they still hold a 32% market share of year to date UK pig meat exports. Shipments to China stood at 9,500 tonnes in August, down 6% (600 tonnes) from July and when compared to the same month last year volumes are down 22% (2,600 tonnes). Year to date exports to China reached 81,400 tonnes in August, a 30% (35,000 tonnes) decline from their peak in 2020.

Shipments to the EU totalled 13,600 tonnes in August, 1% higher than last month as well as August last year. The EU has absorbed most of the lost trade from China, with 115,600 tonnes of UK pig meat exported to the continent so far this year. The Philippines has also seen increased volumes.

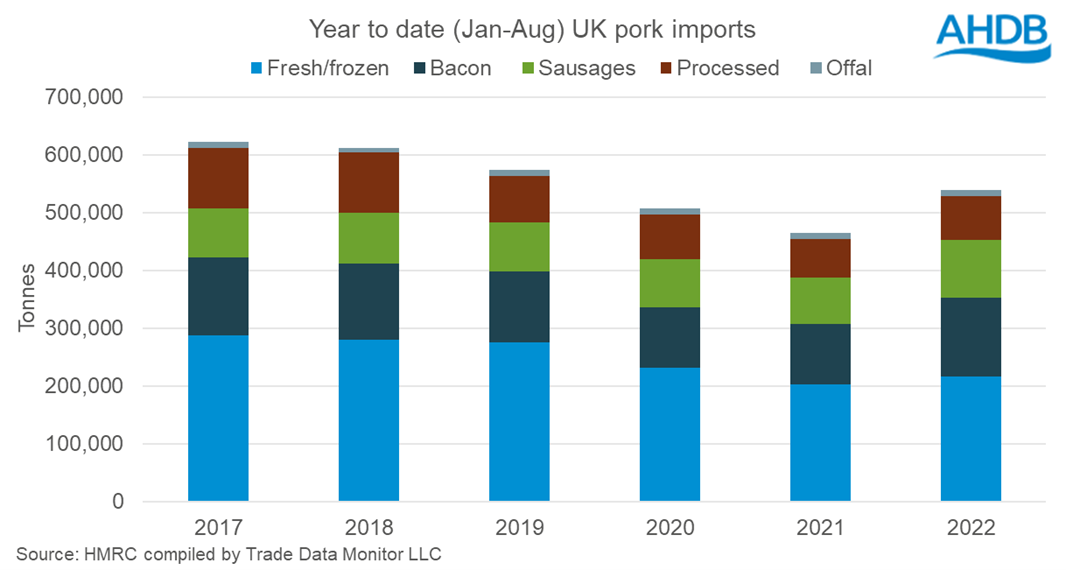

Imports of pig meat to the UK totalled 60,700 tonnes in August 2022, a decline of 3% (2,100 tonnes) from July and down 1% (600 tonnes) compared to the same time last year. For the year to date (Jan-Aug) imports are up by 16% year on year to reach 539,500 tonnes. Imports from the EU are now at 94% of the volumes imported in 2019, suggesting trade has mostly recovered from the disruptions of Brexit and COVID-19. Competitive continental prices will also have played a role in higher imports.

All of the key product categories have seen year on year growth in year to date (Jan-Aug) imports. The largest growth in volume terms has been seen in bacon, up 30% (31,700 tonnes) compared to this time last year. Sausages have also seen a significant increase in imports this year, up 24% (19,600 tonnes) compared to 2021. Fresh/frozen pork remains the largest category for imported product however, with 216,200 tonnes imported so far this year, an increase of 7% year on year.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.