UK wheat area to rise for harvest 2025: Grain market daily

Thursday, 21 November 2024

Market commentary

- Global grain markets made further gains yesterday after news that Ukraine fired further long-range missiles into Russia and buying by speculative traders (Refintiv). The use of long-range missiles follows the US lifting restrictions earlier in the week. This escalation raises the prospects of disruption to grain supplies, though gains were limited by continuing export offers.

- UK feed wheat futures for May-25 gained £0.55/t yesterday to settle at £192.95/t, while the Nov-25 contract lost £0.40/t to settle at £189.85/t. The Nov-24 contract, which finishes trading tomorrow (22 November), also gained £0.55/t to £180.05/t. Stronger sterling limited the rises in old crop prices compared to Paris and Chicago wheat futures.

- Paris rapeseed futures lost further ground yesterday due to continued falls in palm and soya oil prices. The May-25 contract fell €8.25/t to 524.75/t (approx. £437.50/t), while the Nov-25 contract fell €3.25/t to settle at €480.25/t (approx. £400.50/t).

- Soya oil prices are retreating due to favourable weather for soyabean crops in South America and worries about US biodiesel demand due appointments by the President elect who are sceptical towards biofuels. Weaker exports were also a factor for Malaysian palm oil prices. Refintiv reports that cargo surveyors estimate 1 – 20 November Malaysian exports are down between 1% and 5% from the same period in October.

UK wheat area to rise for harvest 2025

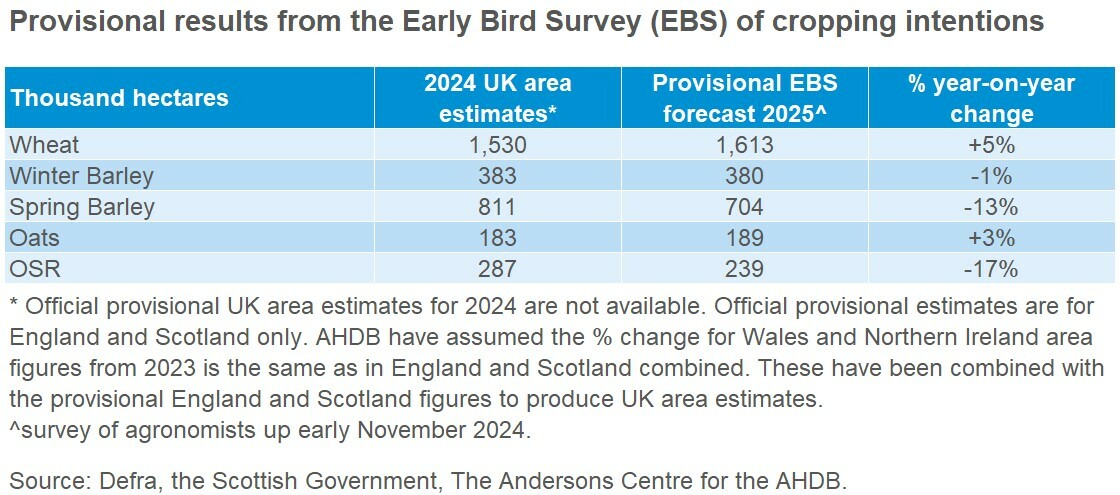

AHDB’s Early Bird Survey provisionally projects the UK wheat and total oat areas rising for harvest 2025, but the winter and spring barley and oilseed rape (OSR) areas falling.

The Early-Bird Survey (EBS) is undertaken each autumn to assess national cropping intentions. It is carried out by The Andersons Centre with help from agronomists from the Association of Independent Crop Consultants (AICC) and the Agricultural Industries Confederation (AIC); independents and nationals alike.

Over 70 agronomists took part in this year’s survey contributing 600 Kha of arable land across the UK. Cropping changes on this land was then applied to provisional 2024 UK area figures to produce forecasted crop areas for harvest 2025. The survey was struck during early November, with most data collected by 11 November, though results were received up to 15 November.

No provisional national crop area figures are published, so we use estimates from amalgamated Defra’s provisional 2024 June Survey data for England and the Scottish Government’s 2024 June Agricultural Census figures, plus estimates for Wales and Northern Ireland. The percentage change in cropped area between 2023 and 2024 in Wales and Northern Ireland is assumed to be in line with England and Scotland combined.

The overall wheat area is forecast to rise by 5.4%, all within the winter crop, after last autumn’s challenging weather sharply reduced the area. However, at 1,613 Kha, the projected 2025 area remains below the 2019 – 2023 average of 1,705 Kha.

Depending on yields, only a partial area recovery for 2025 could mean UK production remains below average in 2025. This will be explored further in future analysis, and insights into crop conditions for 2025 are due in the coming weeks.

The area of oats is projected to rise by a modest 3.5%. At 189 Kha, the 2025 projected area would be slightly above the 2019 – 2023 average but below 2021’s 200 Kha.

The winter barley area is estimated to have fallen by just under 1%, potentially limited by the wet conditions in England in September. Meanwhile, the area of spring barley is anticipated to fall by a considerable 13% after rising sharply in 2024. The decline in spot malting premiums is also likely a contributing factor to the declines in both winter and spring barley areas.

The 2025 spring barley projection at 704 Kha would still be above 2022 and 2023 levels. However, with the winter barley area edging lower again, the falls in spring barley would mean the smallest UK barley area since 2014 at 1,084 Kha. If this area is confirmed and without above-average yields in 2025, UK barley production could fall below 2024’s provisional 7.2 Mt crop.

Further falls in OSR area

A 17% fall in the planted area for oilseed rape is forecast. If confirmed, this would reduce the oilseed rape area to its lowest area in the UK for 42 years. The final area could be even lower depending on damage from pests, particularly cabbage stem flea beetles, and weather conditions between now and harvest.

This follows another challenging growing season for OSR, with 2024 provisional yields again below average. AHDB analysis earlier in the year also indicated cost pressures remaining elevated for oilseed rape. While current OSR prices are above last year’s levels, most of the rises came after the oilseed rape planting window for 2025 had closed.

Historically, when oilseed rape area falls, pulses tend to rise to fill the break crop gap. However, this does not appear to be the case this season, with pulse areas seen falling approximately 7% from last harvest.

Concluding thoughts

The first insight into 2025 cropping patterns shows a mixed picture. While winter cropping has historically usually strongly rebounded the year after a wet autumn, e.g. in 2021, that doesn’t seem to be the case for harvest 2025.

Autumn drilling conditions have been poor in many parts of the UK but good in others. While most data was collected by 11 November, this survey’s deadline was postponed by one week compared to the original plan (until 15 November) to allow time for some regions to gather more clarity on planted areas. Some drilling intentions changed last minute; most were simply delayed.

Nonetheless, the challenging weather in some areas, plus the fallout from the 2024 harvest on profitability seem to have limited the rebounds. This places extra focus on yield potential, and we’ll need to closely monitor crop conditions through the growing season.

The survey also shows potential for the uncropped arable area to rise further (+51%) from 2024’s already high level. But it’s unclear if this represents decisions yet to be made, further land intended for agri-environmental schemes in England, or a mix of both. While there were limited rises in uptake of land requiring actions (either grassland or arable) between July and October, Defra’s next data on SFI uptake in England in February could offer some clarity.

When full 2024 official UK crop areas are available later in December, we’ll be able to produce 2025 area forecasts for a wider range of crops, plus final and regional areas for wheat, barley, oats and oilseed rape.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.