UK wheat exports reached a seasonal high in May: Grain Market Daily

Tuesday, 15 July 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £178.10/t yesterday, up £0.10/t from Friday’s close. The May-26 contract rose £0.35/t over the same period, to close at £190.80/t

- Domestic wheat prices showed some resistance yesterday due to the weaker sterling against the euro and US dollar. Chicago wheat and Paris milling wheat futures (Dec-25) fell 0.6% and 0.7% respectively at yesterday's close. Wheat futures came under pressure due to an improvement in the proportion of US spring wheat rated as being in good or excellent condition, which increased by 4 percentage points as of 13 July

- Nov-25 Paris rapeseed futures ended yesterday’s session at €477.50/t, up €2.00/t from Friday’s session. Meanwhile, Winnipeg canola and Chicago soyabean futures (Nov-25) remained largely unchanged yesterday. Increased tariff concerns make the commodity market more unpredictable

UK wheat exports reached a seasonal high in May

According to the latest HMRC trade data, UK wheat exports in May reached the highest monthly level of the current season at 33.7 kt, up 44% compared to April. The total exports to date are at 188.1 kt, which is 22% down on last year. Season to date (Jul–May) barley exports are at 647.9 Kt, down 12% on the year.

It is also worth mentioning that May saw the highest monthly export level of rapeseed, at 9.3 Kt. A total of 35.5 kt of rapeseed was exported from the UK between July and May, representing an 11% increase on last year's figures.

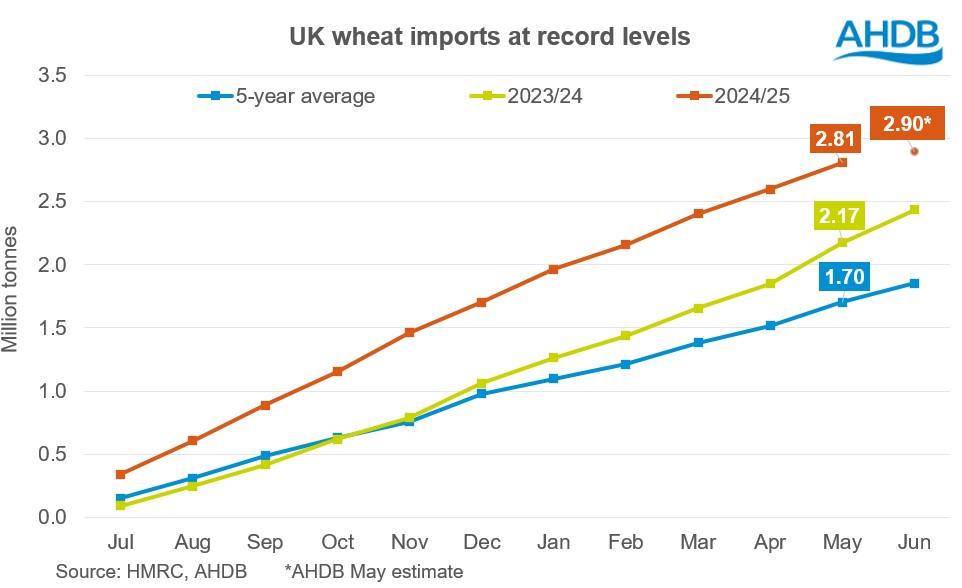

However, the total volume of wheat exported from the UK is 15 times lower than the import volume for the current season up to May. In May, UK wheat imports (including durum wheat) totalled 212.0 Kt, which is a 10% increase compared to April. Wheat imports totalled 2.8 Mt from July–May, up 29% on the same period last year, and up 65% on the five-year average. In May, AHDB estimated full-season wheat imports at 2.9 Mt. To achieve this, imports would need to total 100 Kt in June.

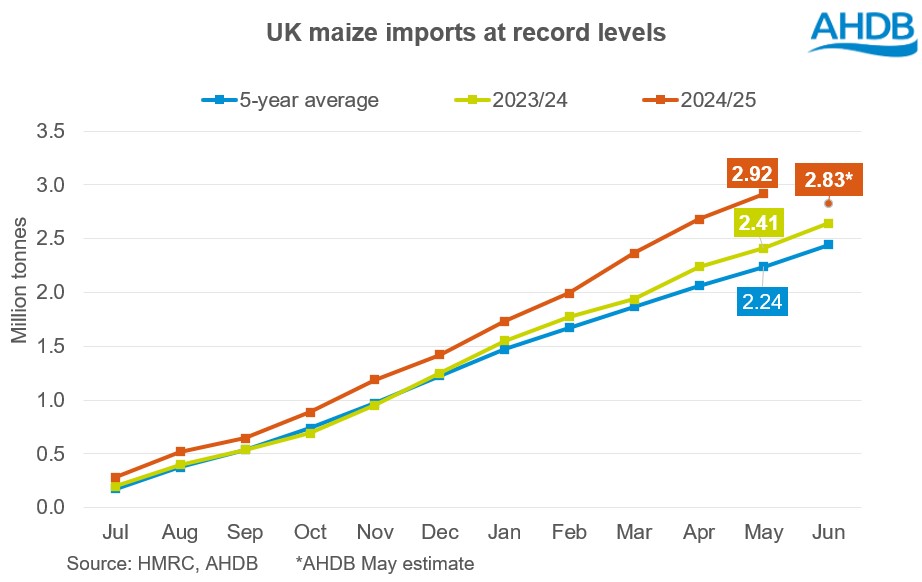

Maize imports in May were level at 235.9 Kt, down 25% compared to April. Season-to-date (Jul–May) maize imports totalled 2.9 Mt, up 21% on levels a year earlier and 30% on the five-year average. In May, AHDB estimated that full-season imports would total 2.83 Mt, but the figures up to May exceeded this forecast. Market conditions changed throughout the season, with maize proving to be more competitive than initially anticipated.

The UK's trade balance for cereals and oilseeds deteriorated significantly in the 2024/25 season due to lower exports and higher imports. Lower production and quality issues in the UK naturally led to an increase in wheat imports, but the stronger pound against the euro and US dollar also encouraged imports.

During the 2024/25 season up to May, the UK's main wheat importers were Germany (33% of the total volume), followed by Canada (22%), France (17%), Denmark (8%) and Poland (5%). Therefore, it is expected that most of the imports were milling quality.

We need the figures for June to make the final estimates of UK trade data for the 2024/25 season. Once they have been published, we can conduct a detailed analysis of the previous marketing year.

The outlook for the domestic market in the 2025/26 season is currently more optimistic in terms of the UK's cereal trade balance. This is primarily due to an increased wheat production forecast compared to the previous year, as well as less competitive maize prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.