UK wheat import pace slows: Grain market daily

Tuesday, 21 December 2021

Market commentary

- UK feed wheat (May-22) gained £1.05/t to close at £224.00/t yesterday. These gains followed Paris and Chicago wheat futures.

- Global wheat contracts re-adjusted yesterday, following thoughts that Omicron concerns had meant prices have become oversold.

- Chicago soyabean (May-22) futures increased $2.30/t yesterday to close at $477.53/t. Concerns that dryness in South America may impact on production continue for both South American soyabeans and maize crops.

- Sovecon, the Russian agriculture consultancy, have increased their forecast for Russian wheat harvest 2022 to 81.3Mt. This is up from 80.7Mt on good sowing conditions.

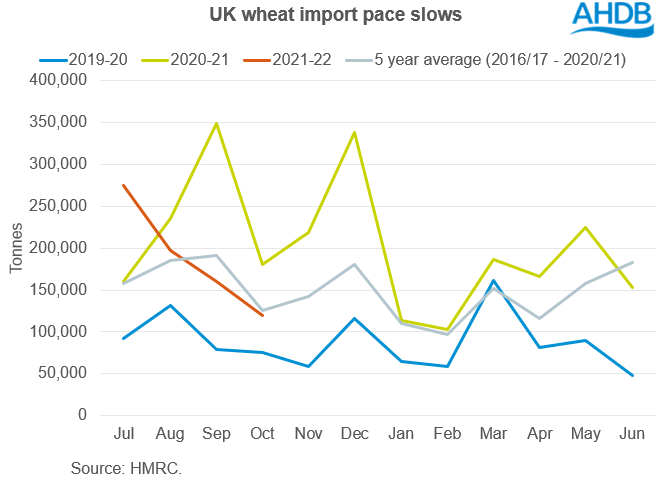

UK wheat import pace slows

HMRC have released their latest trade data to October. These figures show UK wheat imports (inc. durum) continuing to slow. At 119.3Kt, this is below the previous 5-year average (2016/17 – 2020/21) of 125.4Kt for October wheat imports.

This brings total wheat imports for this season (July to October) down 19% from last season.

Will this slow pace continue? Well, the discount of UK feed wheat futures (May-22) to Paris milling wheat futures (May-22) has started to narrow. At the start of November, this was reported by Anthony as c.£17.24/t. This then widened to £19.25/t on 15 November. As at yesterday, this had tapered to c.£11.59/t. While there may be different reasons playing into this, including exchange rate changes and reduced concerns around EU wheat availability, this could mean we start to see UK pricing move away from export competitiveness.

However, challenges remain for sea freight, which may be impacting on slow imports. Though domestic haulage issues may mean some regions could see sea freight if more readily available.

Why is this important?

The UK wheat supply and demand balance is tight this season. With opening stocks the lowest this century, this presents a picture with not much room to give.

On Friday, we saw Defra’s final estimate of the 2021 UK wheat crop at 13.99Mt. This is down slightly from 14.02Mt estimated in October, tightening availability slightly further.

Should UK availability tighten further, and demand remain strong, we may see UK prices remain firm. Especially in areas where the basis is already increasing at a faster pace, e.g. Northern and Scottish ex-farm wheat.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.