US crops in focus: Grain market daily

Tuesday, 8 July 2025

Market commentary

- UK feed wheat futures (Nov-25) fell £0.25/t yesterday, ending the session at £175.45/t. The May-26 contract fell £0.85/t over the same period, to close at £187.45/t.

- Domestic wheat futures followed global grain markets down, with pressure from improved US conditions weighing on prices. Read more on this below.

- Nov-25 Paris rapeseed futures closed at €477.75/t yesterday, down €8.00/t from Friday’s close. The May-26 contract fell €8.75/t over the same period, to end the session at €485.00/t.

- European rapeseed markets followed the wider oilseeds complex, with Nov-25 Chicago soyabeans and Winnipeg canola down 2.7% and 3.2% respectively. Favourable weather in the US, as well as a bumper Brazilian harvest are keeping pressure on prices. Some traders had also expected President Trump to announce a trade agreement with China before the weekend, however this did not happen, weighing on prices further (LSEG).

US crops in focus

While our domestic harvest has only just begun, in the US, a good proportion of the winter wheat crop has now been cut. Focus is also turning to the condition of the country’s maize crop, as it enters its key ‘silking’ phase. Both harvest pressure, and news on maize crop conditions are factoring into global grain price movement at the moment.

US winter wheat harvest reaches halfway point

As of 06 July, 53% of the US winter wheat crop had been harvested. This was up from 37% a week earlier, and relatively in line with the five-year average (54%) for this point in the season.

Harvest is nearing completion in some of the more southern states, including Arkansas (98%), North Carolina (91%), Missouri (90%), Oklahoma (83%) and Texas (83%).

Over the coming seven days however, rain is forecast for most of the midwestern states, which could impact harvest as it progresses up the country.

US maize entering critical growth stage

In the same report, the USDA said 18% of the US maize crop had entered it’s ‘silking’ stage. During this growth stage, the crop is particularly sensitive to temperature and moisture stress.

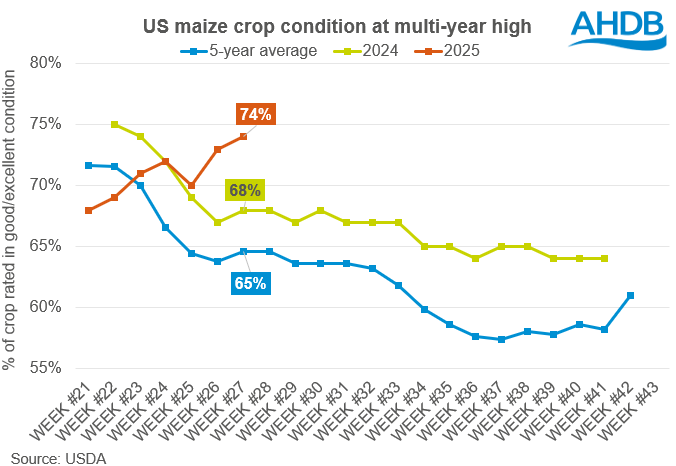

Also as of 06 July, 74% of the crop was rated in good or excellent condition. This was up from 73% a week earlier, and 68% at the same point in 2024. This is also well above the five-year average of 65% for this point of the season.

Historically, weather and subsequent crop conditions throughout July and early August have been key for yield formation. As such weather will be a watchpoint over the coming weeks in key growing regions.

What does this mean for UK wheat growers?

We are entering the new marketing year with historically tight global maize and wheat opening stocks. However, the forecast increase in production this season, combined with consumption, is expected to leave heavier year-on-year combined wheat and maize stocks at the end of 2025/26. This is contributing to the bearish sentiment in grain markets at the moment.

As such, any news of better-than-expected yield potential for the maize crop, and a fast-advancing US wheat harvest, is weighing on global wheat prices, and therefore filtering through to our domestic market. Weather conditions over the coming weeks across the northern hemisphere will remain a key watch factor.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.