US wheat exports are picking up speed: Grain market daily

Thursday, 3 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £190.15/t yesterday, up £3.65/t from Tuesday’s session. The May-25 contract ended at £204.85/t, up £3.80/t over the same period.

- Global wheat markets continued to rise yesterday. Concerns about drought in the Black Sea region on both 2024 output and 2025 potential, especially in Russia is increasing. Yesterday, SovEcon downgraded its forecast for Russia’s wheat exports for the 2024/25 season by 0.5 Mt to 47.6 Mt, due to bad weather affecting the harvest. Also, international demand remains firm with Egypt's state grains buyer (GASC) agreeing a direct wheat deal totalling 3.2 Mt to be supplied over the season, from the Black Sea region.

- Nov-24 Paris rapeseed futures ended yesterday’s session at €477.25/t, down €0.50/t from Tuesday’s close. The May-25 contract ended at €487.75/t, unchanged over the session.

- Global oilseed prices were generally pressured yesterday. Forecast of beneficial rains in northern Brazil’s soybean belt and potential delays on implementing anti-deforestation rules in Europe weighed on prices.

US wheat exports are picking up speed

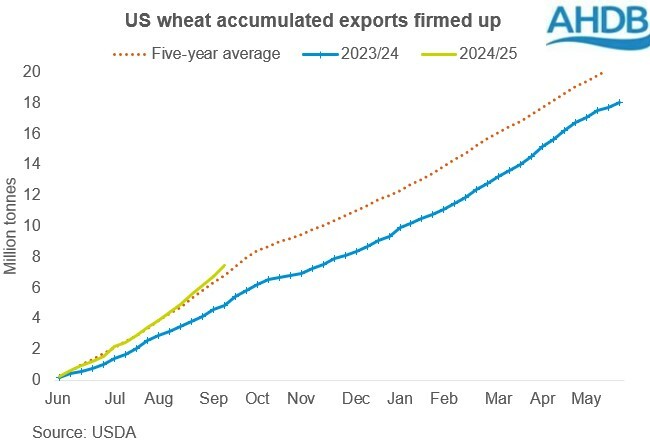

The US wheat export campaign for the 2024/25 season (June-July) has maintained a strong pace, with export commitments reaching 11.2 Mt to date. This represents a 22% increase from commitments (exports plus outstanding sales) at this point last year. More importantly, this figure already accounts for 50% of the projected total exports of 22.5 Mt for the entire season, achieved in just the first four months.

The weekly export statistics provide a clearer view on the firm pace. By 19 September, accumulated exports had reached 7.49 Mt, with a season-high weekly exports of 0.71 Mt. This marks a 53% increase from last year and 9% ahead of the five-year average.

Some reasons for the increase in exports are higher US production, higher demand from current customers, and lower prices.

According to the USDA, wheat production in the US is up by 4.6 Mt to 53.9 Mt this year, while production and exports are lower for other major exporters like Russia, Ukraine and the EU. The uncertainties regarding exports from these countries could allow the US to meet higher export demands than currently projected.

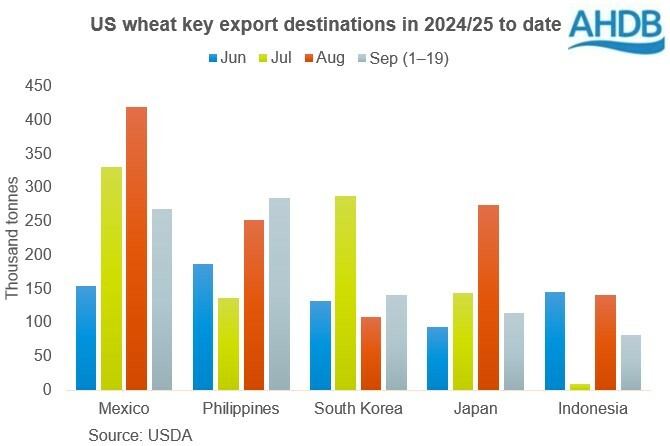

The top export destination of US wheat so far this season is Mexico, with average monthly exports of 0.29 Mt. Other key destinations are Philippines, South Korea, Japan and Indonesia.

What next?

Despite the rapid pace of US wheat exports, the impact on global wheat prices have been minimal. This is due to the current lower price environment compares to last year, driven by strong competition from Black Sea exports, which are already off to a strong start this season.

Given the historically high accumulated sales at this time of the year and stronger shipments from the Black Sea, the US wheat export pace is likely to be slower this week. LSEG trade estimates (0.15 Mt and 0.40 Mt) for the week points to lower export sales compared to the previous week.

Nonetheless, higher export sales than expected could bring some support to wheat prices. The US wheat export sales for the week ending 26 September, due out later today, will provide insight.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.