USDA acreage report ups maize area but cuts soyabean area: Grain market daily

Friday, 1 July 2022

Market commentary

- UK feed wheat futures fell yesterday as Northern hemisphere harvest continues. The Nov-22 contract closed at £275.55/t, down £6.95/t from the previous day’s close.

- Continental prices saw a similar loss, Paris milling wheat (Dec-22) futures were down €7.25/t over the same period closing at €344.50/t.

- Global grain markets were down following the Chicago market as grain stocks in the USDA quarterly report were in-line with trade expectations – Read more below.

- The global rapeseed market saw lowering prices yesterday. The Paris rapeseed Nov-22 contract lost €7.00/t from Wednesday’s session, closing at €694.75/t.

USDA acreage report ups maize area but cuts soyabean area

The USDA’s June acreage report and grain stocks as at 01 June were released yesterday. Due to the ongoing conflict in the Black Sea region, the global supply and demand balance for grain remains tight. Therefore, there is a lot of focus on the US stocks, plantings & weather.

Maize

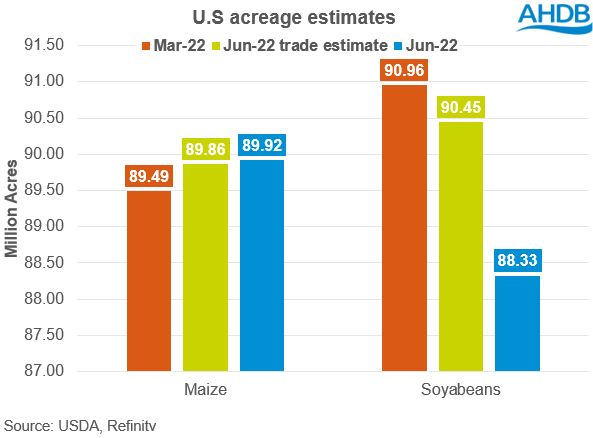

According to a Refinitiv survey, analysts estimated that US maize plantings in the June acreage report would be up by 370K acres on the March perspective plantings. With the trade estimating plantings at 89.86M acres. However, yesterday’s figure slightly exceeded this prediction, at 89.92M acres.

US maize stocks were also up on trade estimates in yesterday’s grain stocks report. Stocks are estimated to be 6% higher year-on-year at 110.39Mt compared to 104.43Mt from the same point last year.

With higher stocks on the year and with the maize area revised up 0.5% on March’s estimate, Chicago maize futures (dec-22) were pressured, falling to their lowest since March 2022. The Dec-22 contract closed at $244.00/t yesterday after the reports were released, a $13.38/t loss from the previous day’s close.

As the US maize crop is heading into the silking phase, the crop will be sensitive to high temperatures and droughts. Therefore, going forward US weather conditions will remain a watch point over the next few weeks.

Soyabeans

However, for soyabeans the acreage was lower than expectations. The latest June acreage report now estimates soyabean plantings at 88.33M acres, down 2.63M acres from March’s estimate, and down 2.12M acres lower than trade estimates.

Soyabean stocks as at 01 Jun were estimated at 26.44Mt, slightly higher (+175.3Kt) than trade expectations. However, they are up 5.3Mt on the same point last year, countering the downward revision to area.

This information combined with lower crude oil prices yesterday mean that Chicago soyabean futures had fallen at the end of yesterday’s session. The Nov-22 contract closed at $535.67/t, down $7.44/t from Wednesday.

Conclusion

To summarise, US maize plantings for harvest 2022 are up on March prospective plantings and slightly higher than trade expectations, that combined with higher stocks than the same point last year has caused pressure, which has filtered into our domestic prices.

For soyabeans, plantings for harvest 2022 are down on March prospective plantings and lower than trade expectations, but stocks are higher than the same point last year.

US weather conditions will be vital to determining the size of the crop which will play into global supply and demand. This will impact the ex-farm price for your cereals and oilseeds going into the 2022/23 marketing year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.