Warmer EU weather to hamper the regions maize crop? Grain market daily

Wednesday, 27 August 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £168.75/t yesterday, up £0.70/t from Friday’s close. The May-26 contract gained £0.85/t over the same period, to close at £180.30/t

- Domestic wheat futures followed US markets up yesterday. Chicago wheat futures (Dec-25) gained 0.9% on the back of technical trading, as well as a decline in the spring wheat crop condition

- Nov-25 Paris rapeseed futures ended yesterday’s session at €471.25/t, down €6.00/t from Monday’s close

- European rapeseed futures followed pressure in the wider vegetable oils complex yesterday. US soyabean oil fell on the back of a better-than-expected crop condition score for the US crop

Warmer EU weather to hamper the regions maize crop?

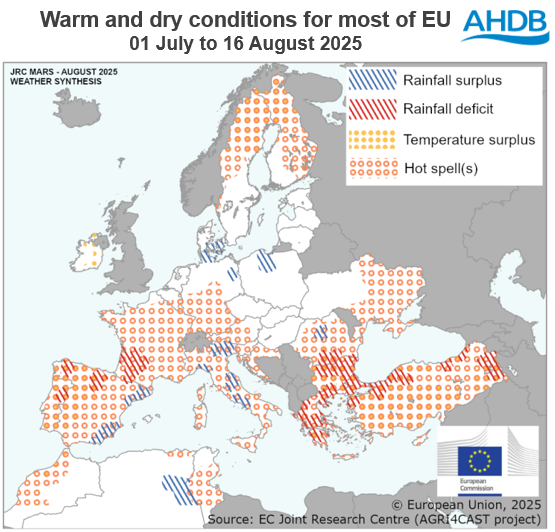

Earlier this week, the EU commission released its August crop monitoring report (MARS bulletin). With harvest of winter and spring crops largely complete for much of the continent, focus is now on summer crops such as maize, sunflowers and soyabeans.

Over the last few weeks, temperatures have remained high for most of Europe, with a rainfall deficit in some southern and eastern regions too.

Why might this impact UK grain prices?

In the report, as a result of the warmer and in some places drier weather, the EU Commission revised down its maize yield estimate to 6.93 t/ha. This is back 3% from July’s estimate, and down 2% on the five-year average.

The current global outlook for maize in 2025/26 is for record high production, with heavy supplies from the USA in particular this season. However, with an uptick in consumption and exports also anticipated, ending stocks are expected to be tighter than average (USDA), especially within the EU.

As such, any changes to the maize supply and demand balance within the EU has the potential to provide some support to European grain markets. As we know, to an extent, UK wheat futures tend to track movement in the European grain complex. Therefore, while the bearish US maize market will likely limit any considerable climbs, any revisions to the maize crop remains a watchpoint.

However, it is worth noting that much of the Northern Hemisphere crop will now be maturing, and therefore past any key stages of development, meaning further revisions will likely be minimal. Looking longer term, greater importance will be on demand and trade flows, as well as plantings in South America.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.