Arable Market Report - 26 August 2025

Tuesday, 26 August 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

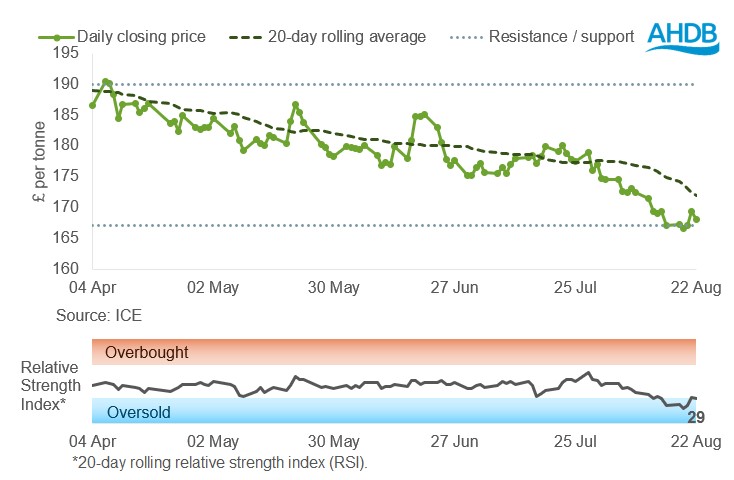

UK feed wheat futures (Nov-25)

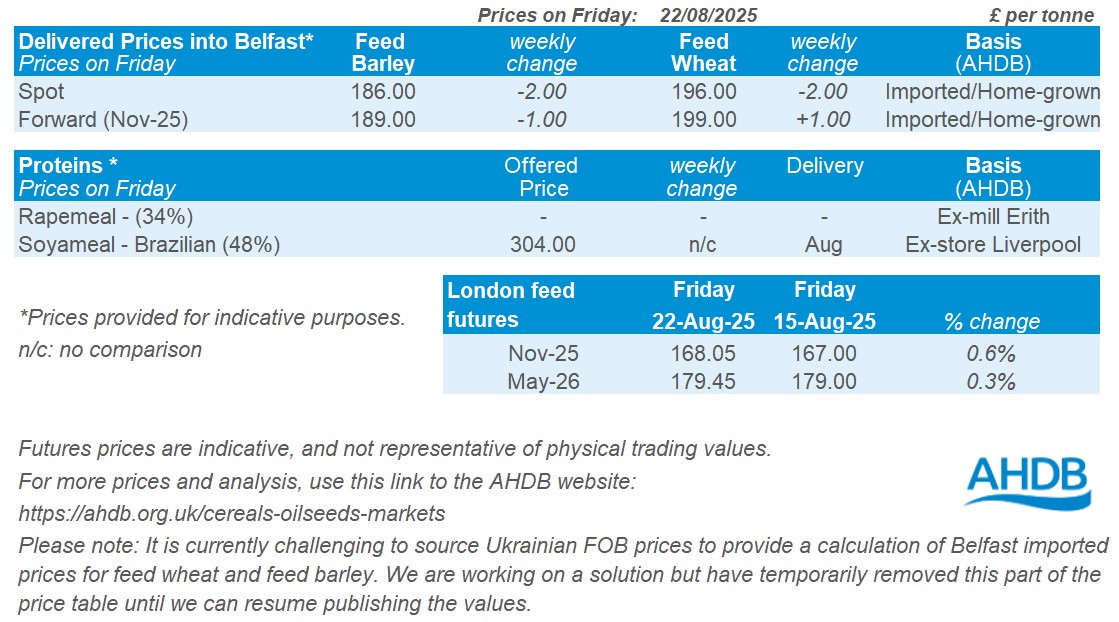

UK feed wheat futures edged higher last week (Friday to Friday), now just above the new ‘support level’ of £167/t, seemingly in line with Paris futures. When analysing price trends, a ‘support line’ is seen as a level that it may be harder for prices to fall below.

The relative strength index (RSI) rose slightly from 21 to 29, maintaining levels described as ‘oversold’ in technical analysis and showing the significant downward market momentum. An RSI at ‘oversold’ levels can also indicate this is a time to watch markets more closely.

Find out more about the graphs in this report and how to use them.

Market drivers

UK wheat futures (Nov-25) gained last week, up £1.05/t (0.6%) closing at £168.05/t on Friday. A slight fall in the value of the sterling against the dollar £1 = $1.3411 (LSEG) on Thursday, as well as buyers repositioning after recent lows, helped prices gain on the week.

The IGC has raised it’s 2025/26 global wheat forecast to 811 Mt. Driven by improved crop conditions, adding 3 Mt to its previous estimate, signalling stronger supply potential heading into the new season.

In the United States, crop scouts on the Pro Farmer tour noted above-average yield potential in key states. With Iowa, the top producing maize area in the US, seeing the highest yield potential in 22 years. Maize production this season was estimated at 411.6 Mt (below USDA’s 425.3 Mt). Pro farmer added widespread southern rust and sudden death syndrome could trim final output.

In the EU, France has seen mixed quality in its wheat, with lower protein but strong milling indicators. 73% of soft wheat meets ≥11% protein (vs. 83% five-year average), but Hagberg falling numbers and specific weights are solid across the board. France has seen a run of exports to Egypt, Tunisia, and Thailand, noting this is partly due to a slow start to Russia’s export campaign.

In Germany, the wheat harvest rebounds to 21.7 Mt, but rain has dented quality. Output is up 21.9% year-on-year after last season’s poor results. However, persistent summer rain delayed harvest and reduced protein content and falling numbers.

The August MARS report sees expected wheat yield rise by 1% from the July report at 5.92 t/ha. Maize yields for Europe have been cut by 3% from the previous report to 6.93/t/ha, citing drought across the southeast of the continent.

In Russia, Sovecon revised wheat output upward to 85.4 Mt (+0.2 Mt) due to strong yields in Siberia and the Urals. Yet, logistical delays from inland regions to Black Sea ports are holding back early-season exports.

In Argentina, the Rosario exchange expects the wheat crop for 2025/26 at 20 Mt, 15.3% above the 5-year average, amid ideal planting conditions, abundant rainfall over recent months and less disease/pest pressure from the plague of leaf hopper bugs seen last season. Argentina is also expected to see a near record planted area for maize at 7.8 Mha in 2025/26, up 9.6% on the year, and the second largest after the 8.4 Mha planted in 2023/24.

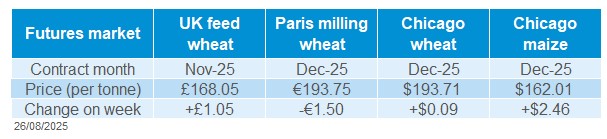

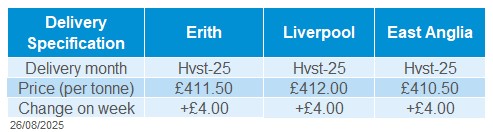

UK delivered cereal prices

Feed wheat delivered into East Anglia (September delivery) was quoted at £167.00/t on Thursday, down £0.50/t from the previous week.

Bread wheat delivered into Northamptonshire in October was quoted at £198.50/t, also down £0.50/t on the week.

Rapeseed

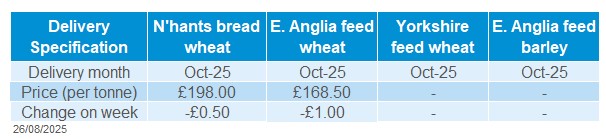

Paris rapeseed futures in £/t (Nov-25)

Paris rapeseed futures (Nov-25) ended last week close to the 20-day moving average. Currently, the 20-day moving average is acting as a barrier to further increases in the price.

The relative strength index (RSI) decreased from 41 to 39 during the week (Friday-Friday), still indicating the lack of momentum as of late.

Find out more about the graphs in this report and how to use them

Market drivers

Paris rapeseed futures (Nov-25) increased last week, finishing at €475.50/t on Friday, up €1.75/t (0.4%) from the previous Friday. During the week, Chicago soybean futures and Winnipeg canola futures (Nov-25) increased by 1.5% and 0.9%, respectively. Paris rapeseed futures (Nov-25) gained a further €1.75/t during yesterday's session, while domestic markets were closed.

Prices in the oilseeds complex were mainly supported last week by rising crude oil prices and the recent activation of 2025 soyabean exports from US. However, any potential increase was limited by global supply, as well as geopolitical and economic unpredictability. For rapeseed, the outlook for production in Canada and the restricted capacity to export to China limit any further potential increase.

Yesterday, the Monitoring Agricultural Resources (MARS) bulletin increased its forecast for European 2025 rapeseed yield, revising it upwards slightly from 3.20 to 3.24 t/ha.

According to data published by the European Commission last Tuesday, EU rapeseed imports reached 0.33 Mt by 17 August in the 2025/26 season that started in July, compared with 0.57 Mt a year earlier, reflecting a tighter balance.

As of 22 August, Ukraine had harvested 3.16 Mt of the 2025 rapeseed crop, compared to 3.36 Mt of the 2024 crop at the same date. The pace of exports has slowed down in the current season, which are well below last year's levels.

Yesterday's USDA Crop Progress Report revealed that the proportion of soyabeans rated as being in good or excellent condition as of 24 August increased by 1% compared to the previous week, and is the highest it has been for the last four years.

Last Thursday, the US Weekly Export Sales Report showed net sales of 1.14 Mt of soyabeans for the 2025/26 season. This figure was higher than traders' estimates. Net sales were recorded for destinations including unknown locations (645 kt), Mexico (120 kt), Spain (106 kt), the United Kingdom (66 kt) and Egypt (60 kt).

UK delivered rapeseed prices

Rapeseed to be delivered into Erith on a harvest contract was quoted at £411.50/t on Friday, up £4.00/t on the week.

Deliveries into Liverpool and East Anglia for August were quoted at £412.00/t and £410.50/t respectively, also both up £4.00/t on the week. Prices for delivered rapeseed generally followed Paris rapeseed futures last week.

Extra information

Provisional Defra England crop areas are due to be released this Thursday (28 August), covering wheat, barley, OSR and other crops for harvest 2025.

AHDB’s fourth harvest report, released on Friday 22 August, highlights key challenges faced throughout this year’s campaign as harvest enters its latter stages. Yields remain highly variable, with the survey estimating the UK average wheat yield at 7.3 t/ha, 5% below the five-year average and 9% below the ten-year average.

Defra data released last week showed on-farm stocks of own-grown wheat in England and Wales at the end of June were back 44% on the year, and 18% lower than the five-year average. Home-grown stocks held by merchants, ports, and co-operatives (MPC) in the UK were down 39% year-on-year, while imported wheat stocks rose 21% to a record high.

Total end-season stocks for the 2024/25 season will be published in the final 2024/25 balance sheets in mid-September and will incorporate the data from the UK MPC and Defra England and Wales on-farm stocks surveys released last week, as well as stocks held by processors in the UK and farmers in Scotland and Northern Ireland. In the May UK cereal supply and demand estimates, end-season wheat stocks for 2024/25 were estimated at 2.94 Mt, down 2% from the previous season.

AHDB released cost of production forecasts for the 2025/26 season. Unfortunately, it suggests that UK crop production costs are set to rise for harvest 2026, mainly due to higher fertiliser prices, though as it stands, most other input costs are currently expected to remain relatively stable.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.