What are the prospects for UK wheat exports this year? Grain market daily

Friday, 31 January 2025

Market commentary

- UK feed wheat futures (May-25) closed yesterday at £190.75/t, up £0.75/t from Wednesday’s close. The Nov-25 contract settled at £195.30/t, also up £0.30/t over the day.

- Domestic wheat futures closed higher, supported by gains in Chicago and Paris markets. This was driven by a 0.9 Mt reduction to Russia's 2024/25 wheat export forecast by SovEcon and concerns over cold weather damaging the US winter wheat crop.

- Paris rapeseed future (May-25) closed at €516.75/t yesterday, up €4.25/t from Wednesday’s close. The new crop futures contract (Nov-25) closed at €485.00/t, rising €0.25/t over the same period.

- Paris rapeseed futures were supported the vegetable oil complex, with Winnipeg canola futures (May-25) up 0.43% and Chicago soybean oil futures (Dec-25) gaining 0.12%. However, falls in Chicago soyabean prices due to worries about US tariffs capped gains.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

What are the prospects for UK wheat exports this year?

We released our January balance sheet yesterday, providing the first look at wheat exports this season. Full season exports are forecast at 175 Kt (including durum), down 32% on the year, and the lowest since at least the turn of the century. With 51.6 Kt exported from July to November, 123.4 Kt remains to be shipped from December to June.

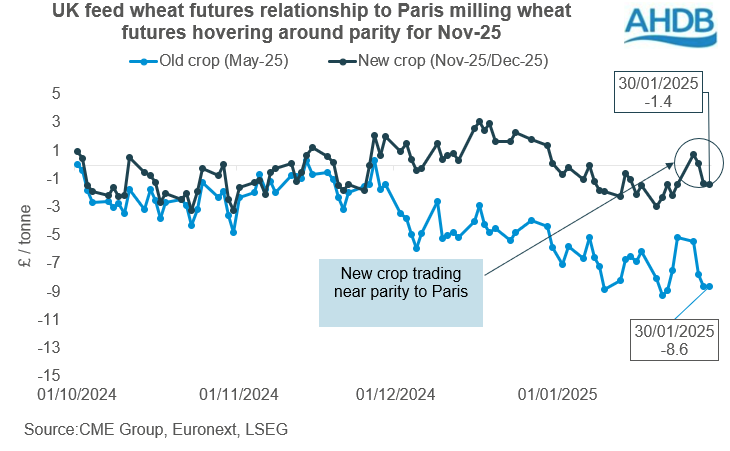

The ability to meet the forecast will depend on if UK wheat can become more competitive in the global market. One way to assess the competitiveness is by comparing the price relationship with Paris milling wheat futures.

Yesterday, old crop (May-25) UK feed wheat futures traded at a discount of approximately £8.60/t, to Paris milling wheat futures (May-25). At this point, the futures prices look less competitive for new import demand compared to earlier in the season but not yet at export parity. Historically, UK feed wheat has been more competitive for export when UK feed wheat futures are around £15.00/t or more below Paris milling wheat.

Despite a slight decline in Paris May-25 wheat prices this season, UK feed wheat futures for May-25 have fallen more. The fall in UK futures has been driven by limited export demand from eastern and southern areas of England, coupled with a historically strong pound against the euro.

Both the EU and UK have faced similar production challenges this season due to adverse weather conditions. However, with export restrictions and further cuts to Russia’s wheat exports forecast, demand for EU wheat may rise in the coming months. Any support for Paris futures from increased demand could help widen the discount of UK feed wheat to Paris milling wheat futures.

However, it will be important to monitor both the relationship and export pace going forward to see if the export forecast can be met. Even with the current export forecast, end of season stocks are expected to be well above average. If the export forecast is not met, stocks could be even higher and weigh on both old and new crop UK feed wheat prices.

Looking ahead to harvest 2025

New crop UK feed wheat futures (Nov-25) are currently trading near parity with Paris futures, following a brief period of premium pricing earlier this week. For the new crop to move from its current trading level (at parity with Paris futures) to a level which discourages imports, or even encourages exports, UK prices will need to drop compared to Paris futures. This change is likely due to a 5% rise in planted area for harvest 2025 compared to 2024, according to our early bird survey, which in turn points to potential for a larger UK wheat crop in 2025.

Be sure to look out for our Agri-Market Outlook in late February, which will include 2025 production scenarios. Also, our next UK crop condition report is due at the end of March, which will provide a post-winter update on 2025 crop potential.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.