What can we expect from animal feed demand this season? Grain market daily

Thursday, 19 October 2023

Market commentary

- UK feed wheat futures (Nov-23) gained £6.65/t yesterday, ending the session at £191.30/t. The Nov-24 contract closed at £202.40/t, up £3.40/t over the same period.

- Domestic feed wheat futures followed gains in European wheat markets yesterday. This was largely due to a weakening euro and British pound, making wheat more competitive on the global market. Some support from bargain buying on the US wheat market also filtered through.

- Paris rapeseed futures (Nov-23) fell €1.00/t yesterday, to close at €419.00/t. The Nov-24 contract was up €5.00/t over the same period, closing at €459.75/t.

- Support in US soyabean markets filtered into EU rapeseed prices yesterday. Strong US demand and concerns over a severe drought in Brazil saw Chicago soyabean futures (Nov-23) up 1.1% over yesterday’s session.

What can we expect from animal feed demand this season?

The 2023/24 AHDB Early Balance Sheet estimates of wheat and barley were released on Tuesday. In the estimates, wheat usage in animal feed production was forecast up 3% on the year, at 7.119 Mt. For barley however, usage was forecast down 3% on the year, to 3.814 Mt. As outlined in Tuesday’s Grain Market Daily, the reason why wheat has seen such an increase and barley such a decrease, is largely due to their relative price. We can therefore expect a higher inclusion rate of wheat (and potentially maize) overall in rations this season at the expense of barley.

However, last season’s total feed production figure (incl. Integrated Poultry Units) was the lowest since 2011/12, and as it stands, a significant rebound this season is unlikely. High input costs, and therefore struggling margins leading to declining herd numbers were largely the reason for lacklustre feed demand last season. So, it’s important to assess what could happen to these costs in the livestock sector this season. Freya Shuttleworth (Senior Analyst – Livestock) takes a look at input cost inflation in the article below.

Input cost inflation easing till summer, but volatility remains

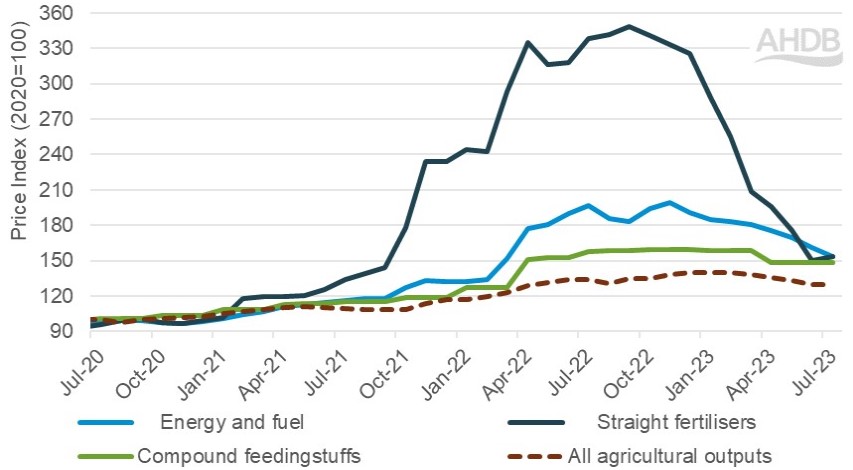

The latest Agricultural Price Index (API)[i] shows that the rate of inflation in prices paid for goods and services has continued to ease. Although this will be welcome news to farmers, pressure on their margins remains as price inflation continues to sit at elevated levels, with key inputs maintaining a higher rate of inflation than outputs. The increase in the Bank of England base rate to 5.25% will also be applying additional pressure to working capital by increasing the cost of borrowing.

UK agriculture price inflation

Source: Defra

Fertiliser price inflation has seen the largest decline, falling 53% in the first 7 months of the year (Dec 22 vs Jul 23) and down 56% compared to the inflationary peak in September last year. However, between June and July, there has been a slight uptick in fertiliser price inflation. GB fertiliser prices rose in August, with UK produced AN up £17/t compared to the previous month. We anticipate some volatility to continue in fertiliser price inflation as market pricing closely follows the movements in the natural gas markets.

Energy and fuel price inflation has eased at a more gradual rate than fertilisers, down 20% from the start of the year (Dec 22 vs Jul 23) and a 23% drop compared to November 2022 where inflation peaked. Again, we would expect to see some volatility over the coming months as we enter winter and the cooler weather increases demand. Addiing to the volatility is the current pressure seen on oil markets and prices, which energy and fuel closely follow. In September, UK fuel prices increased again with red diesel prices increasing 8% month-on-month.

Inflation for compound feeds has seen more marginal downwards movement, down just 7% from the peak in October last year. Wheat futures markets are currently at a similar price point to the beginning of last year, before the Russian invasion of Ukraine. Southern Hemisphere crops are currently in focus, for both short and long-term price direction. However, competitive Black Sea supplies continue to cap gains and are expected to fulfil global demand. Ample US, EU and South American maize supplies are also expected to weigh on grain markets moving forward. Find out more about the cereals and oilseeds markets at our upcoming Grain Market Outlook Conference.

[i] The Agricultural Price Index (API) reflects the change in the price farmers have paid for goods and services in relation to the base year of 2020.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.