Wheat markets rise on production worries: Grain market daily

Friday, 11 October 2024

Market commentary

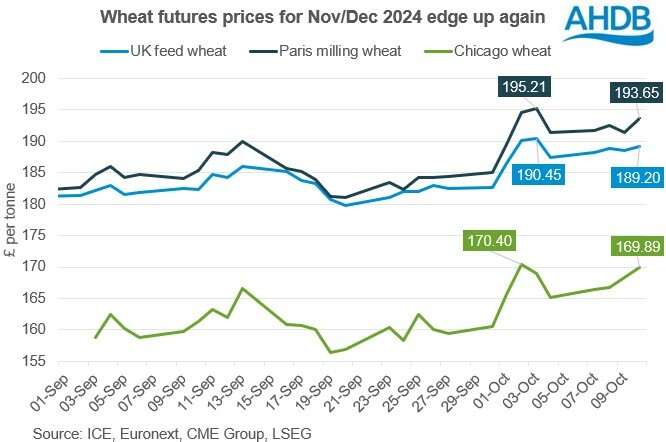

- Global crop supply worries supported global wheat markets yesterday – more below. UK feed wheat futures for Nov-24 gained £0.70/t to settle at £189.20/t, while the Nov-25 contract settled at £202.20/t, up £1.45/t.

- Paris rapeseed futures for Nov-24 gained €5.75/t to settle at €496.00/t (approx. £415.50/t) due to strength in vegetable oil prices. The Nov-25 contract gained €1.50/t to close at €483.00/t (approx. £404.50/t).

- The gains are despite Chicago maize and soyabean futures coming under pressure from the advancing harvests and re-positioning by speculative traders ahead of tonight’s USDA report. The market is expecting the USDA to only make small changes to US maize and soyabean production, and trim global wheat and maize stocks for 2024/25 (LSEG).

Wheat markets rise on production worries

Crop worries in key global producers, as well as access to Black Sea grain and short covering by speculative traders have continued to support wheat prices this week. While prices are up, they remain below the recent peaks on 2/3 October.

Uncertainty over the size of the 2024/25 Russian crop and slow planting of the 2025 crop, amid dry weather, have been factors in markets for a couple of weeks now. The Russian government reportedly trimmed its estimate of the 2024 wheat crop from 84.0 – 86.0 Mt to 83.0 Mt yesterday. Against this backdrop, and with strong exports so far, there are rumours that Russia could introduce a higher minimum export price. If measures are introduced, it would likely add to the nervous sentiment. Some rain is predicted in key producing regions of the country for the week ahead.

Dry weather also caused planting delays in Ukraine, though there are reports that recent rain has helped, and that winter crop planting is advancing. Drier than usual weather in the US winter wheat areas is also starting to be monitored, with planting underway.

In Argentina, the Buenos Aries Grain Exchange (BAGE) reported that more rain is needed to sustain yields for the 2024/25 wheat crop. The Rosario Stock Exchange yesterday cut 1.0 Mt from its crop forecast because of the dry weather, though its estimate is still above that from BAGE. The lack of moisture is also delaying maize and sunflower planting.

In parts of Europe, planting is also delayed by wet weather, and late harvesting of 2024 spring crops, such as maize. For example, in France just 6% of the late-planted 2024 maize crop had been harvested by 7 October, vs 40% on average (FranceAgriMer). Planting progress has improved over the past week and the forecast for the week ahead is also looking drier. Winter barley planting was 12% complete by 7 October, up from 2% a week earlier but still behind the 16% planting on average for the time of year.

With harvest mostly wrapped up (read more in AHDB’s final harvest report of 2024), farmers are keen to start planting for 2025. Wet weather in large areas of England has not been ideal, so it will be important to watch the weather over the coming weeks. There’s more on establishing crops in the growth guides available from AHDB’s website here.

Weather will be a key driver over the coming weeks, with the potential for further adverse weather to support wheat markets. But improved conditions could pressure markets once more. Tonight’s USDA report could also influence market direction.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.