Wheat usage for bioethanol remains low: Grain market daily

Thursday, 6 February 2025

Market commentary

- UK feed wheat futures (May-25) closed at £187.25/t yesterday, falling £2.20/t from Tuesday’s close. The Nov-25 contract lost £0.25/t over the same period, to close at £194.25/t.

- Global wheat markets declined yesterday due to reduced demand, especially from Chinese buyers amid ongoing trade tensions with the US. Chicago wheat futures (May-25) dropped by 0.72%, while Paris milling wheat futures (May-25) saw a decrease of 0.94%.

- Paris rapeseed futures (May-25) closed at €518.00/t yesterday, falling €4.00t from Tuesday’s close. The Nov-25 contract lost €2.25/t over the same period, to close at €488.75/t.

- Weakness in the broader oilseeds complex, driven by beneficial rains in Argentina, weighed on the European rapeseed market. Both Chicago soybean and soybean oil futures (May-25) dropped by 1.45% each.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Wheat usage for bioethanol remains low

Earlier today, AHDB released the latest UK human and industrial cereal usage figures, covering the season to date (July–December). The category ‘other flour’ produced primarily reflects the starch and bioethanol industries and can indicate wheat demand within the sector.

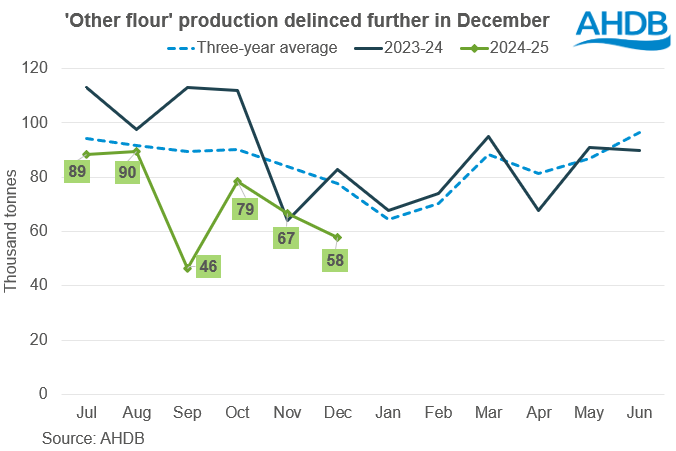

In December 2024, ‘other flour’ production dropped by 13%, or 8.7 Kt, compared to November, and by 31% or 25.3 Kt from the same month last year. For the season to date (July–December), 427.0 Kt of ‘other flour’ was produced, a decline of 27% from the previous year.

Despite a recovery in October after September’s low usage levels, there have been consistent month-on-month declines in November and December. December's usage was below both last year's level and the three year-average.

In our January balance sheet total 2024/25 wheat usage by the human and industrial (H&I) sectors was anticipated to fall by 86 Kt compared to November and down 3% year-on-year. This is primarily due to reduced capacity, with neither UK bioethanol plant expected to operate at full capacity and partly because of competitively priced ethanol imports.

In addition, maize usage by the H&I sector in 2024/25 was estimated at 1.109 Mt, up 88 Kt from previous estimate and 191 Kt higher on the year. This rise is driven by higher bioethanol sector usage, competitive pricing earlier in the season and challenges in meeting Renewable Energy Directive (RED II) compliance for UK-grown grains. It’s being supported by strong maize imports so far this season.

Going forward

So, what does all this mean for wheat demand in bioethanol and starch production going forward?

Recently, maize has become less competitive compared to wheat, with low stocks and crop worries likely to offer support to maize prices at least in the medium term. If this trend continues, we could see reduced maize imports and usage in the sector in future months, though the extent depends on what has already been priced and booked. As such, the price relationship between imported maize and domestic wheat will be a key factor to watch as the season progresses.

In addition, stable and relatively low crude oil prices, due to sluggish demand and ample supply, are making biofuels less cost-competitive globally. This could, in turn, impact grain demand from the biofuels sector, including in the UK.

These factors, along with the tighter domestic availability and uncertainty over RED II situation for home-grown grains will influence wheat demand from the sector in the remainder of the season.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.