Why prices feel lower than they are: Analyst insight

Thursday, 2 October 2025

Market commentary

- UK feed wheat futures rose yesterday, with the Nov-25 contract closing up £0.50/t (0.3%) at £164.55/t. The May 2026 contract gained £0.45/t, ending the day at £176.85/t.

- The domestic market moved higher in line with global prices, with Chicago wheat and Paris milling wheat futures (Dec-25) up 0.2% and 0.8% respectively. The uptick in prices yesterday likely reflects a technical rebound, following the downward trend seen earlier in the week that saw prices drop to new contract lows. However, abundant global supply is still keeping a lid on any sustained price recovery.

- Paris rapeseed futures (Nov-25) closed unchanged yesterday at €466.00/t, while Chicago soyabeans futures (Nov-25) rose by 1.1%. The upcoming US-China meeting raises hopes for improved trade, particularly for renewed exports of US soybeans to China.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Why prices feel lower than they are

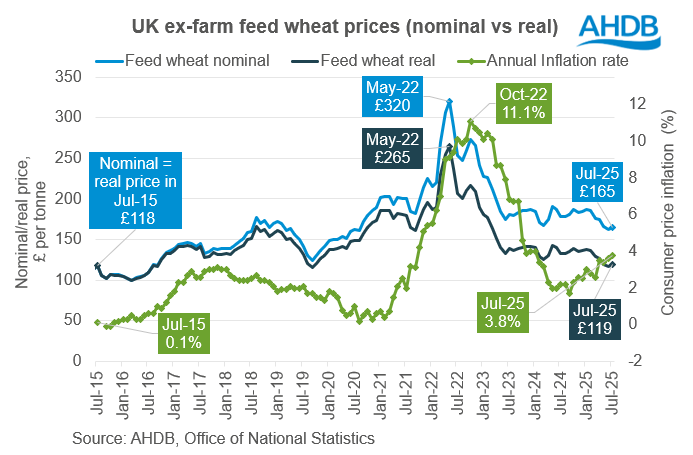

While crop prices are higher than a decade ago, farm profitability remains under pressure. Inflation and rising input costs have eroded the real value of those price gains. Prices may look strong on paper, but they often fail to keep pace with the cost of living or production.

In recent conversations, many farmers have reported that, despite historically high prices, falling commodity prices have added further strain, leaving profit margins tighter than ever.

Inflation has slowed, but costs remain high

Since 2020, UK agriculture has faced significant economic pressures. Brexit disrupted trade with the EU, our largest trading partner as well as labour availability, COVID-19 strained supply chains, and the war in Ukraine drove up global grain and fertiliser costs. These factors contributed to sharp inflation, with the Consumer Prices Index (CPI) peaking at 11.1% in October 2022, the highest rate since October 1981.

Although inflation eased to 3.8% in July 2025 (ONS), prices across the economy remain high. A slower rate of inflation means prices are rising more gradually, not falling. For growers, key inputs such as fertiliser, fuel, and labour remain relatively expensive, continuing to squeeze already tight margins.

Another challenge is that farmers often struggle to pass on rising costs due to limited pricing power and global market forces. As a result, farmer income is not keeping up with inflationary pressures.

Real vs nominal prices

To understand why crop prices feel lower, it is important to distinguish between nominal and real values. Economists refer to actual amounts received at sale, such as ex-farm prices, as nominal prices. When these are adjusted for inflation to reflect true purchasing power over time, they are known as real prices.

For example, the UK ex-farm price of wheat increased from £118.40/t in July 2015 to £165.00/t in July 2025, a 39% nominal increase over the decade. However, after adjusting for inflation, the real value rose by just 0.3%, from £118.40/t to £118.71/t, reflecting a 28% loss in purchasing power.

This helps explain why farmers feel worse off: a £1 today buys less than a £1 yesterday (Time Value of Money).

Between 2015 and early 2021, nominal and real feed wheat prices remained closely aligned, reflecting a period of low and stable inflation.

Prices peaked in mid-2022, driven by global disruptions including the Russia–Ukraine conflict, ongoing post-COVID supply chain challenges and concerns over global grain availability.

Although inflation had been rising since mid-2021, the unusual spike in grain prices in 2022 briefly outpaced it, creating a short window where farmers earned more in both nominal and real terms. Since then, the gap between nominal and real prices has widened.

Real prices have now fallen back to levels last widely seen in 2016–2018, despite higher nominal figures. So, while headline prices may appear strong, their actual purchasing power has weakened. Similar patterns are evident in barley and oilseed rape markets.

Conclusion

Prices may appear higher, but inflation has quietly eroded the real value of arable returns. At the same time, input costs have surged, further tightening margins. For growers, it is essential to assess business performance in real terms, not just nominal figures.

Tools like AHDB Farmbench can support margin management by highlighting true costs and returns, helping farmers make informed decisions and manage risk in today’s challenging economic climate.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.