Will China continue the downtrend in dairy demand?

Tuesday, 11 April 2023

China plays a vital role in setting price direction on global dairy markets. During recent times, they have been buying less amid high imports in 2021 and comfortable domestic milk supplies.

Farmgate milk prices have been declining in recent months in response to weaker global market prices. While milk production has improved, the reduction in demand has been more instrumental in driving down market prices. So what is the outlook for China’s import demand this year?

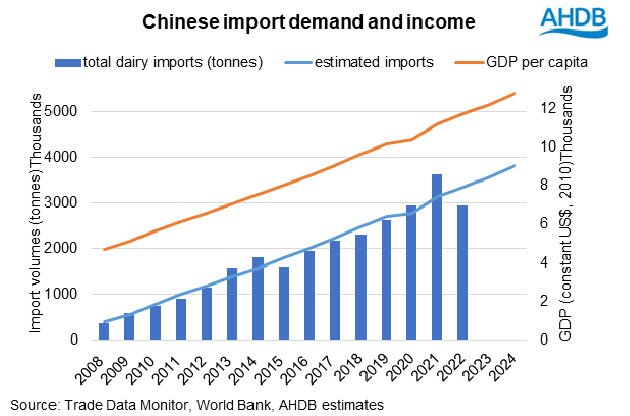

Historically there has been a strong relationship between China’s economic growth (as measured by GDP per capita) and its level of dairy imports. So much so, that comparing the two trends can give an indication of expected imports and potential risks around stock building.

Following heightened import volumes in 2021 to ensure food security, imports fell by around 19% in 2022. The drop was in part a response to the high stock levels, but will also have been impacted by China’s zero-Covid policy, low GDP growth, and lower consumer spending on the back of high prices .

All products saw lower imports in 2022, although for most, import volumes were similar or slightly above 2020 levels. Butter was an exception showing marginal increase compared to previous year. The products recording the largest year on year decline in 2022 were liquid milk & cream and whey products.

.png)

Is the downtrend likely to continue?

Based on predicted economic growth[1] of 4.5% for 2023 and 2024, import volumes would be expected to increase by around 6.7% per year. While imports in the first two months remain below previous year levels, it is expected that demand will recover through the year, pulling up import demand.

There are of course, other factors which could impact on import volumes going forward. As stocks dissipate through the year, imports are likely to improve. In addition, as consumers return to pre-Covid habits, per capita consumption may return to growth helping to bolster import requirements. However, the upside could be curtailed if milk production shows good growth and consumer spending is weak.

[1] International Monetary Fund GDP projections

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.