- Home

- Oilseeds market outlook

Oilseeds market outlook

September 2025

Key points

- Forty-year low in the estimated UK rapeseed area in 2025

- Higher average yield forecast for the 2025 UK rapeseed crop, although yields vary significantly by farm

- UK rapeseed production is expected to increase in 2025 compared to the 2024 crop due to higher average yields

- An increase in UK rapeseed production in 2025 may lead to fewer imports during the 2025/26 season

- Lower global demand has put pressure on rapeseed prices since the beginning of the 2025/26 season

Production

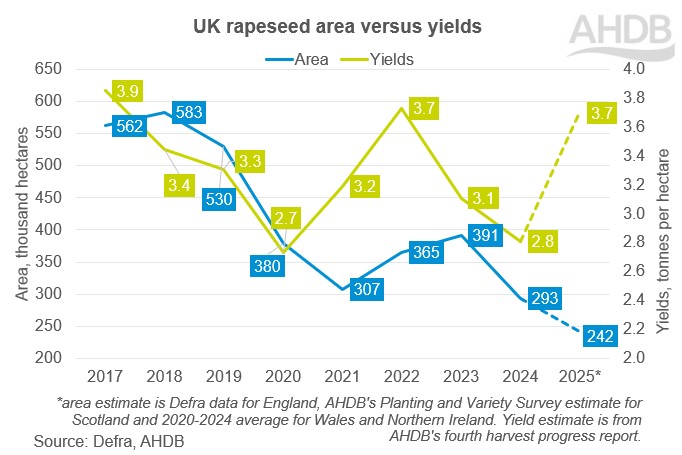

The results of Defra’s 2025 June Survey of Agriculture, released on 28 August, show an 18% decline in the area of oilseed rape (OSR) in England to 204,000 hectares (Kha). When combined with the estimate for Scotland from our Planting and Variety Survey, plus the 2020–24 average areas for Wales and Northern Ireland, the total UK OSR area would be down 17% year-on-year at 242 Kha.

The yearly decline in rapeseed area is likely driven by a combination of variable weather and alternative options under the Sustainable Farming Incentive (SFI) scheme in England. In addition, variable crop performance in recent years and ongoing cost pressures from pest control continue to strain profitability. This is now the smallest cultivated area in over four decades.

The winter oilseed rape (WOSR) 2025 harvest was complete by 8 August, slightly ahead of 2024 and the five-year average of 82% of the area harvested by this date. The national average yield for WOSR is calculated to be 3.7 tonnes per hectare (t/ha) based on the results from farms in this survey, though there is significant variation between farms.

This is up 20% on the five-year (2020–2024) average yield and is one of the highest levels since 2017. Oil content is averaging around 45%, with a range of 42–46%. Average moisture of oilseed rape is reported to be 8.6%, with a range from 8% to 10%.

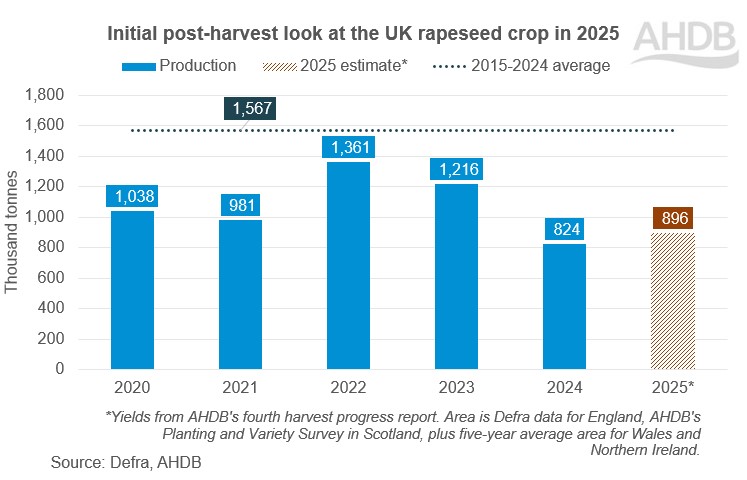

The yield estimate from the fourth harvest progress report and the combined area data available so far suggest UK OSR production could have increased by 9% to 896 Kt in 2025, compared to 2024.

This increase is driven by higher yields, which offset the sharp fall in area. However, the forecast level of rapeseed production for the 2025/26 season is still 43% below the 10-year average.

Trade

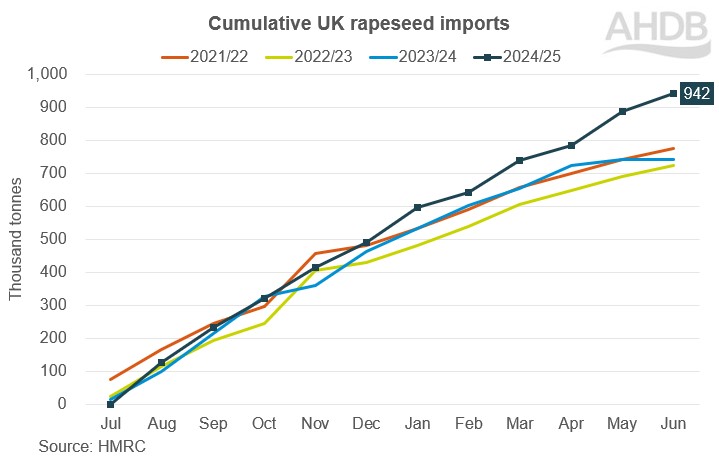

From July 2024 to June 2025, the UK imported 942 Kt of rapeseed, up by 27% from the previous season. Almost 57% of this came from the EU. The main origins were the Netherlands (175 Kt), France (104 Kt), Latvia (77 Kt), Romania (62 Kt), Lithuania (57 Kt) and Ireland (46 Kt).

From non-EU counties, the main origins were Ukraine (343 Kt) and Uruguay (64 Kt).

If higher production is confirmed, then domestic imports could be slightly lower in the first half of this marketing year (2025/26). The August USDA World Agricultural Supply and Demand Estimates forecast that total imports in the 2025/26 season will be 4% lower than last season’s level.

In August, the EU Commission forecast EU-27 rapeseed production for the 2025/26 season at 18.8 million tonnes (Mt), which is 13% higher than for the 2024/25 season. This increase is due to more favourable weather conditions and additional land being cultivated.

Consequently, the UK domestic market may have more options for buying rapeseed from EU countries in the 2025/26 season. However, the initial pace of rapeseed exports and imports in the EU is slow.

According to Ministry data, Ukraine had harvested 3.19 Mt of rapeseed by the end of August 2025. This figure is lower than the 3.4 Mt harvested in the 2024/25 season and is due to the impact of adverse weather conditions.

Ukraine is considering introducing a 10% duty on the export of rapeseed and soya beans, which could make the market more unpredictable.

Demand

EU+UK rapeseed crushing in 2024/25 was the lowest since the 2021/22 season, according to data from FEDOIL (the federation of the European vegetable oil and protein meal industry).

After a positive start in July and August 2024, EU+UK rapeseed crushing slowed. The total from July 2024 to June 2025 decreased by 6% compared to the previous season.

The 2025/26 season got off to a slow start, with just 1.34 Mt of rapeseed crushed in the EU and UK in July 2025 – less than in the previous two seasons. Seasonally, rapeseed crushing in the EU and UK is usually at its peak in August due to higher market supply.

According to the USDA’s WASDE report from August 2025, the EU's demand for OSR is forecast to increase from 24.10 Mt in 2024/25 to 24.95 Mt in 2025/26.

What could the outlook mean for UK prices?

From January to August 2025, we saw a downward movement in rapeseed prices (spot, delivered into Erith) of over 8%. The global supply and demand balance for rapeseed is expected to be better than in the previous season, and this is putting pressure on Paris rapeseed futures and domestic prices.

Favourable prospects for canola production in Canada, coupled with an import duty imposed by China, are also putting pressure on the market. Currently China is the top destination for Canadian canola.

Conversely, the potential for increased US soya bean consumption due to higher biodiesel demand could support global oilseed prices. However, any potential price increase is being limited by global oilseeds supply, as well as geopolitical and economic unpredictability.

In the medium to long term, concerns about sunflower production could offer some support for rapeseed prices. In August, the Monitoring Agricultural Resources (MARS) bulletin revised its 2025 European sunflower yield forecast downwards by 6%: from 1.94 t/ha in July to 1.83 t/ha.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.