The Middle East crisis - why is this region relevant to UK fertiliser prices?

Tuesday, 2 September 2025

The Middle East crisis continues, and this remains a key watchpoint for the global fertiliser market too. Israel is a key natural gas exporter, and Iran a major crude oil producer with substantial natural gas reserves. With natural gas an essential feedstock for fertiliser production, the cost of natural gas is a key driver of the cost of fertiliser.

Middle East update

A key factor to monitor is trade flow from the region. Iran has threatened to close the Strait of Hormuz in recent months, a significant passage which connects the Persian Gulf to the Gulf of Oman. It is estimated that 20% of liquified natural gas passes through here (EIA) and around 45% of global urea exports come from this region (Rabobank). It is also estimated that 25% of global ammonia exports, and 20% of diammonium phosphate exports (DAP) (Rabobank) flow through.

Egypt is a major producer of urea, including to the EU, but is dependent on imports of natural gas. Israel currently supplies natural gas to Egypt, and in 2024 this increased by 13.4% (Reuters). Since 2020, the UK has imported 1,275 Kt f urea from Egypt (27% of total imports). There have been reports that Egypt’s urea production has been impacted by disruption of gas supplies from Israel. However, Israel and Egypt are expected to close a large gas deal in the coming weeks.

The UK imports muriate of potash (MOP) from Israel directly. In 2024, the UK imported 74 Kt of MOP from Israel, down 53% from 2023, but accounting for 23% of total UK MOP imports in 2024. So far in 2025 (January to June), the UK has imported 72 Kt from Israel (32% of total MOP imports).

In recent years, CF Fertilisers UK have closed two UK sites due to high production costs, seeing the UK become more reliant on imported fertilisers, and ingredients needed for fertiliser production.

The UK is heavily dependent on the EU for imports of all fertiliser products. In 2024, 99% of ammonium nitrate (AN) imports came from the EU. European gas prices can also impact our domestic natural gas market, impacting domestic supply, as well as impacting the cost of imported fertiliser.

So, where are prices currently?

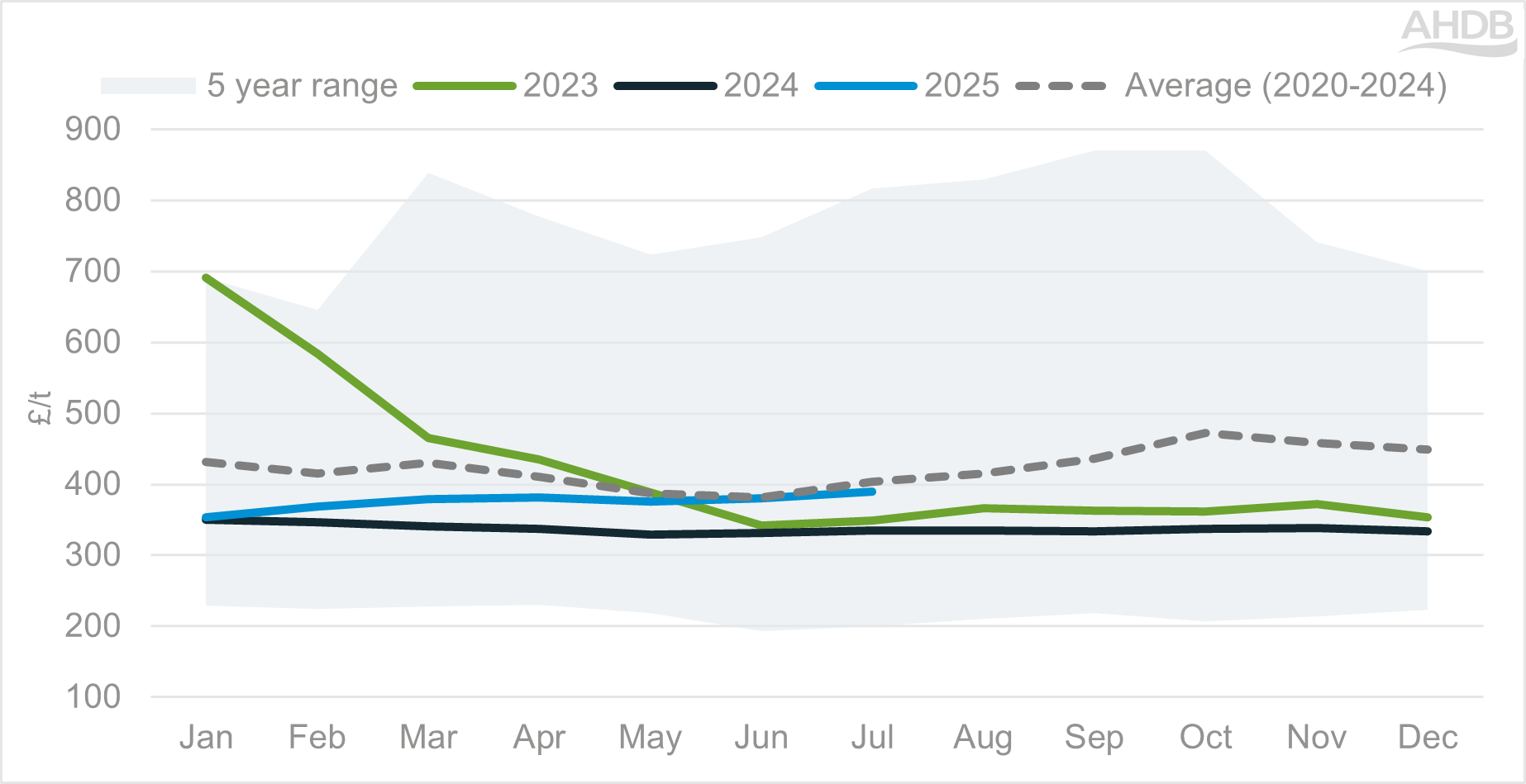

UK produced AN averaged at £390/t in July, which was £7/t higher than June and £52/t higher than July last year. Imported AN sat at £389/t in July which was £13/t higher than a month earlier and £56/t higher than July last year.

Average AN 34.5% N fertiliser price (average of UK produced and imported)

Source: AHDB

The graph above shows that in July, AN (average of UK and imported) prices were more expensive than this time last year but sit slightly below the 5-year average. However, this does follow several seasons of elevated prices, with prices starting to climb late 2021 and peaking in 2022 after the outbreak of war in Ukraine.

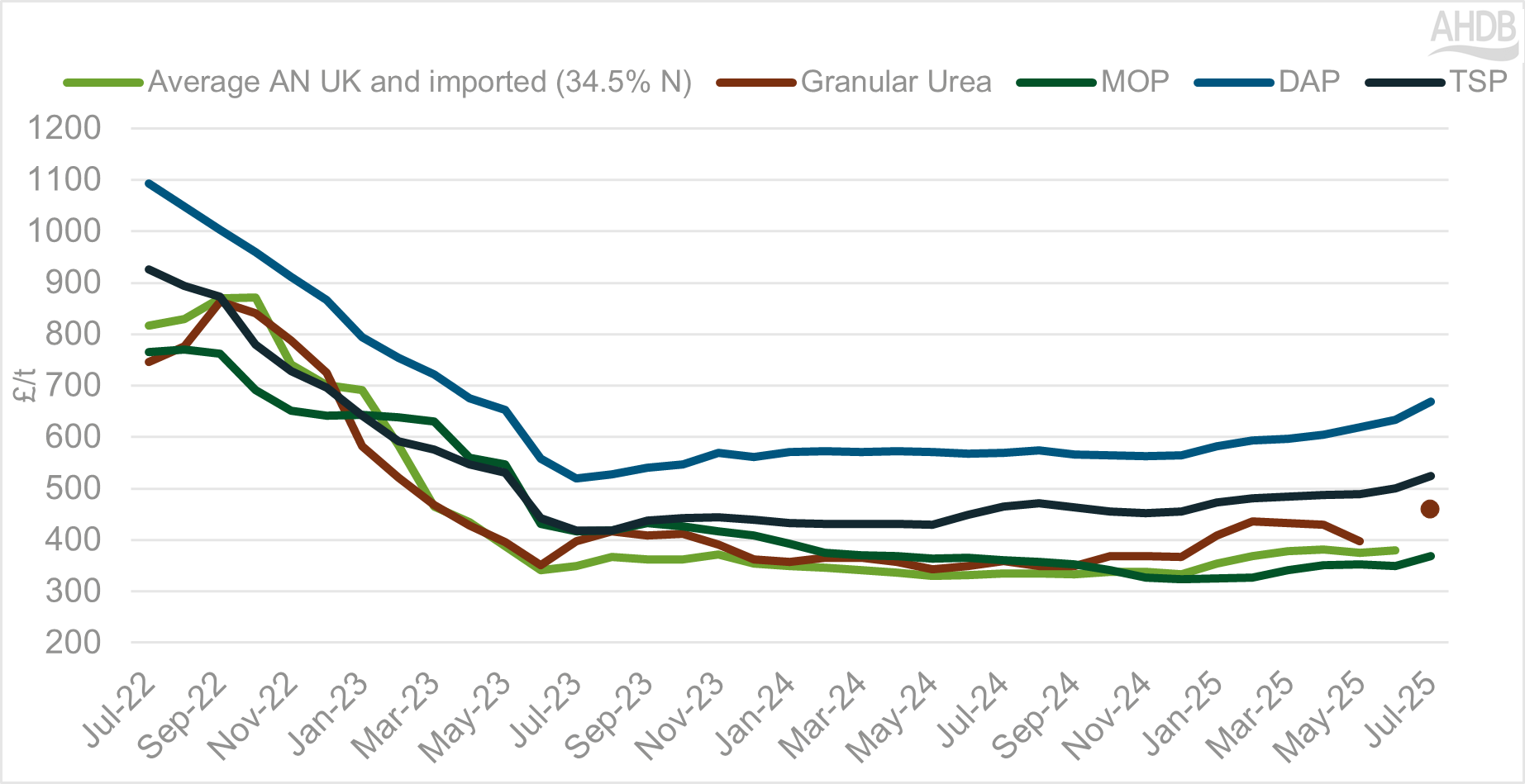

Looking at other products, MOP averaged at £369/t in July, an increase of £20/t compared to June and £8/t higher than July last year. Whereas DAP saw an increase of £35/t compared to June to average at £669/t, this is £99/t higher than July 2024.

Fertiliser prices over the past three years – selection of products

Source: AHDB

For more prices see GB fertiliser prices

Where next?

Going forward, geopolitics remains a key factor in price direction for UK fertiliser prices considering the UK has become increasingly reliant on importing fertiliser products/ingredients to fulfil domestic demand. Global energy prices and fertiliser trade flows remain important for price direction and imported product supply, so close monitoring will continue surrounding the wars in the Middle East and Ukraine, as well as around other news driving energy markets including US tariffs.

Importantly, many farmers are currently making decisions for purchasing key inputs for the upcoming growing season. Currently, AN prices sit over £50/t higher year-on-year and other products, especially DAP, have also seen significant rises in prices in recent months. This comes after a challenging harvest 2025 for many too, considering difficult weather and challenging growing conditions.

Natural gas prices have come down from highs earlier this year, however they remain historically supported due to firm import demand and supply constraints. Looking ahead, UK natural gas futures prices sit higher in forward months over the winter - a watchpoint for the cost of UK and imported fertilisers going forward.

Topics:

Sectors:

Tags: