2023 pig cost of production in selected countries: Overview

Tuesday, 21 January 2025

Overall, 2023 was a positive year for pig producers in both Great Britain (GB) and the European Union (EU). Production costs either fell or remained stable and pig prices saw significant increases. However, challenges remained, particularly with rising energy and interest costs. Despite these pressures, the combination of higher prices and more stable or reduced costs contributed to an overall better year for the pig industry.

Key points from 2023

- The average cost of pig production for indoor pigs in GB dropped significantly to £1.94/kg, compared to £2.60/kg in 2022.

- For the EU, the average production cost remained steady at £1.89/kg.

- Italy had the highest cost of production in the EU for the second consecutive year, at £2.18/kg.

- In GB, the annual average price of pigs increased by 19.02% from £1.83/kg in 2022 to £2.18/kg in 2023.

- The EU average pig price increased by 26.1% to £1.98/kg.

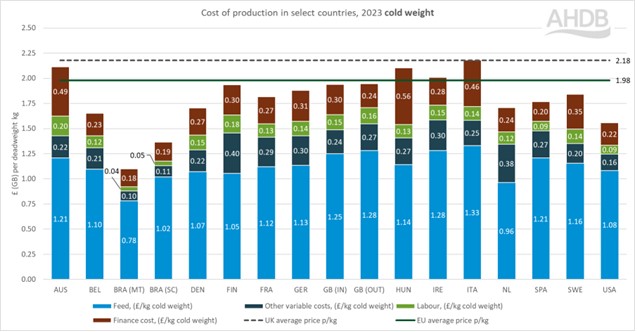

Cost of production in select countries, 2023 cold weight

Source: InterPIG

This improvement in prices, alongside stable or reduced production costs, benefited pig producers in both GB and the EU. Feed costs, which constitute the largest portion of production expenses, dropped across both regions. In the EU, feed prices fell from £1.23/kg in 2022 to £1.15/kg. GB indoor feed prices dropped 21.0%, from £1.58/kg to £1.25/kg, and outdoor feed prices decreased by 19.5%, from £1.59/kg to £1.28/kg.

Weaned pigs' productivity metrics showed a slight improvement in the UK, with indoor pigs weaned per sow per year rising by 0.5% to 27.8, though outdoor pigs saw a small 0.2% decrease to 25.06. In the EU, productivity varied, with the average weaned pigs per sow falling slightly to 30.12. Some EU countries experienced small decreases, while others like Hungary saw a significant 5.2% increase.

Energy costs, while representing a small portion (3–4%) of total production costs, also varied across countries. In GB, energy costs rose slightly, while in the EU, some countries like Austria and France saw significant hikes (39.6% and 96.6%, respectively), though many others experienced significant cost reductions. Although there were significant changes in energy costs, its impact on total cost was outweighed by other factors.

Interest rates, which were raised by the Bank of England in 2023 to combat inflation, also affected production costs. In GB, interest costs rose sharply, with indoor producers seeing a 39.8% increase and outdoor producers a 43.6% rise. EU producers faced similar interest cost increases, averaging 40.4%.

The production costs of pig meat in 2023 for all the countries covered in this series are shown above. This data includes all variable and overhead costs, other than transport of pigs to abattoirs and abattoir-related deductions, such as carcase classification and statutory levies paid at slaughter.

Overhead costs include depreciation and interest costs for capital items such as buildings and equipment. Costs for regular and casual labour are included but directors’ salaries or partners’ drawings are not included.