2024 dairy trade review: growth continues for cheese exports

Thursday, 20 February 2025

Key trends

- Total UK dairy export volume for 2024 declined marginally by 0.3% at 1.22 Mn tonnes

- Growth in exports of cheese and curd, whey and whey products, yogurt, milk and cream were outweighed by decline in exports of powders and butter

- Total UK dairy import volume for 2024 grew by 8.3% year-on-year at 1.25 Mn tonnes

- Yogurt and cheese continue to dominate the import basket

Focus on cheese and curd exports

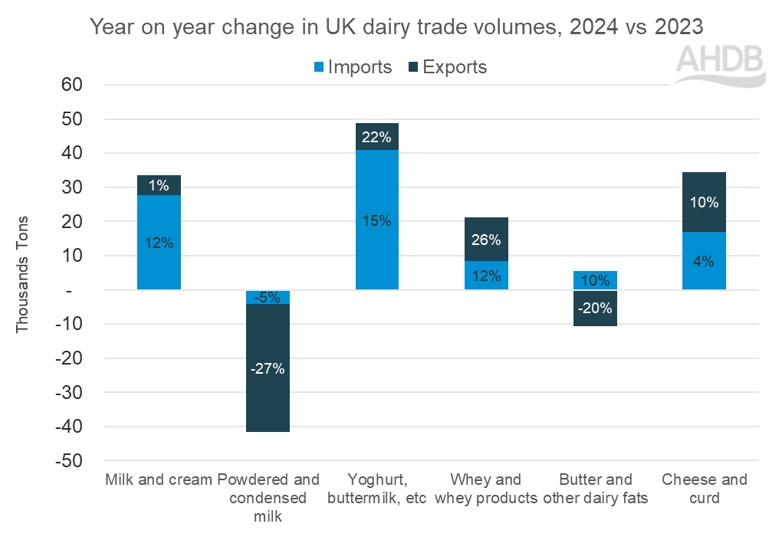

Total export volume for 2024 was 1.22 Mn tonnes, a marginal decline of 3,900t (0.3%) from 2023. Exports to the EU picked up by 8800t (0.8%) so declines were driven by non-EU nations. Despite this, cheese and curd, whey, yogurt, milk and cream exports grew in 2024. Lower exports of powder by 37,500t (26.7%) and butter by 10,600t (19.5%) dragged down overall exports. In non-EU destinations, the biggest declines came from Bangladesh (-4900t), Nigeria (-2900t), Peru (-2500t), South Africa (-1500t), Saudi Arabia (-1500t) and Morocco (-1200t).

Cheese and curd continue to be the shining star in the export basket, with exports picking up by 17,700t (9.9%). This is followed by whey and whey products and yogurt at 12,600t (26.2%) and 8,000t (22.1%) respectively. Exports of cheese and curd has been increasing consecutively for the last three years. The more value-added dairy products like cheese boosted the export channel and supported domestic prices in the second half of 2024.

Cheese exports to the EU27 increased by 15,300t (11.1%) in 2024, recovering after a period of decline in 2023. Key gains in the EU27 were to the Netherlands, Germany, Ireland and Spain. This was capped by losses of exports to Belgium, one of our biggest destinations for British cheese. Globally, increases in tonnage also came from Algeria, the United Arab Emirates, the USA and the Czech Republic.

Imports edge up

Total import volumes are up over 95,000t (8.3%) from 2023 levels to 1.25 Mn tonnes. This was predominantly driven by an increase in imports from EU nations (+83,500t) which constitute the majority of our imports. Major EU nations contributing to the increase are Ireland (+35300t), Greece (+19,400t), France (+9500t) and Germany (+5500t).

The most significant increase was in yogurt imports by 40,900t (15.5%) followed by milk and cream at 27,700t (11.7%) and cheese and curd at 16,800t (3.9%). Whey and whey products and butter also contributed to the increase by 8500t (11.7%) and 5600t (9.7%) respectively. Conversely, imports of powders noticed a decline of 4200t (4.9%) during the year.

There has been a surge of dairy imports from New Zealand, with imports from that destination increasing by 11,600t from a weak comparable base of just 160t in 2023. Majority of the dairy products imported from New Zealand was cheese and curd followed by butter.

Prospects for the UK

The government is focussed on promoting UK dairy produce and dairy showcase has been organised to support the sector. Recently, an exclusive event for key industry cheese buyers was held in Las Vegas which was an winning hand for British cheese. The growing preference for British speciality cheese is an opportunity to tap on by increasing presence in different parts of the world. However, we need to closely watch trade developments with US as Trump tariffs coming into picture for some countries will affect trade flows.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.