2030 dairy supply trends: Will global supply be sufficient to feed the world?

Thursday, 24 July 2025

Key points

- Dairy is predicted to remain the fastest-growing livestock sector globally. However, the drivers of growth will vary by region

- Global milk production is forecast to grow 1.8% p.a. by 2034 to 1146 Mt (Million metric tonnes, dry weight equivalent), driven by an increase in milk yields

- Dairy product manufacturing growth is mostly coming from developing countries, fuelled by demand trends including population and economic growth

- Developed countries such as the UK are forecast to show steadier growth

Cow’s milk supply outlook

The European Union

EU is continuing to lose milk amid decline in the herd size and lower yield growth. Countries within the EU have a diverse outlook, however with a broadly East/West divide.

There are long-term environmental policy decisions affecting the sector. In Denmark, for example, 15% of farmland will be converted to forest, an introduction of a carbon tax on CO2 emissions from cattle and environmental footprint for the benefit of water resources Germany and the Netherlands are also being challenged to decrease nitrogen and ammonia emissions via a reduction of cow numbers amongst other measures.

In Ireland, milk production declined consecutively in 2023 and 2024 for the first time after the milk production quotas were lifted in 2015.

This was mainly driven by decline in herd numbers and challenging weather in the summer and spring, which impacted seasonal peak production.

However, in 2025 production is picking up and in the year to date (Jan-May), it has increased by 7.6% year-on-year.

For the full year 2025 production is estimated to increase by 2.5% according to GIRA’s mid-year update. However, a lot of uncertainty revolves around changes to nitrates derogation, Trump tariffs and uncertain Chinese demand.

During recent times, we have seen milk production in the EU moving from west to east. Milk production in Poland in particular has grown.

In 2024, Poland contributed 9% of total EU milk production which has grown from 1.9% in 2019 to 3.9% in 2024.

There is still strong potential for future growth as Polish yields remain low compared to the western European average. This will further heighten the west to east flow.

On top of policy challenges, countries in western Europe like Germany, France and the Netherlands have witnessed significant losses in milk production following Bluetongue virus (BTV).

While cases have slowed there has been a lasting effect on cow numbers which could stymie recovery. In the longer-term, the OECD expects EU milk production to decline slightly by 0.09% between 2014–2023 and 2024–2033

Despite the fall in milk production, the EU will continue to be the main cheese exporter in the world. Declining liquid milk consumption across the continent could free up more volumes to divert towards cheese production.

United Kingdom

Milk production is only expected to grow marginally by 0.7% in 2025–2034 compared to the previous decade according to the OECD, largely due to policy challenges such as environmental regulation, changing support regimes and land and labour availability.

There will be opportunities for cheese exporters as global consumers have a taste for British speciality cheeses that are perceived as high quality and have authentic heritage.

North America

According to the OECD, production of cow’s milk in the US is projected to grow at 0.8% p.a. between 2025 and 2024.

They predict dairy herd numbers in the United States and Canada will be mostly flat and production growth will be driven by yield growths.

The United States will continue to expand SMP production and the growth of butter production is forecast to continue in strong growth of 1.8% p.a. by 2034.

New cheese capacity is being added in 2025 and is expected to be operational in the second half of the year. Price competitiveness and lower domestic demand is driving cheese exports.

The rising trend of GLP-1 drugs (diet injections) in the USA will drive the demand for whey proteins but could hold back demand for fats.

Whey protein has also become a popular trend among young and health-conscious consumers to boost protein intake.

China is expected to be one of the major consumers of whey and global demand for whey is expected to see significant increase presenting opportunities for the USA. However, uncertain trade policy will be a risk to the outlook.

Latin America

Milk production has been growing since the latter part of 2024. In March 2025, milk production in the region was up 7.2% year-on-year.

Favourable weather and margins have aided the increasing milk flows, but production growth is uneven across the regions of Latin America.

Argentina’s milk production is showing a dramatic recovery following economic recovery and much improved margins.

Brazil is also gaining steam, though the market is dependent on imports and are not export focused.

As per OECD figures, cow’s milk production is expected to grow 1.0% p.a. between 2025 and 2034.

New Zealand

NZ contributes only 2.5% of world milk production. However, it is one of the major exporters of dairy products in the world due to a small domestic market and an outward-looking focus.

Milk production grew enormously in the last twenty years but is expected to slow down to the growth rate of 0.9% p.a. over the next decade.

The grass management system and clement weather makes it a cost effective and sustainable place to produce dairy. Land availability and increasing environmental regulations are the major factors restricting growth though.

New Zealand is the primary provider of butter and WMP in the global market and its market shares are estimated to be around 45% and 60% respectively by 2033.

India

Dairy Farming is the backbone of the Indian agricultural sector, contributing 4% of the country’s GDP and 25% of the total agricultural GDP.

The dairy sector is still focussed on small-scale production but is experiencing robust growth supported by technological advancements, increased private sector investment, government initiatives and a focus on value-added products.

Increasing milk production is driven by an increase in the national herd and improved breeding methods.

India has a stated ambition to become a major exporter of high-quality dairy products.

According to the OECD, milk production is likely to grow at an impressive rate of 3.6% p.a. between 2025 and 2034. This is the highest growth forecast for any country in the global market.

Pakistan

The dairy sector is a major contributor to the country’s GDP. It is the fourth largest milk-producing country in the world.

During the last three decades, per capita milk availability has increased by three times.

Most of the milk production is concentrated in the rural areas and there is a growing trend towards increased processing and organized distribution for the urban population.

Around 80% of the milk output comes from buffaloes. There is significant growth in the sector, and it is likely to emerge as one of the major exporters on the global market in future.

OECD reports a growth of 3.0% p.a. in cow’s milk production between 2025 and 2034.

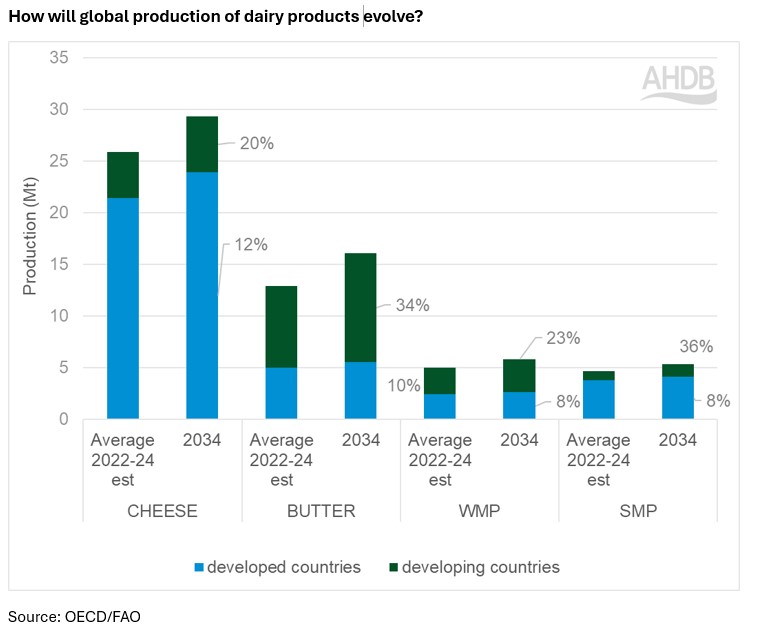

Production of dairy products will witness growth in both developed and developing countries.

WMP will see less growth in developed countries as milk is diverted to other products such as cheese and butter.

According to OECD, the UK will grow production of cheese and whey.

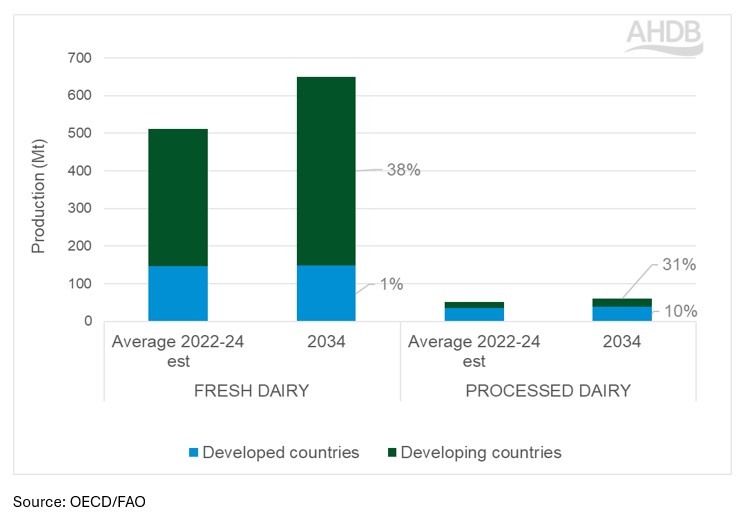

Production of fresh dairy products is likely to increase marginally by 1% by 2034 in developed countries whereas it is expected to grow significantly by 38% in developing countries as consumption of liquid milk and yoghurts increases.

Production of processed dairy products is likely to see an impressive growth of 31% in developing countries. In developing countries, growth is significant following from a low base.

Butter, SMP, WMP and whey powder are likely to see significant production growth in developing countries.

Processed dairy products include cheese, butter, WMP, SMP and whey.

Main challenges in the dairy world

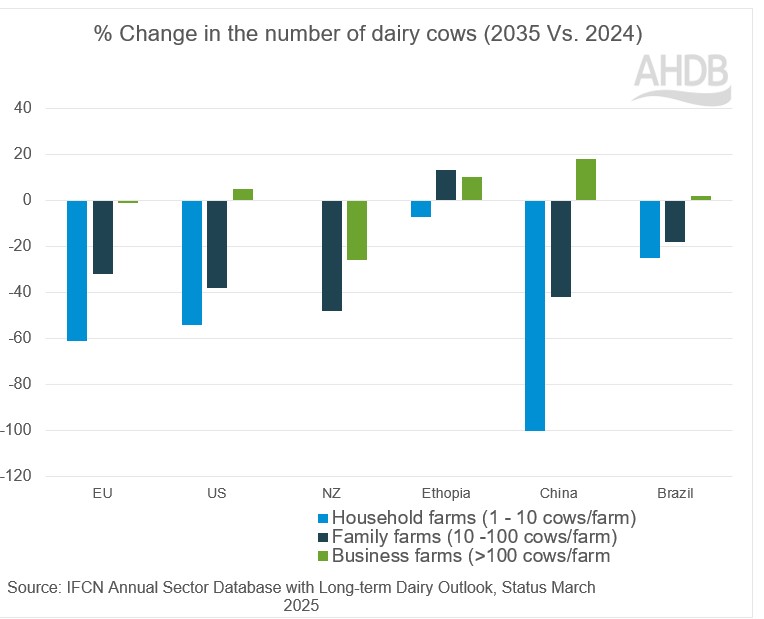

Globally, the number of farms and cows are expected to decline by 17% and 8% respectively between 2024 and 2035.

Southeast Asia and Africa are an exception, where those regions are expected to grow production.

Sustainability and environmental regulations vary in different countries, and this will add cost burdens and constrictions for producers.

Substantial investments in technology and processes will be required to meet stringent requirements and to maintain high standards.

Considering this, the focus will be on driving supply through yield growth via better genetics, animal health and welfare and nutrition, whilst maintaining or declining cow numbers.

There is a perverse outcome globally in that many markets which have high rainfall and grass growth and can produce dairy to a lower environmental footprint tend to be those who have been most constrained by environmental limitations.

With dairy demand continuing to grow it will be left to less sustainable regions to make up the shortfall.

Risks and uncertainties for global dairy supply

- Labour shortages remain one of the major concerns for the sector. With the aging workforce in more developed markets there are fewer newer generation interested to enter the sector

- Sustainability and environmental regulations will affect dairy production in the future. GHG emissions should be reduced, and the target is net zero in the years to come

- Climate change and extreme weather conditions in the major dairy producing regions are also matters of concern. Recently, the dry weather conditions in Australia have affected milk production, whilst extremely wet conditions held up production in the UK in 2024

- Price volatility in the dairy sector will drive commodity production. Current record high prices of butter remain favourable for production while SMP prices are steady to weak, distorting the market

- Input costs are increasingly volatile depending on external and internal events. The war between Russia and Ukraine in 2021 escalated the prices of energy and fertiliser. This affects the economy of the country and in turn agriculture. Though input costs have steadied, they remain challenging. Further global conflicts have the potential to destabilise further

- Trade agreements between countries affect trade flows and subsequently affect production. The recent trade deal between the UK and the US is likely to impact bioethanol production in the UK as it has lifted tariffs on imports. The Trump administration has signed trade deals with various countries, which will displace products from the shelves and affect trade flows with an, as yet, high degree of uncertainty. The old ‘rules-based’ international order is dissolving

- Geopolitical tensions around the world affects trade and in turn production like the recent war between India and Pakistan, conflict in the Middle East, Russia-Ukraine war. Disruptions to maritime passage around the Suez Canal, the Panama Canal and the Black Sea will affect the movement of agricultural commodities between the countries

- Disease outbreaks in the global market is another uncertain factor affecting dairy production. Bluetongue and the recent outbreaks of Foot and Mouth Disease (FMD) in the EU has affected milk production in Germany, France and Netherlands. Outbreaks of Lumpy skin disease in France and Italy and Avian Influenza in the US all have the potential to hold back production. TB remains a perennial issue in the UK

Implications for UK dairy

Long-term supply forecasts are subject to risks and uncertainties in the sector and global geopolitical tensions.

Any triggers on the supply side in the global market will influence prices accordingly and impact the domestic market.

With the growing demand for milk components, fats and protein rather, processors can focus on capitalising those.

With changing consumer preferences, dairy is well placed for producing healthier and protein rich, affordable products as well as more indulgent products.

In order to meet the growing demand, production has to be cost-effective and efficient and in line with the regional environmental policies directed towards sustainability and limiting GHG emissions.

Achieving sustainable growth by 2034 will be the focus, which can be attained by further investment and adaptability.

Producers face a delicate balancing act to make the most of the opportunities created by growing global demand in a high regulatory environment with limited government support.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.