April 2025 dairy market review

Wednesday, 7 May 2025

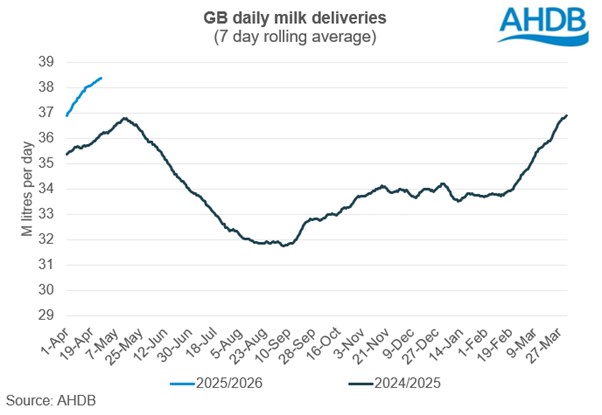

Milk production

GB milk deliveries are estimated to total 1,140 million litres in April, up 5.9% compared to the same period in 2024. Deliveries averaged at 38 million litres per day.

The 2024/25 milk year ended at an estimated 12.44bn litres in GB, a significant increase of 0.7% compared to the previous season and in-line with our forecast. This is the highest milk-year volume recorded since the 2020/21 season. The figures include the extra day from the leap year in 2024.

Milk production in April to date is running at record-breaking levels (5.9% ahead of last year) due to an extremely favourable milk-to-feed-price ratio and excellent spring weather. UK production is running marginally ahead of this at 6.9% ahead of last year for the month to date. Organic milk deliveries have also been growing strongly and are sitting at 14% ahead of last year in April to date.

These rising milk volumes, teamed with a series of breakdowns and concerns over access to drying facilities have begun to put pressure on processing capacity.

The latest global production data tells a different story. Accounting for the leap year in 2024 milk deliveries are flat year-on-year. The EU saw a decline of 2.3% being driven by supply challenges in Belgium, Denmark, France and Germany that have been hit by BTV. US production saw growth of 1.0% with Australia and New Zealand seeing declines. Argentina’s production has been recovering strongly (+12.1%) compared to the weakness seen in 2024.

Rabobank expect the key exporting regions to see modest growth in production in 2025 driven by growth in the EU and US. However, the EU was expected to grow by 0.5% which could already be at risk given the impact of BTV seen so far.

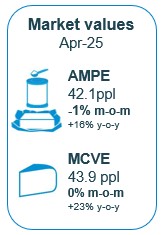

Wholesale markets

Overall, there was marginal movement in monthly average commodity prices in April despite currency fluctuations and demand shifts around Easter. Generally, the buying market was still reported to have a wait and see approach ahead of the imminent spring flush and confusing global market signals.

Bulk cream prices have been stable for three of the four months in 2025 so far, edging up just £1/t on average in April. Although milk availability has increased significantly it was noted by some commentators that cream was not easily accessible with a lot of fat being directed into cheese making.

Average butter prices edged marginally lower month-on-month, down just £20/t. UK stocks remain tight but improving but still tight in the EU.

Mild cheddar markets saw little movement. Availability is still reported as limited, but production has picked up alongside milk flows, although some processors have reportedly made adjustments to their lines to keep up the pace.

SMP markets saw the most pressure this month, with prices easing £30/t on average. Geopolitics created volatile exchange rates, notably on the US dollar and Euro, and breakdowns limited domestic processing capacity, both providing negative sentiment. Overall demand was reported as mixed on both domestic and export markets with buyers waiting to see what happens next.

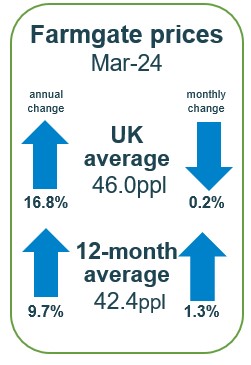

Farmgate milk prices

The latest published farmgate price was for March with a UK average milk price announced by Defra as being 46.01, down 0.08 pence (0.2%) on the previous month.

Latest announced farmgate prices were fairly steady for May apart from for non-aligned liquid milk.

Retail aligned liquid contracts announcements were either positive or steady in May. Co-op Dairy and Tesco have made positive announcements for the month, increasing their price by 0.11p and 0.23p respectively. Sainsbury’s and M&S held on to their price after positive announcement last month.

On non-aligned liquid contracts, prices cooled off for some while others held steady. Freshways and Payne’s Dairies reduced their price by 2.00p each respectively after holding steady for last six months. There was a decline of 0.43p by Pembrokeshire Creamery. Crediton Dairy continue to hold on to their price for another consecutive month. Muller Direct has also held steady for the last seven months.

Cheese manufacturers on the AHDB League table announced no changes for May. Belton and Saputo made no changes to price announcements and have held steady for the last seven months. Barbers, First Milk Manufacturing, Lactalis, Leprino Food, South Caernarfon Creameries, Wensleydale and Wyke Farms also remained steady.

Manufacturing contracts remained stable in May. Arla Direct have held for the last five months. Meadow and UK Arla Farmers Manufacturing also held on to their price after announcing a decline last month. Pattemores Dairy have been steady for the last seven months.

Trade

The recent series of announcements by US President Donald Trump regarding new tariffs on imports have sent ripples through global trade markets. Among the industries affected, the British dairy sector faces significant challenges as the USA imposes an additional 10% tariff on all UK imports.

AHDB examined the current trade landscape between the UK and the US, the broader global dairy trade dynamics, and the potential implications for British dairy producers, identifying there could be several challenges ahead. Reduced competitiveness to the US and trade displacement could cause headaches for exporters. Whether potential impacts could look more positive or negative will depend on where the level of tariffs for the UK compared to other markets settles to after the 90-day period. Whilst 10% sits well within the level of potential market variations, the dairy market is already at a high level.

Trump’s tariff policy introduces uncertainty into the British dairy sector, disrupting established trade flows and forcing producers to reassess their export strategies. While the UK remains committed to negotiating a trade deal with the US, the industry must prepare for potential shifts in demand and explore alternative markets to mitigate the impact of these tariffs.

Retail performance

During the 52 weeks ending 19 April 2025, volumes of cow’s dairy declined by 0.7% year-on-year (NIQ Homescan POD, Total GB). Spend on cow’s dairy grew 2.6% year-on-year, driven by growth in average prices of 3.4%.

Cow’s milk volumes continued to decrease, back 2.2% year-on-year, despite seeing an additional 184,000 shoppers during the period (NIQ, 52 w/e 19 April 2025). Volumes declined for semi-skimmed, skimmed and other (including specialty cow’s milk such as Channel Island), while whole milk continued to see volume growth (+2.6%) driven by an additional 781,000 shoppers.

Cow’s cheese remained in volume growth, up 4.3% year-on-year, likely helped by average price decreasing by 1.2%. Spend during the period increased by 3.0%, (NIQ, 52 w/e 19 April 2025). Cheddar, which represents 41.5% of all cow cheese volumes, saw a 5.3% increase in volumes. Almost all cow cheeses saw year-on-year volume growth with the exception of British regionals which saw a 2.4% decrease in volumes purchased.

Cow’s butter, at a total level, experienced a 2.4% decline in volume but a 4.2% increase in spending; this was driven by 6.7% increase in average price paid (NIQ, 52 w/e 19 April 2025). Block butter, however, continued to see volume increases of 6.7% driven by an increase in shopper numbers and an increase in shopper frequency of purchase. Plant-based spread volumes also continued to increase (+2.7%) despite a decrease in shopper numbers. However, those shoppers who remained purchased in greater quantities and more frequently which contributed to the positive performance of plant-based spread.

Cow's yoghurt, yoghurt drinks and fromage frais volumes continue to see growth (+6.2%), with spend increasing by 8.8% (NIQ, 52 w/e 19 April 2025). All products saw volume growth during the period, apart from fromage frais (-10.4%). Cow’s fat-free yoghurt saw the greatest actual growth with an additional 11.2m kilos purchased year-on-year (+7.5%), while cow’s standard plain yoghurt saw the fastest growth of 24.0% year-on-year.

Cow's cream volumes grew by 1.7% year-on-year, driven by increased frequency of purchase and increase in volume per shop (NIQ, 52 w/e 19 April 2025). Double and sour cream both experienced volume growth and drove overall cow cream performance.

See the full data and these insights visualised on our GB household dairy purchases retail dashboard.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.