Arable Market Report – 03 March 2025

Monday, 3 March 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

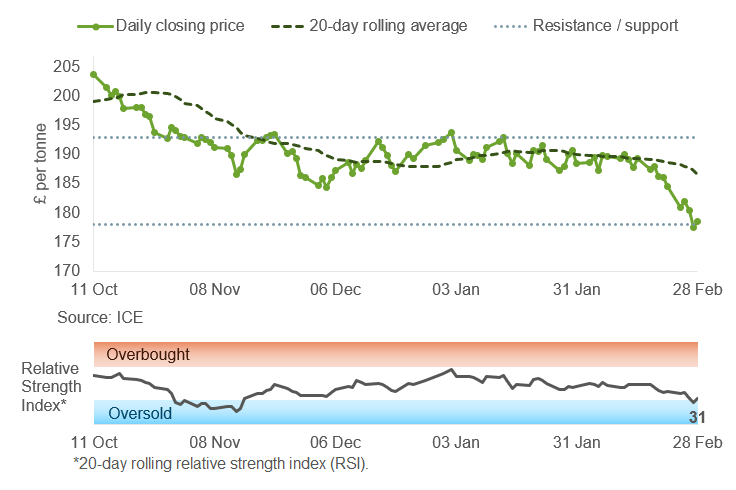

The May-25 UK feed wheat futures closed below the recent support level (£186/t) for two consecutive weeks. Therefore, the previous support and resistance levels no longer held. With the Relative Strength Index (RSI) at the oversold level, prices may now find support around £178/t.

Find out more about the graphs in this report and how to use them here.

Market drivers

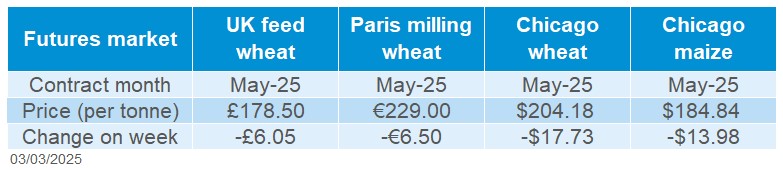

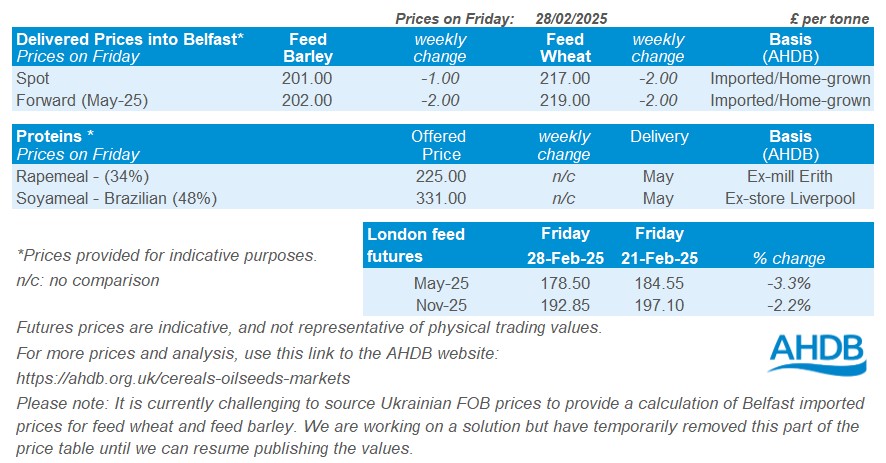

Old crop (May-25) UK feed wheat futures reached a new low on Thursday, finishing the week at £178.50/t on Friday, down £6.05/t from the previous week. The new crop (Nov-25) contract also fell, losing £4.25/t to settle at £192.85/t on Friday.

The UK market faced pressure as global wheat futures declined, driven by easing weather concerns in key producing regions, uncertainty over US import tariffs on Mexico and Canada, and lacklustre demand. Chicago wheat and Paris milling wheat futures (May-25) dropped by 8.0% and 2.8%, respectively.

Winter crops in the US and Russia were reported last week to have withstood a period of cold weather without significant frost damage, while rain forecasts in Argentina provided relief to the maize crop (LSEG).

With the 04 March deadline for the US 25% import tariffs on Canada and Mexico approaching, uncertainty remains over whether they will take effect or be extended. If implemented, retaliation could impact trade over the coming days.

US net export sales of wheat were reported at 269 Kt by the USDA for the week ending 20 February, down 50% on the week and below the trade estimate range of 300 Kt – 600 Kt. Net export sales of maize also fell to 795 Kt, below the trade estimate range of 900 Kt – 1.7 Mt.

The USDA predicted last week that US farmers will favour maize over soybeans for the 2025/26 season. Maize planted area is projected to rise by 3.8% in 2025. Wheat planted area is expected to grow by 2.0% year-on-year. Ending stocks for both crops are set to rise, with maize seeing a larger increase.

Potential bullish factors to watch this week include a decline in French wheat crop condition, with 73% of soft wheat rated in good or excellent condition by February 24, down from 74% the previous week (FranceAgrimer). The EU Commission revised its 2024/25 soft wheat production estimate for the EU to 111.8 Mt, slightly down from 111.9 Mt. Also, IKAR has reduced Russia’s wheat production in 2025 and export in 2024/25 season estimates by 1.0 Mt and 500 Kt, respectively.

UK delivered cereal prices

Domestic delivered wheat prices fell across the week (Thursday-Thursday). Feed wheat delivered into Yorkshire for July 2025 fell £4.00/t on the week, quoted at £204.50/t. Bread wheat delivered to Northamptonshire for May 2025 was quoted at £212.00/t, down £9.50/t, while July delivery lost £9.00/t on the week to £216.50/t.

Rapeseed

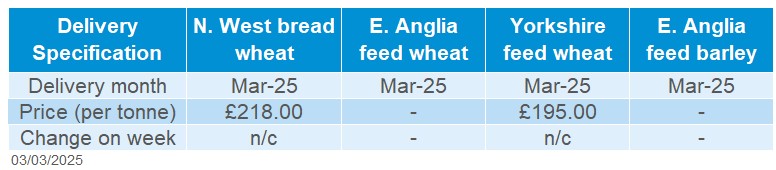

May-25 Paris rapeseed futures traded higher than the 20-day moving average last week. The Relative Strength Index shows that the market continues to look for further direction of price movement.

Find out more about the graphs in this report and how to use them here.

Market drivers

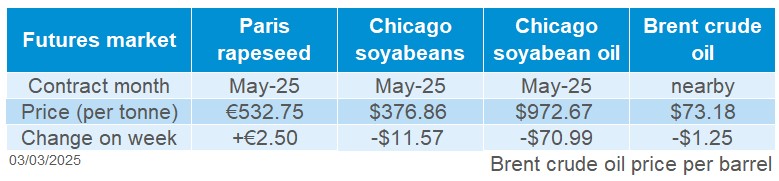

May-25 Paris rapeseed futures closed at £440.09/t on Friday, up £1.26/t on the week. New crop (Nov-25) futures finished on Friday at £412.83/t, down £1.59/t.

Winnipeg canola futures (May-25) fell by 4.2% over the last week (Friday to Friday). Canola crushing in Canada is still at a higher level than last year. However, US import tariffs on Canadian goods, particularly canola oil and meal limited any attempts to push prices higher.

Strategie Grains on Friday showed an unchanged EU forecast for rapeseed production in 2025/26 at 19.0 Mt, up 13% from 2024/25 due to favourable crop conditions. In Ukraine, new crop rapeseed is affected by drought in some southern regions and is forecast to be smaller than this season’s crop.

Declining crushing of rapeseed and sunflower in the 2024/25 season in the EU could be partly offset by rising soyabeans crush. Rumours of import tariffs to be imposed by the US on EU goods could lead to trade conflict, and as such impact trading relationships. With US soyabeans accounting for more than 50% of total EU soyabean imports in the current season, this will remain a key factor to watch.

May-25 Chicago soyabeans and soyabean oil futures decreased by 3.0% and 7.0% respectively (Friday-Friday). The USDA forecast soybean planting area 3.6% lower than last year due to a larger maize area. US soyabean crush estimates for January 2025 are higher than for January last year.

US tariffs on Canadian and Mexican goods could start on 4 March. The tariffs could lead to an increase in US crude oil import prices, as supply from Canada and Mexico may be reduced. This could support soyabean crush in the US. On the other hand, US import tariffs on Chinese goods are weighing on Chicago soybean futures.

Weather in South America, reduced palm oil purchases by India, and increased soyabean oil purchases also continue to influence the global oilseed market.

UK delivered rapeseed prices

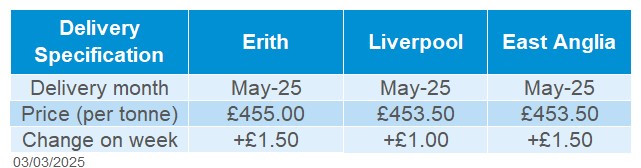

Rapeseed to be delivered into Erith in May was quoted at £455.00/t on Thursday, up £1.50/t from the previous week, while November delivery was quoted at £429/t, down £2.00/t. As such, the gap between old and new crop prices is widening.

Extra information

The latest British Survey of Fertiliser Practice report shows that total use of nitrogen across core products increased by 4% year-on-year in 2023. This increase in usage was expected, as fertiliser prices have reduced considerably since their highs in 2022. Read more on this in the AHDB’s fertiliser outlook 2025.

AHDB’s Agri-market outlooks for cereals and oilseeds, released last Monday (24 February), shows UK wheat production in 2025 is set to rise from 2024 levels, while oilseed rape production is likely to decline this coming harvest.

At the end of 2024, Defra published the UK Food Security Report for the year. Over the past three years there have been a number of shocks and major events that have impacted the food system and have therefore had a knock-on effect to food security. We have explored the impact of these shocks and analysed the report further in this article.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.