Arable Market Report – 10 March 2025

Monday, 10 March 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

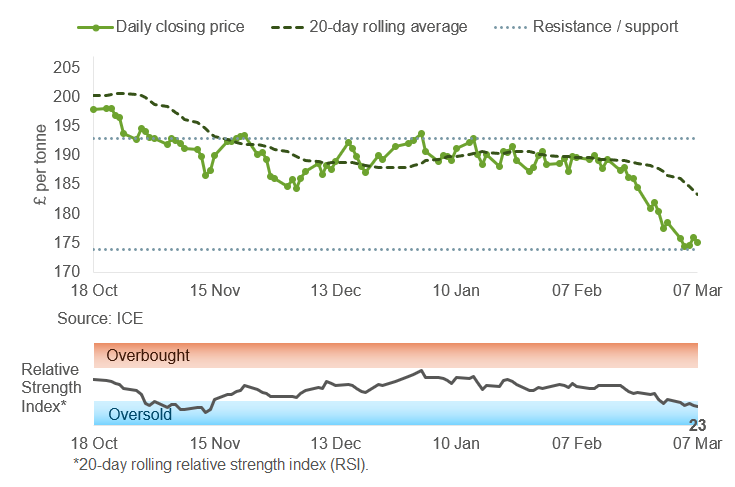

The May-25 UK feed wheat futures contract has closed below previous support levels for three weeks now. With the Relative Strength Index (RSI) in the oversold range, prices may find support around last week's low of £174/t.

Find out more about the graphs in this report and how to use them here.

Market drivers

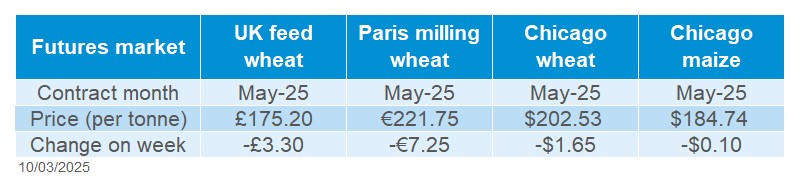

Old crop (May-25) UK feed wheat futures closed the week at £175.20/t on Friday, down £3.30/t from the previous week. The new crop (Nov-25) contract lost £3.60/t Friday-Friday to settle at £189.25/t. Prices were largely pressured by fluctuations in US trade policy, expectations of a bumper harvest in China and improving conditions elsewhere.

US President Donald Trump's latest tariff hikes took effect on Tuesday, leading to a sharp drop in US grain prices. However, prices rebounded slightly on Thursday after the temporary suspension of tariffs on goods from Canada and Mexico. The 20% tariffs on Chinese goods remain, with China responding with countermeasures.

China is expected to have a strong wheat crop this year due to good weather, according to a COFCO executive (LSEG). This could increase domestic supplies and reduce the need for imports. As one of the largest wheat buyers, China has recently cut back on imports. The USDA reports wheat production for 2024/25 at 140.0 Mt, up from 136.6 Mt in 2023/24, with imports dropping by 5.6 Mt year-on-year to 8.0 Mt.

Meanwhile, weather conditions elsewhere in the Northern Hemisphere are also improving. FranceAgriMer reported that by 3 March, 74% of France's wheat crop was rated good or excellent, up from 73% the previous week, though still the second lowest in five years. Spring barley conditions have also improved slightly, with planting ahead of previous years.

Recent rains also benefited the maize crop in Argentina.

As at 4 March, speculators had increased their net short positions in Chicago wheat and reduced their net long positions in maize futures. This reflects the recent falls in prices and suggests a more cautious market outlook.

The focus is now on the USDA world supply and demand estimates, scheduled for release on Tuesday at 5pm, to provide market direction.

UK delivered cereal prices

Domestic delivered wheat prices fell across the week (Thursday-Thursday) in line with global prices. Feed wheat delivered into Yorkshire for March 2025 fell £4.50/t on the week, quoted at £190.50/t on Thursday. Bread wheat delivered to the North-West for March 2025 was quoted at £211.50/t, down £6.50/t, while July delivery lost £6.00/t on the week to £220.50/t.

Rapeseed

.png)

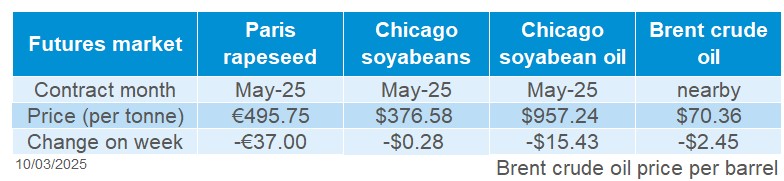

May-25 Paris rapeseed futures traded notably lower than the 20-day moving average last week. After a significant drop Friday-Friday, the price chart has found a new, lower support level.

Find out more about the graphs in this report and how to use them here.

Market drivers

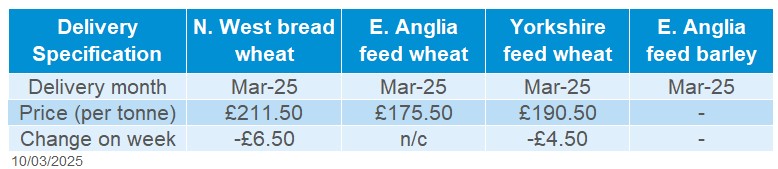

May-25 Paris rapeseed futures closed at £416.87/t on Friday, down £23.22/t on the week. New crop (Nov-25) futures finished on Friday at £403.12/t, down £9.42/t. The euro rose to a three-month high against the US dollar and that's adding pressure to the European market on top on wider price falls for oilseeds.

Winnipeg canola futures (May-25) fell by 0.9% over the last week (Friday to Friday). The US import tariffs on Canadian goods, particularly canola oil and meal, continue to have a significant impact on the market.

China has decided to impose 100% tariffs on imports of canola meal and oil from Canada. Announced over the weekend, this is putting significant pressure on Winnipeg canola futures today.

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) estimates Australian canola production in 2024/25 was 2% lower than last season at 5.9 Mt. This is still fourth highest production on record. In 2025/26, canola production is forecast to increase by 1% to 6.0 Mt. However, the average Australian canola price is forecast to be 2% higher in 2025/26 than in the 2024/25 season due to anticipated high export demand for Australian canola.

Higher global sunflower production forecast for the 2025 harvest (OilWorld.biz) is a factor in the pressure on rapeseed new crop prices.

May-25 Chicago soyabeans and soyabean oil futures decreased by 0.1% and 1.6% respectively (Friday-Friday). US net export sales of soyabeans were reported at 353 Kt by the USDA for the week ending 27 February, down 14 % from the previous week.

The next USDA WASDE report will be on 11 March 2025. It will be interesting to see how the USDA adjusts soybean exports and domestic consumption due to the unpredictability of tariffs.

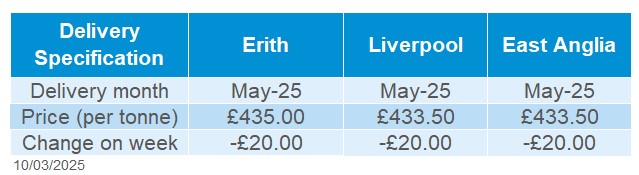

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in May was quoted at £435.00/t on Thursday, down £20.00/t from the previous week. Delivery to East Anglia in May was quoted at £433.50/t, also falling £20.00/t. In a volatile market please note that the survey is usually conducted mid-late morning on Friday, so can show differences from Paris futures closing prices.

Extra information

On Thursday, AHDB published the latest GB animal feed production figures, including information on cereal usage and feed production up to January. This season-to-date (Jul-Jan), total feed production, including by Integrated poultry units (IPU), totalled 7.84 Mt. This is up 0.5% on the same period last year, when feed production totalled 7.79 Mt.

AHDB also published data on Human and industrial (H&I) usage of cereals in January.

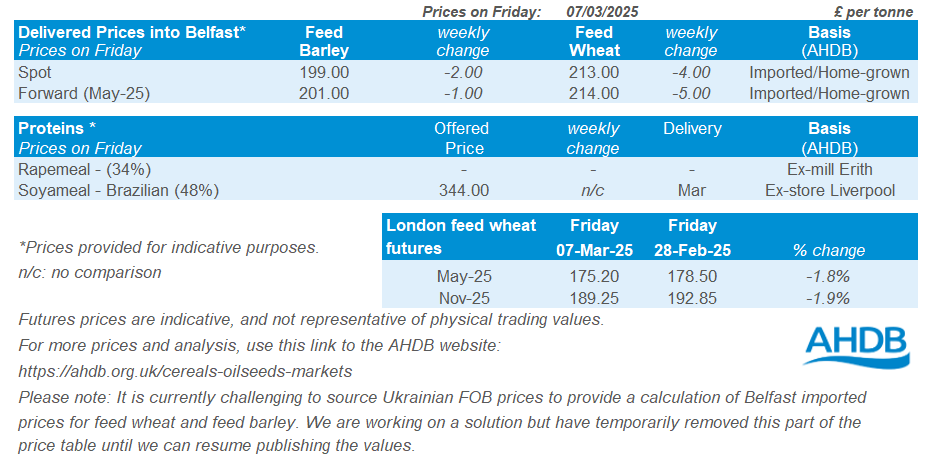

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.