Are GB pig prices stabilising?

Monday, 18 March 2024

Key points

- The SPP saw mixed weekly movements through February and into March

- Clean pig kill has continued to ease, tightening an already limited supply base

- Retail purchase volumes remain in year on year decline

- The EU/UK price differential has narrowed following price increases in key EU nations

Overview

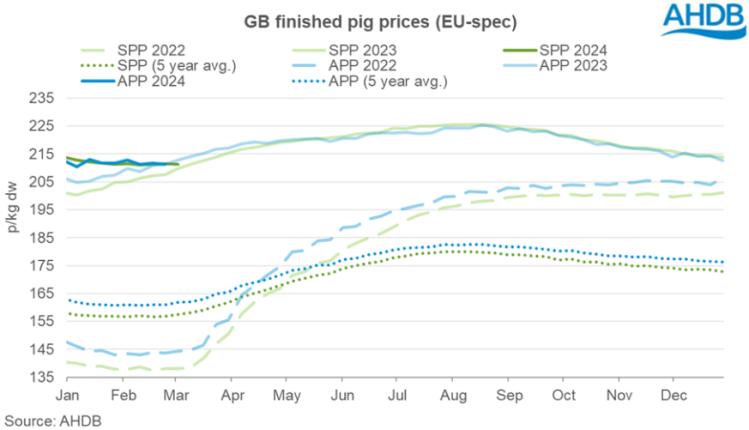

GB finished pig prices have been continuing to track downwards through the first 2 months of 2024. In February the EU spec SPP averaged 211.32p/kg, a decline of 0.59p/kg compared to the average for January, but still nearly 4p/kg above prices recorded this time last year.

Prices were not consistently negative through the month with weeks 2 and 3 both seeing small positive movements. Overall, these were outweighed by the larger declines seen in weeks 1 and 4. However, the most recent weeks data (w/e 09 March) recorded another small weekly increase of 0.16p/kg, bringing the EU spec SPP to currently sit at 211.49p/kg. This may indicate towards some stabilisation in prices through March.

Defra’s UK clean pig kill for February 2024 stands at 765,600 head, an 8% drop from January and a decline of 1% compared to the same month last year. It has been widely reported across industry that supplies of available pigs have been tightening from an already limited supply base. This is likely to support prices over the coming weeks, and possibly months, if demand is sustained.

The start of the year is often a tricky time for demand as consumers look to action their new year resolutions, often centred around money saving, health, and fitness. In the 12 weeks ending 18 February, GB retail pork purchase volumes have eased 1.4% year on year, as average prices rose 6.8%, according to Kantar. Industry will soon be looking ahead to the summer BBQ season and hoping for some better weather to provide a boost in demand.

The latest HMRC trade data shows the UK imported 63,500t of pigmeat in January. Although this is a 3% increase year on year, volumes in January 2023 were at a historic low, if we compare to 2022 instead, import volumes in 2024 are down 6%. Exports remain subdued with January volumes down 8% on the same month last year. Market dynamics across Europe will continue to be a key watch point. Production volumes have been in decline for the last couple of years and although the price differential between the EU and UK grew through the second half of 2023 to stand at over 36p/kg at the end of January, it has now narrowed to under 24p/kg, as prices in key producing nations have been ticking up in recent weeks. These movements are also likely to provide support to UK pricing in the coming weeks.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.