Beef market update: European beef production drops by 56,000 tonnes in Q1

Friday, 27 June 2025

The EU is the primary destination for UK beef exports. This article looks into how EU beef production is progressing this year and what this could mean for UK exports.

Key points

- In Jan-Mar this year EU beef production was down by 3% compared to 2024

- The largest drops in production were seen in northwestern countries severely affected by bluetongue

- Import volumes into the EU-27 were up 11% on the year in Q1, with growth from South American countries driving this

Production

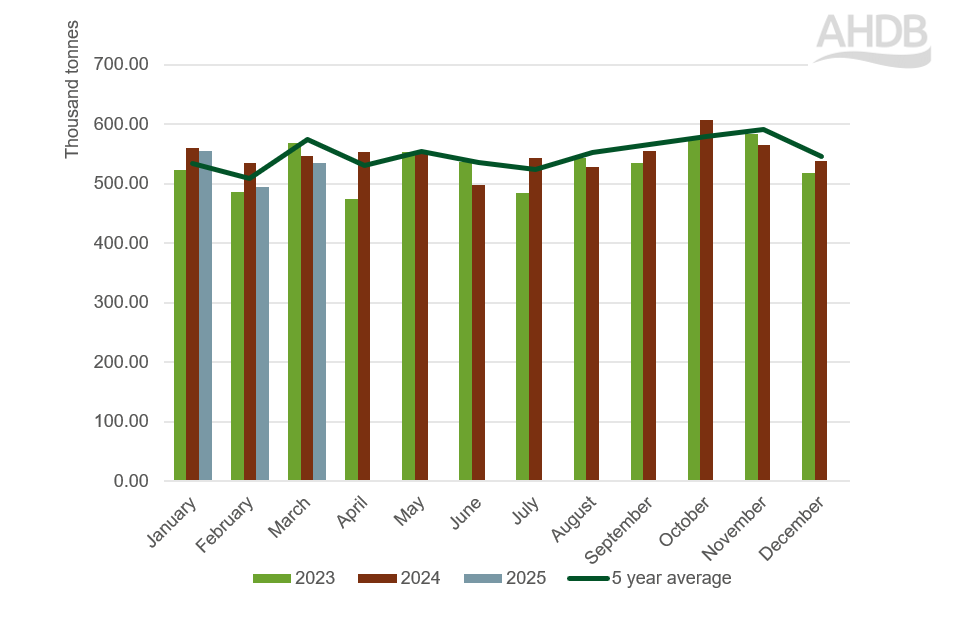

In the first quarter of 2025, beef production across the European Union was down by 3% (56 thousand tonnes) compared to last year, bringing total Q1 production to 1.58 million tonnes.

Monthly European beef production

Source: European Commission.

The reasons behind the reduction in overall production are widespread: including disease, profitability challenges, and structural herd decline, but are especially present in specific individual European States.

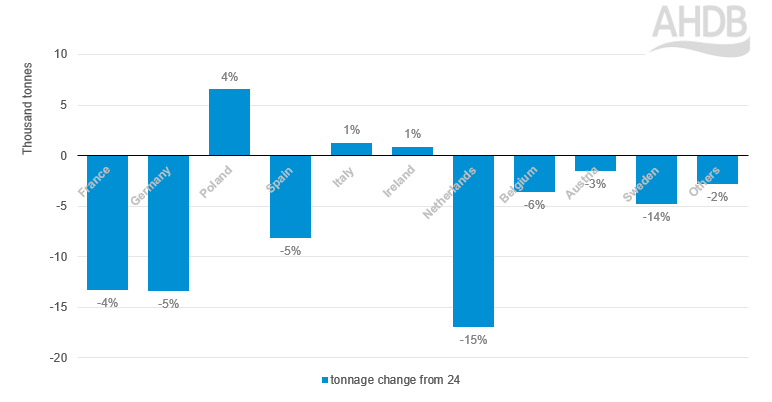

The graph below shows the changes in production volumes for Q1 2025 compared to the year earlier for the top ten beef producing countries of the European Union.

Q1 Y-O-Y production change of the top ten EU beef producing countries

Source: European Commission

From this data we can see that the largest reductions in beef volumes have been observed in France, Germany and the Netherlands.

These three countries have reportedly been hit hard by BTV-3 which is likely what has driven the loss of productivity in these western states.

Furthermore, in some regions, European farmers have been incentivised to downscale livestock production, which will be affecting farmer sentiment and impacting decisions.

For example, the EU have approved a €128 million fund to compensate Dutch livestock farmers for voluntarily close their operations to meet nitrogen and nature targets.

However, both Poland and Ireland have seen increased beef production throughout this period, likely driven by strong domestic prices bringing animals forward and a lucrative export market amongst sustained demand.

Indeed, in Q1 this year Poland exported 133,000 tonnes of beef, compared to 125,000 tonnes in 2024.

Trade

Despite reduced beef production, demand for beef on the continent has remained strong.

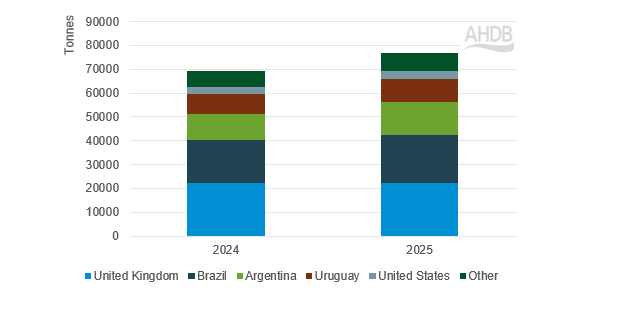

Imported beef volumes into the EU-27 have risen by 11% year on year to approximately 77,000 tonnes (Jan-Mar), with the UK as the largest supplier of these beef imports.

However, the main growth in import volumes into the EU-27 in Q1 this year has come from South American countries, with an additional 2,200 tonnes (+12% y-o-y) from Brazil, 2,500 tonnes from Argentina (+23% y-o-y), and an additional 1,700 tonnes (+22% y-o-y) from Uruguay.

Q1 beef import volumes into EU-27 by origin

Source: TDM LLC

What could this mean for the UK?

Falling EU production could offer opportunity for UK beef exports as more product is needed to fulfil demand. However, price will remain a major determining factor.

As of the week ending 13 June the EU average steer price was 609p/kg while the UK average steer price stood 41 pence higher at 650p/kg.

This price disparity could dissuade European importers, potentially opting for more competitively priced product from South America as we have seen in the year so far.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.