Brazil pork update: production set to grow as trade continues to boom

Wednesday, 13 September 2023

Key points:

- H1 pork production hit 2.6m tonnes.

- Slaughter totals 28.15m head.

- Brazil’s exports year-to-date totalled over 760,000 tonnes.

What does Brazil’s production look like?

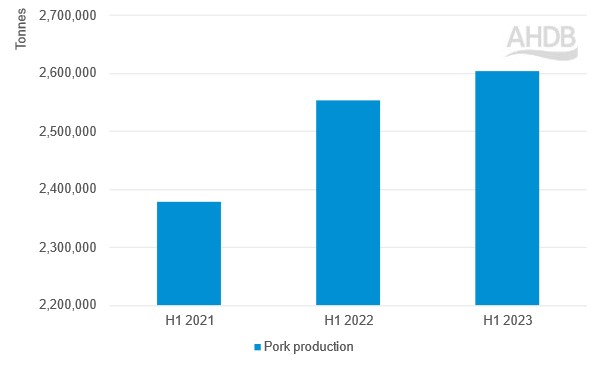

Pork production in Brazil has grown year on year in the first half of 2023, totalling 2.6m tonnes (+2%). This has been driven by increased slaughter with throughputs totalling 28.15m head. The USDA are predicting continued growth for 2023, with pork production in Brazil forecast to end the year up 7% and for 2024 up a further 5%. Brazilian maize and soya crop for the remainder of 2023 is set to reach record highs, with higher feed availability lowering prices providing a boost to pig production. Brazil’s pork production is set to remain elevated for some time, as industry reports indicate that tight domestic supplies in China continue to necessitate imports. At a time of falling EU supplies, this leaves space for Brazil to gain export volumes.

Brazil’s yearly change in pork production

Source: IBGE Brazil

Domestic consumption is set to increase by 6% through 2023, and a further 4% in 2024, as domestic prices fall due to oversupply, and more pork becomes available on the domestic market. Consumption has been incentivised through lower prices compared to the generally more popular meats of beef and poultry.

Trade update

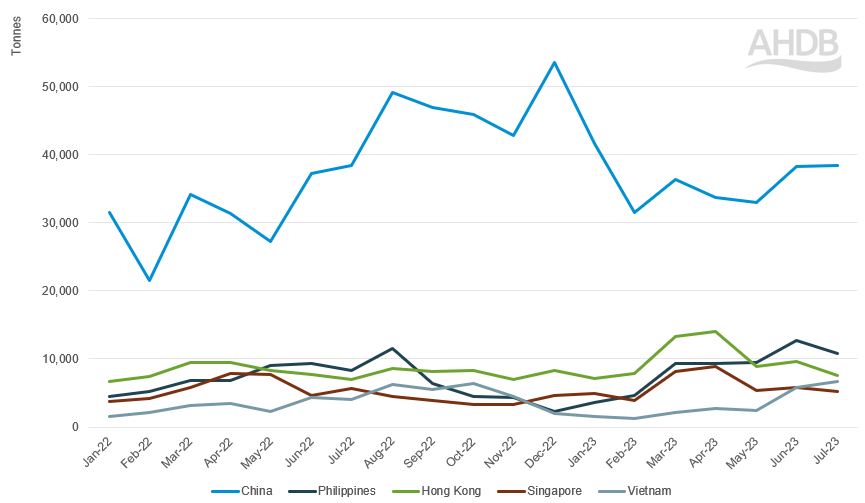

Exports from Brazil have grown 10% from 2022, as for the 2023 year-to-date (Jan – Jul) volumes sit at 760,500 tonnes. This is growth of nearly 70,000 tonnes. China continues to be the main export destination receiving 33% of Brazil’s exports by volume totalling 235,000 tonnes YTD in 2023, growth of 31,400 tonnes (14%) compared to last year. Hong Kong and the Philippines are also growing destinations at 9% and 8% of total exports, at 68,000t and 60,000t YTD. This represents growth of 21% and 20% from 2022 volumes, highlighting the importance of the East Asian region for Brazil’s exports.

The market share of Brazilian pork into China and the wider southeast Asian region has the potential to increase further if current market conditions continue to subdue the European market, reducing competition. ASF also offers some benefit to export growth for Brazil, with many countries in Asia still grappling to control the spread of the disease. If the outbreak in Europe spreads to Spain (currently the largest pork exporter to China) Brazil would likely take the top spot and drastically grow its market share.

Brazil’s monthly pork exports to Asia

Source: Brazil Ministry of Development, Industry and Trade via Trade Data Monitor LLC

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.