Butter stocks remain tight whilst cheese supplies grow in Q1

Thursday, 3 July 2025

Key trends

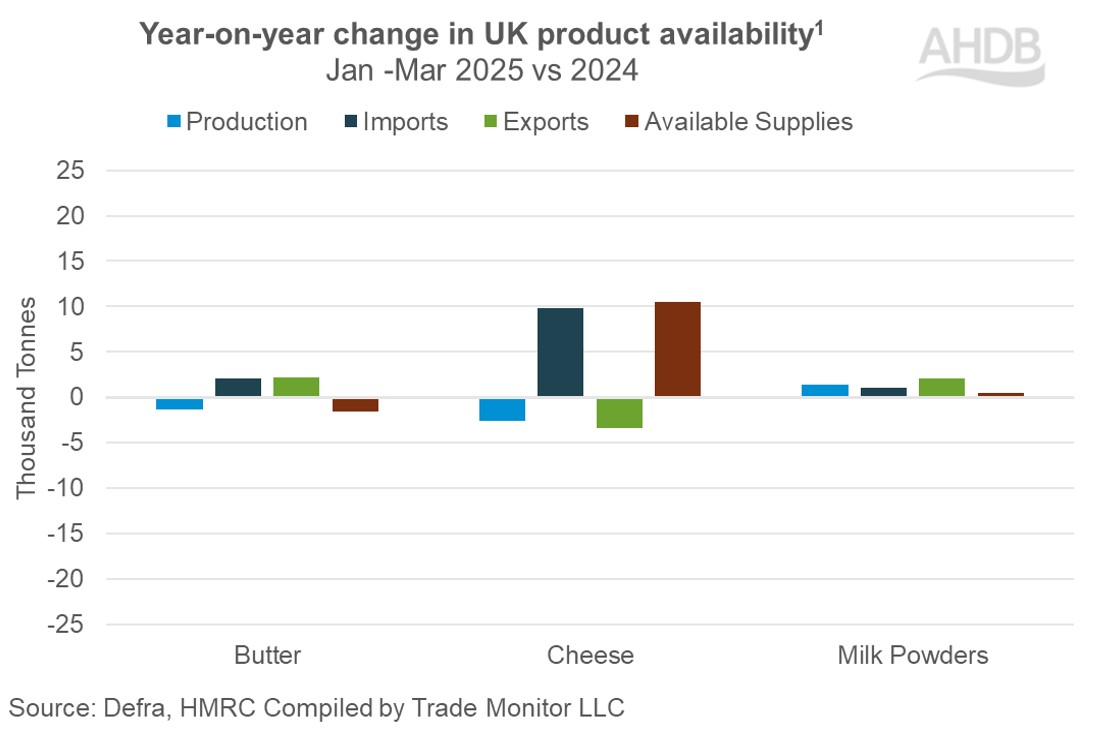

- Cheese imports compensated for lower production

- Supplies of milk powders almost at par with Q1 2024

- Butter supplies stay tight due to lower production and higher exports

UK milk deliveries in the first quarter of the calendar year 2025 totalled 3,829m litres, which is 2.1% higher year-on-year. Favourable dairy economics have boosted supplies, which is continuing in the new milk year. Overall, the increase in milk deliveries boosted the production of powders to deal with the over-supply. However, production of cheese and butter declined during the period.

Supplies of cheese boosted by imports

Lower production of cheese of 2,600 tonnes or 2%, were compensated for by imports (of 9,800 tonnes or 10%) resulting in an increase of stocks by 6% (10,500 tonnes) in the first quarter year-on-year. Cheese imports from New Zealand saw impressive growth of 4,500 tonnes following the trade deal, although from a low base. More than 90 per cent of imports came from the EU followed by New Zealand. We also exported less by 6% (3,400 tonnes). Marked higher price of British cheddar cheese compared to the global market weighed on exports and supported the influx of imports.

Butter supplies in negative territory

Butter production declined by 3% (1,400 tonnes) year-on-year in Q1 despite higher prices in UK wholesale markets, perhaps due to the high cream price. Exports increased by 24% (2,200 tonnes) during the period, however, inspite of high prices compared to the global average. Lack of fats in the EU and difficulties over foot and mouth restrictions from Germany increase demand for British butter. Lower production also resulted in higher imports. Tight supplies in the domestic market have been fuelling prices. Overall, lower production and higher exports dragged down available supplies by 3% (1,600 tonnes), adding to the tightness in the market.

Powder supplies finely balanced as exports fill the gap

Milk powder production increased by 6% (1,400 tonnes) in Q1, driven by higher milk production. Imports also edged up during the period by 20% (1,100 tonnes) year-on-year. Exports increased by only 14% (2,100 tonnes) which, paired with the increase in production and imports, led to a marginal increase in available supplies by 400 tonnes. Good demand from Asia, Oceania, MENA, Latin America and Caribbean outweighed the decline in exports to the EU. Geopolitical factors in the global market are influencing trade flows.

In the Asian region, demand from China, one of the major dairy importers in the global market picked up slightly in the first quarter year-on-year after remaining muted in 2024. However, China continues to be challenged by surplus milk availability in the domestic market and a stagnating economy. Reporters do not expect any remarkable increase in exports to China in the coming months. Volatility in the exchange rates, uncertainties pertaining to Trump tariffs and tensions in the Middle-East will impact trade flows in the coming months.

Milk deliveries are at record highs this season which denotes increased production of dairy products in 2025. How demand absorbs this higher production will be crucial for underpinning the positive tone of the market.

Looking ahead, market commentators are expecting good demand ahead of summer holidays. According to Rabobank, slowing economic growth driven by weaker consumer confidence, trade tensions and consumers struggling with post-Covid inflation will pose challenges on the demand side. Trade dynamics will be one of the key watch points influencing available supplies in the market.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.