China pork market: offal imports continue to grow despite changing consumption

Tuesday, 15 April 2025

Key points

- Pork production declined in 2024, but it is expected to be relatively stable in 2025

- Both liveweight and wholesale prices continue to ease in 2025, although holiday demand provides temporary uplift

- Imports of pig meat, excluding offal, fell for the fourth year in a row, while imports of offal continued to grow

- Geopolitical tensions lead to trade uncertainties

Supply

According to the National Bureau of Statistics, China’s pork production in 2024 declined 1.5% to 57.06 million tonnes in 2024. Disease outbreaks led to some herd liquidation during the period. There continues to be market consolidation with small holders exiting the industry. Moreover, producers have been careful with sow herd expansion, removing unproductive sows and focusing on efficiency and productivity improvements.

In 2025, USDA forecast production to be relatively stable, at around 57.0 million tonnes. A declining inventory of finishing pigs will see slaughter numbers ease. However, increases in average carcase weight will support overall production. The impact of disease such as African Swine Fever (ASF) on production is expected to be limited due to stable management.

Prices

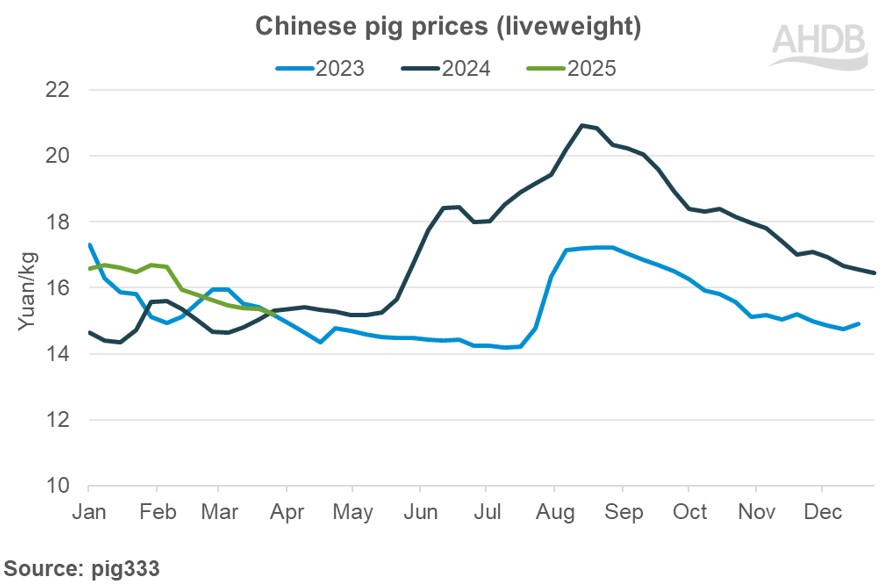

Chinese pig prices were generally higher in 2024 than 2023, averaging 17.1 yuan/kg (source: pig333.com), an increase of around 2 yuan/kg year-on-year. It is reported that the cost of production for producers was below 15 yuan/kg in 2024, compared to higher costs of above 16 yuan/kg in 2023. Better management of disease, lower feed costs and improved productivity have driven this trend.

However, so far in 2025 pig prices have been drifting southwards, except for a minor uplift prior to the Chinese New Year holiday at the start of February. Live pig prices started the year at around 16.5 yuan/kg and have fallen to 15.2 yuan/kg in the final week of March.

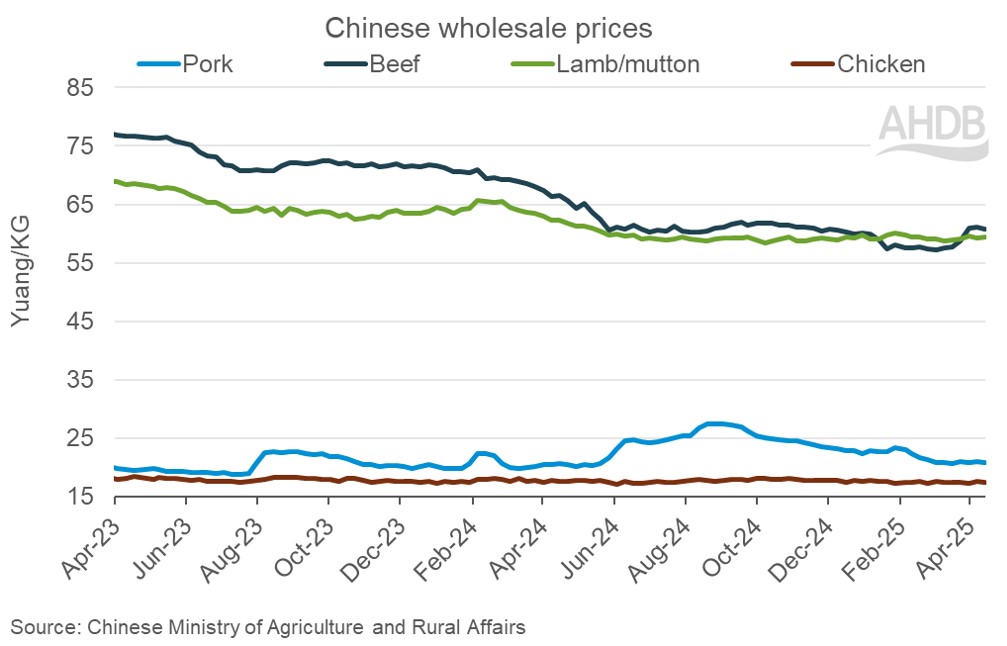

Wholesale pork prices have also been weakening through the first quarter of 2025 so far. As with live prices, there was a small uplift in prices through late January and early February to meet the demand of Chinese New Year, peaking at 23.4 yuan/kg on 27 January, prices have since eased to 20.8 yuan/kg on 14 April.

For the rest of the year, prices are expected to be more volatile, with supplies marginally tightening on one hand and softening consumer demand on the other.

Changing consumer habits and a stagnating economy are the leading drivers behind lower consumption. Consumers are shifting from pork to other animal protein sources like poultry and seafood for perceived health and cost reasons. Lower demand is seen both in the retail and hospitality sectors.

Imports

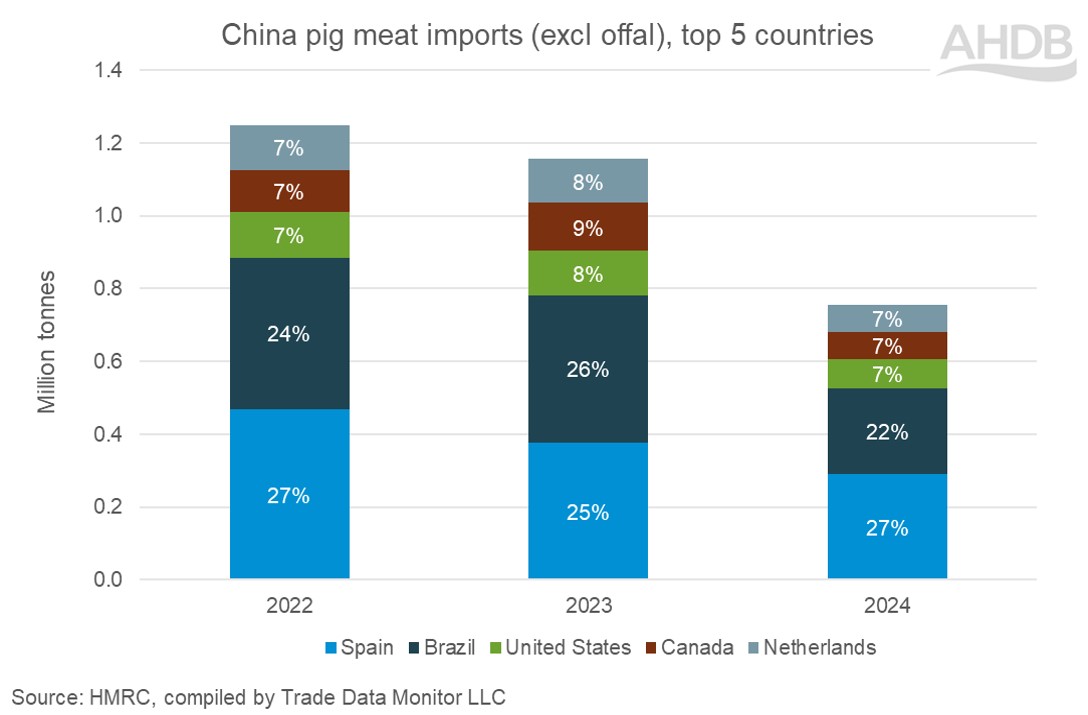

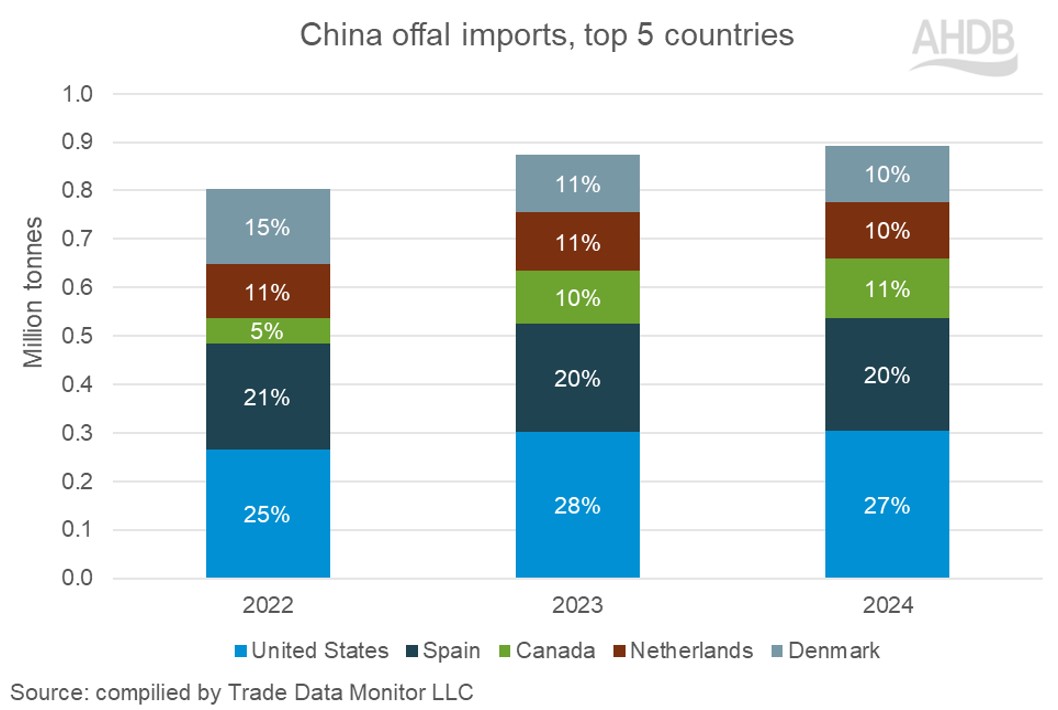

Over the last couple of years, we have seen two sides of the coin to China’s import volume; a trend of declining pig meat imports but an increase in offal. This has carried into 2024, where total pig meat (excluding offal) volumes declined for a fourth year, falling 31% year-on-year to 1.06 million tonnes in 2024. However, offal import volumes grew for a second year, up 4% year on year to 1.15 million tonnes. Looking at data for the first two months of 2025, volumes of both total pig meat and offal have grown compared to a year ago.

The EU27 remains the largest exporter of pig meat (excluding offal) to China. Spain has regained the top spot in the list of importing countries, having been knocked off by Brazil in 2023. Brazil now holds second position, followed by the USA. Both Brazil and the USA continue to be competitive on the global market despite EU prices easing.

Likewise, for the offal category, the EU27 retains the largest volume share, followed by the USA. However, the market share of EU product has been declining steadily from 2020 onwards. Specifically, the Netherlands and Denmark have lost market share to Canada.

Imports from the UK witnessed a year-on-year increase of 10% in 2024. Higher production boosted offal shipments from the UK.

Geopolitical tensions lead to trade uncertainties

According to Rabobank, Chinese import demand may be stable in 2025. However, uncertainties on shifting trade flows grow as geopolitical tensions rise. The ongoing tariff war between the USA and China is likely to displace product from the USA down the ladder of importing countries. Further opportunities for European and UK product may be created in this scenario, although the conclusion of last year’s anti-dumping investigation is yet to be given.

Disease outbreaks such as FMD and ASF have also increased in recent months, leading to export bans. This highlights the need for industry and individuals to remain vigilant with biosecurity if these vital trade routes are to remain open.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.