Dairy December forecast update: GB milk production scales uncharted levels

Wednesday, 3 December 2025

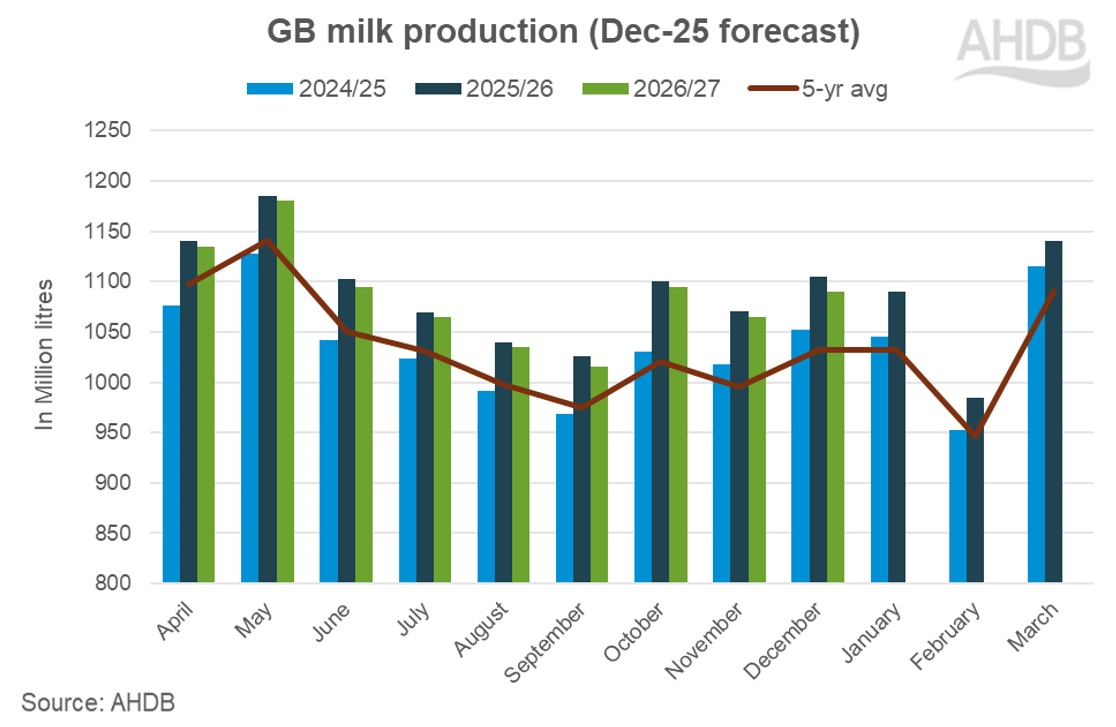

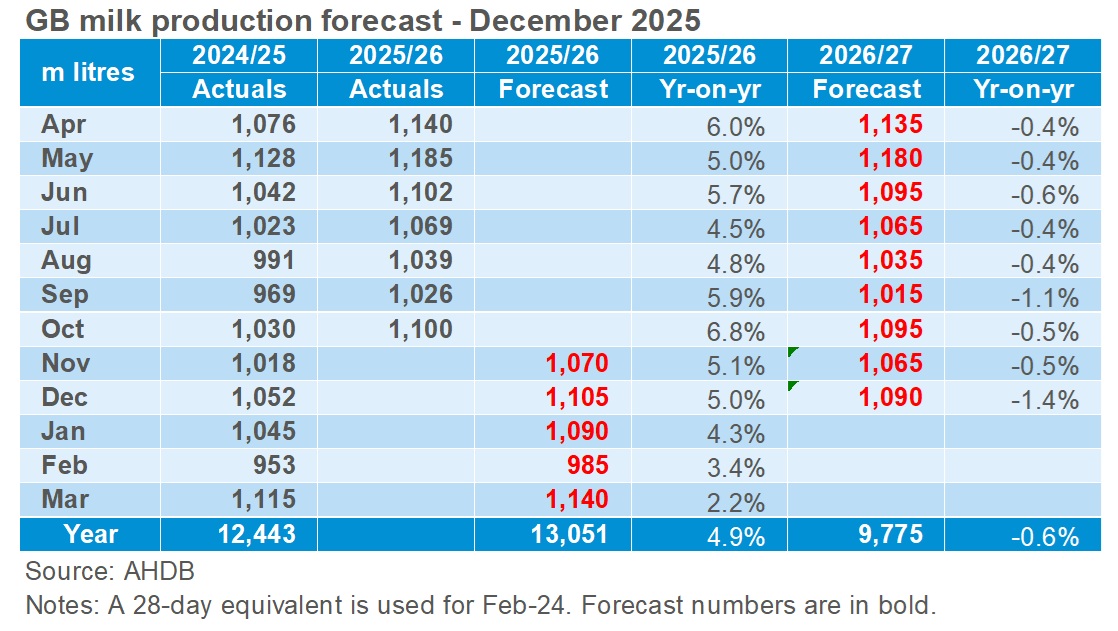

GB milk production for the 2025/26 season is forecast to record a new high of 13.05bn litres, 4.9% more than the previous milk year according to the December forecast update.

This milk year has seen incredible volumes with deliveries surpassing record highs. Not only is production running well ahead of last year, but it has also passed previous highs. Favourable dairy economics continue to boost yields thereby supporting overall milk volumes.

So far this milk year (April-22 Nov), deliveries are ahead 5.5% compared to previous year. We are also annualising against a period of high growth which began last September.

This growth is likely to continue until the spring flush despite recent falls in milk prices. Even though some milk prices have been cut substantially, some have not. Those on retail aligned or organic contracts have not felt cuts.

For others, high constituent levels in the milk will compensate for some of the headline milk price falls and soften the impact.

Beginning in the next milk year, the momentum is likely to cool down as prices fall further and the impact of punitive B-price mechanisms is felt, and milk deliveries are likely to decline gradually.

Favourable dairy economics are running out of road

The milk to feed price ratio continues to be in the expansion zone and is at a 20-year high as falling milk prices have not yet been seen in the data. A key factor is the availability of cheaper feed with record levels of compound feed being produced this season.

Defra’s average milk price for October stood at 46.56ppl motivating farmers to expand their businesses and grow production.

Additionally, this summer’s drought meant many farmers needed to feed more compound feed to compensate for lack of grazing in some areas. Moreover, the trend towards block calving has boosted milk flows in the autumn and winter months.

A mild Autumn also allowed for a late flush of grass growth, adding to milk volumes. These factors have added to the significant over-supply situation.

Markets are pressurised

Record milk volumes are pressurising commodity markets. Global milk deliveries also are now over-supplied, which is adding to the overall bearish tone of the market.

Latest figures for September showed that the EU was up by 4.3%, the USA by 4%, New Zealand 2.5% and Argentina 9.9%.

In response, bulk cream, butter, and cheese prices have seen significant losses of £835/t (32%), £1250/t (23%) and £460/t (13%) respectively since the last reforecast in September.

November milk prices have fallen sharply in some quarters which is affecting profit margins and farmer confidence.

However, these losses will be felt differently according to the type of contracts that farmers are on. Retail-aligned contracts are based on cost of production and are not as driven by dairy commodity markets.

Some areas, such as organic, that are still trying to rebuild milk supplies, have seen price holds in latest announcements. In September, the overall Agriculture Price Index for all agricultural inputs increased 2% year-on-year.

This was mainly driven by energy and fertiliser. Apart from feed costs, all other prices increased. Labour cost (which is not a part of the index) and availability is another challenge for the sector.

In addition to this, the cost of borrowing also remains high. Forage cost and availability this winter and higher bedding costs will also squeeze margins.

Another consideration is that the very high levels of fat and protein in the milk could compensate for some of the headline losses in farmers’ milk cheques. This could dampen the effect of price cuts in terms of slowing production.

The risk of diseases like bluetongue virus remains a potential factor for 2026. The EU milk situation demonstrates the impact that that disease could potentially have both in cutting supplies and in disrupting the timing of calving.

Although we are in a vector low period currently, it will remain a risk next year. However, the uptake of vaccines could mitigate some of the losses. Lumpy skin disease (LSD) and Foot and mouth disease (FMD) are also potential disruptors to monitor.

The outlook

The dairy market is likely to see further price falls as demand is unable to cope with oversupply in both the domestic and global markets which will be felt in headline milk prices in the months ahead.

However, the levels of decline in milk output in response will depend on the magnitude of price falls. We have based our forecast on the current published price announcements in the dairy market and changes in the MMV indicator and on 'normal' seasonal weather conditions.

This will be subject to change if there is a further, more extreme decline in prices and more extreme weather conditions.

The momentum of higher production is likely to continue for some time in the run up to the spring flush. Long-term breeding decisions would have been made when prices remained high.

As margins are squeezed, limited forage availability, increasing other costs will lead to reassessment of the herd size and culling decisions. Beef prices are currently extremely strong with deadweight cow prices sitting at 522p/kg this week, up from around 350p/kg a year ago.

At the time of writing, BCMS data was delayed but the latest data we have indicated herd sizes had declined by 0.6%. This suggests the growth seen was driven by yield growth rather than cow numbers.

Latest culling numbers show there has been a tick up in the last two weeks but still at fairly minimal levels as farmers adopt a 'wait and see' mindset.

After the flush we should see market signals to begin to be registered in the production numbers and should start to see some year-on-year decline, but it is important to note we will still be annualising versus a very high base and there is likely to still be too much milk for demand well into 2026.

Dairy farmers should adapt their future plans depending on what type of contract they are on ensuring they keep tight control of costs. Making the most of contracts to ensure they make the most of any bonuses and avoid unnecessary penalties will be critical.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.