- Home

- News

- Dairy March forecast update: GB milk production marches towards record volumes with some risk

Dairy March forecast update: GB milk production marches towards record volumes with some risk

Tuesday, 25 March 2025

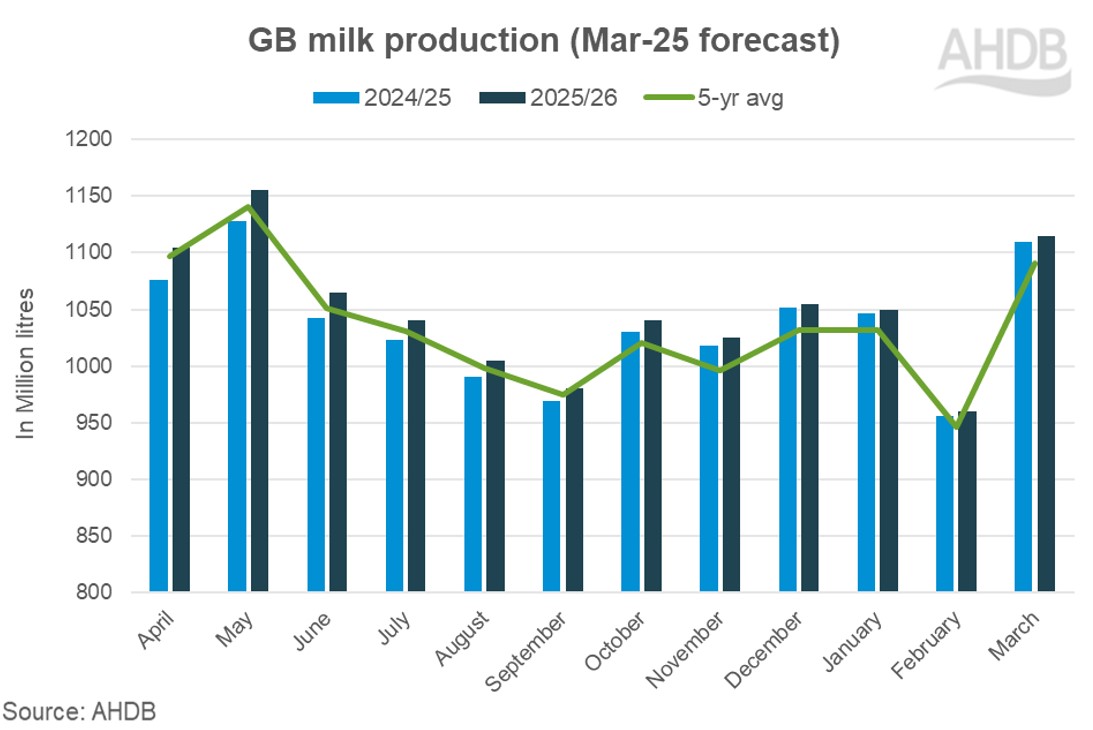

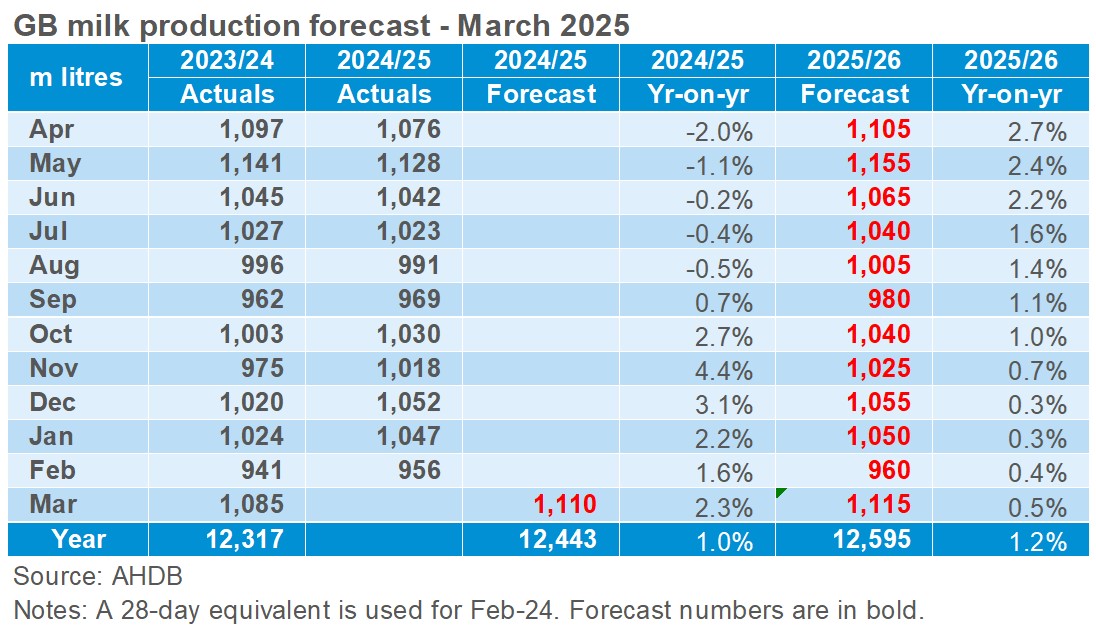

GB milk production for the 2025/26 season is forecast to reach 12.6 billion litres, 1.2% more than the previous milk year, according to our March forecast update

The past milk year was divided into two halves, with the first half trailing behind the previous year’s production following extremely wet weather conditions and lower prices. There was a turnaround in September 2024 with robust growth in milk volumes driven by higher milk prices, improving margins and good grass growth (varied in regions). The dry Autumn weather allowed the cows to stay out for longer leading to a revival of milk flows. This legacy is likely to be carried forward into the new milk season (2025/26) and volumes are expected to record new highs this season.

The improvements in milk production in the second half of 2024/25 season were predominantly driven by higher yields, encouraged by the high milk prices paid through the winter months and lower feed costs. An increasing shift to block calving, particularly the increase in autumn block, also encourages an increase in milk flows through the autumn and winter months compared to historic trends. The growth in the first half of the year (2025-26) will exceed growth in the second half of the year. However, we are annualising against a higher base in the second half of the year.

Prospects remain bright

The milk to feed price ratio is firmly in the expansion zone favouring further growth in production driven by both good milk prices and lower feed costs. In 2025, the weather so far has been far less wet than 2024. We are assuming more seasonable weather conditions are likely to continue through the flush period leading to earlier grazing of cows and better forage quality and availability this season. The milk to feed price ratio is almost at a 20 year high which will incentivise farmers to push production further.

Milk prices are much better compared to last year. The average Defra price for Dec-24 increased 21% year on year to 46.38ppl. Commodity markets, especially butter, have eased slightly in domestic markets as well as on the continent. However, they continue to sit at historically high levels. Generally positive milk price announcements in March also supports this.

In general, inflation in key input costs, has slowed in recent months. In November, the overall API for all agricultural inputs continued to fall, down 5 index points year-on-year. Lower input costs will boost farmer’s confidence and support business planning. Average concentrate prices have declined 6.7% to £302/ton in Dec-24 year on year. The combination of lower production costs, higher milk to feed price ratio, favourable weather and higher milk prices will support production.

Challenges persist

Cow numbers are less, with the size of the GB milking herd in January 2025, 0.9% lower than a year earlier. This is the lowest January month on record. This could mean farmers may need to plan carefully exits from the herd and their heifer replacement strategies and is certainly something for the sector to keep an eye on.

Excellent beef prices have incentivised both culling and a greater use of beef semen which have constricted dairy cow and youngstock numbers respectively. The availability of replacement heifers from the continent is limited due to the prevalence of Bluetongue Virus on mainland Europe and this could affect herd management decisions and impact the future national herd size.

Long-term environmental and structural changes are also barriers for future investment. The increase in inheritance tax and the recent closure of the SFI scheme could damage the morale of the farmers, and their likelihood to invest further in infrastructure. Though recent cuts in interest rates have been announced, they are still higher compared to the previous decade which also holds back investment.

A big increase in labour costs also pose a challenge for the sector. These have continued to rise over the past 12 months, up another 4 index points. The National Living Wage and National Insurance costs are set to rise in April which will exacerbate the issue further.

Disease outbreaks such as TB and BTV pose a significant risk to our forecast. BTV in particular has significantly impacted milk production in regions such as France, Germany and the Netherlands. With warmer temperatures ahead the spectre of BTV in the UK will return. Much will depend on the availability, speed and uptake of vaccinations. Currently, the outbreak of Foot and Mouth Disease in Germany has been contained but new cases have been reported in Hungary and Slovakia.

Growing geopolitical tensions in the global markets like conflict in the Middle East, EU-China trade war and the recently announced tariffs by the Trump administration will change trade dynamics and could dampen market sentiment. Quite how these dynamics will play out is yet to be determined but represents a risk.

Going forward

Easing feed costs will promote farmer confidence and business expansion but this could be offset by other costs such as labour, environmental regulatory compliance and replacement heifer costs. The growing threat of disease also presents significant downside risk to the forecast. On the demand side, higher commodity prices may continue to flow through to the supermarket shelves thereby squeezing the budget of the consumers and stifling demand.

Global economic and geopolitical developments will inevitably exert influence. The extent to which commodity prices will ease will depend on demand in the domestic and global markets. This coupled with other significant structural and environmental policy changes may continue to play a larger role in farm decision making.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.