Dairy market outlook - autumn 2019

Wednesday, 11 September 2019

by Patty Clayton

Dairy markets now...

- UK milk production has hit 25-year highs almost every month from January to June. Total deliveries in the first half of the year were up 2.8% compared to last year and 3.7% compared to the 5-year average (2014-2018)

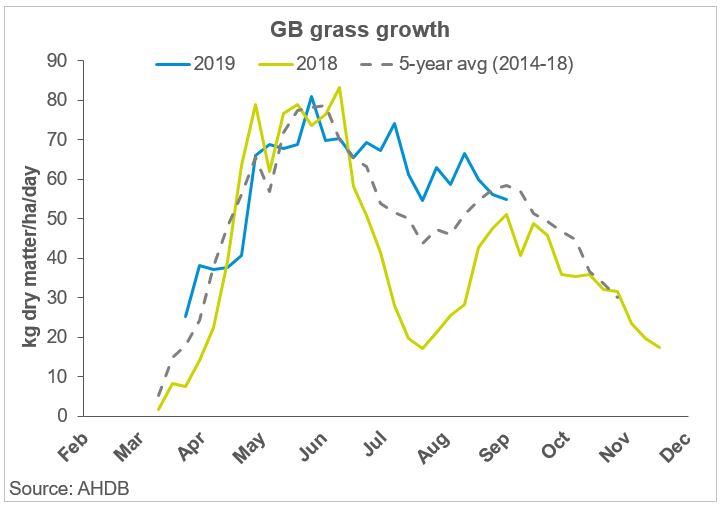

- Yields were enhanced in the first quarter of 2019 from the increased use of purchased feed, while excellent grass growth has supported yields over the spring and summer.

- Milk production in the EU between January and June of this year is not showing the same growth, with total deliveries up by only 0.4% year-on-year. Declines in production in Germany, France and the Netherlands have mostly offset the growth seen elsewhere (Ireland, Poland, UK).

- Product availability in EU markets has varied, impacted mostly by trade flows. Total available supplies of butter and cheese (12 months to May) are on a par with last year, while SMP supplies have been depleted by strong exports and a drop in production over the period. WMP supplies are up as export volumes fell over the year.

- The lack of excess stocks of most dairy products, along with limited supply growth in key dairying nations, has helped to limit downward movements in wholesale prices. The exception is butter prices, which have been declining steadily since summer 2018 as demand from the food manufacturing sector has dropped.

- Despite lower market returns, UK farmgate prices have remained in the region of 29ppl on average over the previous 12 months (Jul-Jun), slightly above the 5-year average of 27.5ppl.

Global market outlook

- Globally, milk production growth for 2019 is expected to be limited. Weather is the main issue limiting growth, although low margins in the US and Australia are also playing a part. New Zealand has started its new season on a high note, although Fonterra’s recent financial results, leading to the absence of a dividend payment this year, may put some pressure on NZ farmer margins.

- Product availability across the main exporting nations is estimated to be well balanced. There is some build-up of cheese stocks in the US, as high prices and trade tensions are limiting their exports.

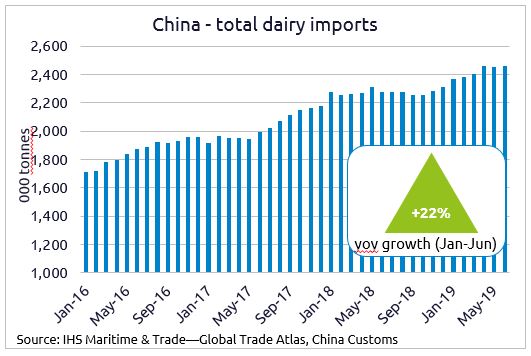

- China’s import demand has been strong so far in 2019, with the exception of whey. It is uncertain if the higher imports have led to some stock building or have simply replenished stocks after lower than normal imports in 2018.

- On balance, the outlook for commodity prices at a global level is relatively stable. Any downside risks will come from the impact on China’s import demand from the weakening of its currency against the US dollar and lower consumer spending due to slow economic growth in the US and EU.

The domestic outlook…

- Milk yields are expected to return to more normal levels in the second half of the year as farmers reduce concentrate usage in a bid to recoup margin and make use of plentiful silage stocks.

- This, combined with the reduced milking herd, is expected to lead to slower growth in milk deliveries.

- Market returns have been put under pressure from high milk deliveries, particularly for fat-based products, leading to some cuts to farmgate prices in recent months. These have predominantly affected those supplying liquid milk markets.

- On balance, lower milk deliveries in the UK should reduce some of the pressure on wholesale markets, providing some support to farmgate prices as we move into the new year.

- Brexit outcomes will, however, play a major role in market outcomes in the final quarter of the year. In a no-deal scenario, exports could be severely disrupted, leading to a build-up of stocks (cheddar and butter) and cash flow pressures for these manufacturers.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.