- Home

- News

- Dairy September forecast update: GB milk production to peak, with some impact from incoming milk price shifts

Dairy September forecast update: GB milk production to peak, with some impact from incoming milk price shifts

Thursday, 2 October 2025

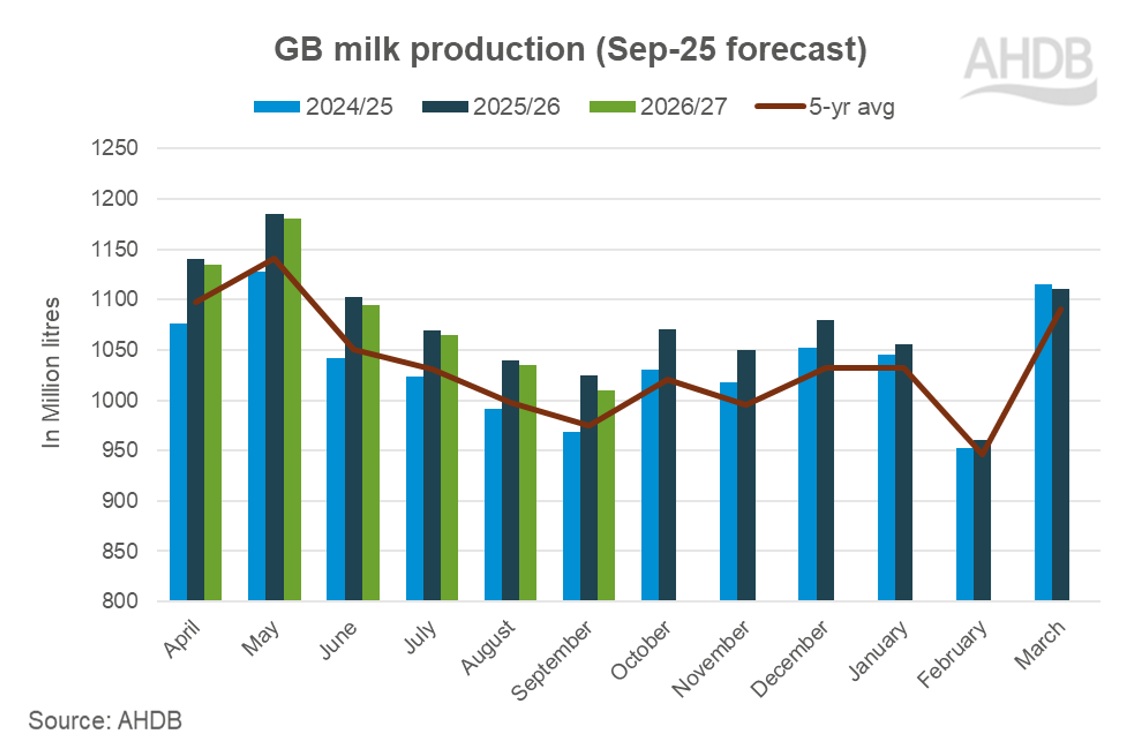

GB milk production for the 2025/26 season is forecast to record a new high of 12.89bn litres, 3.6% more than the previous milk year, before beginning to contract according to our September forecast update

GB milk volumes have continued to march through the summer. Spectacular year-on-year growth in milk volumes began last year in September, driven by higher milk prices, lower feed costs and improving margins. The momentum is likely to be carried forward in the remaining months of the 2025 calendar year with milk volumes recording new highs in the current milk year (2025/26), before beginning to fall back in early 2026.

The improvements in milk production have been driven primarily by increasing yields. Farmers were incentivised to push production: retain cows in the herd and feed for growth, in the face of favourable margins, even though there were grass growth challenges for many. However, beginning next year, the flow of milk is likely to slow down amid easing commodity prices and consequent milk price falls, and we will be annualising against a year of record volumes. This is likely to trickle through the first half of the next milk season (2026/27). We have built in the forecast balancing both the bullish and bearish factors influencing the market under the current scenario.

Cheap feed, but other costs may challenge

The milk to feed price ratio remains firmly in the expansion zone, at an almost 20-year high, incentivising farmers to continue to push production. Feed costs continue to decline, standing at almost 3% lower year-on-year (as of June-25). Feed costs are expected to remain favourable for the farmers in the coming months.

Autumn rain after the drought is producing a flush of grass growth which could take some pressure off forage stocks for a time and may enable a late silage cut. However, forage costs and availability this winter will be a challenge for some.

Inflation of overall key input costs, which constitute a vital part of cost of production, nudged up slightly by 0.3% in July-25 compared to the previous year. However, there was variable performance across fertiliser, energy and feed. Easing feed and fuel costs will continue to boost farmer’s confidence. This index does not account for labour costs which have continued to increase though, and the cost of borrowing remains high. Forage costs will also be abnormally high for some (although by no means all) this year. However, high production levels will continue as long as milk prices remain high enough to support the favourable milk-to-feed price ratio.

The risk of Bluetongue virus which was threatening in the early part of the year, and has caused significant milk supply issues on the continent, has not yet impacted on milk production at a national level. However, it remains a risk next year and is a risk to fertility as well as production and the advice is still for farmers to discuss vaccination with their vets.

The market is turning

However, rising milk volumes have started to pressurise commodity prices. Butter and cheese prices have seen a significant decline of £510/t and £410/ton respectively in September month-on-month following the lead on the continent. Record milk volumes have resulted in building up of stocks whilst demand remained subdued. Whilst milk price announcements for October have been mixed, those for November are showing a number of very sharp falls which will start to damage farmer confidence.

The question is how widespread and how fast the milk price falls will be, and how that will marry up with costs. Organic and some other speciality dairy prices have remained strong due to a shortage of organic milk. Some processors have taken a short, sharp correction approach, whilst others so far look to be taking a more progressive approach. Those farmers on the latter contracts will not feel significant falls until the new year. For those on manufacturing contracts very strong fat and protein levels in the milk will also compensate for some of the headline price falls. This may lead to a delay in falls in the yield over what headline milk prices may predict.

Cow numbers are declining, with the size of the GB milking herd in July 2025 0.6% lower than a year earlier. This is mainly driven by the decline in the under 4-years of age categories highlighting the issue of shortage of replacement heifers for the future. Lower milk prices, teamed with the need to buy-in costly forage supplies for some and increased bedding and labour availability and cost challenges (+8.6% in June year-on-year), will cause many to assess their herd size. Exceptional beef prices and lower culling rates through the summer is likely to cause cow numbers to fall by Spring as more come forward for slaughter. This will start to slow production.

The forecast

Slumping commodity prices and falling milk prices will begin to feed through levels of milk production. As mentioned, the extent of the decline in milk output will depend on how much milk prices fall in the coming months. Our forecast is based on current observed falls in commodity prices and normal weather conditions. However, a more severe fall in prices and extreme weather conditions could result in further lowering of output in the next milk season.

Nitrates derogation policy in the EU, the price differential between EU and global commodity values, shifting demand and global supply growth are key factors to keep an eye on along with observing shifts in global trade. Rabobank has predicted faster growth in global supply in the second half of 2025. Demand will need to be robust to keep pace with this supply which is challenging where GDP growth is sluggish. Dairy farmers should be prepared for uncertain times ahead and plan their farming business strategy accordingly.

.jpg)

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.