Decline in cheese production whilst powders and cream increase in 2024

Thursday, 17 July 2025

Raw milk availability for processing increased in 2024 following record volumes in the second half of the year. How was that milk used?

Milk production increased since last September with favourable dairy economics incentivising producers to scale up production and volumes are sitting at record highs. UK milk deliveries for the 2024 calendar year increased 1.2% year-on-year to 15.0 billion litres.

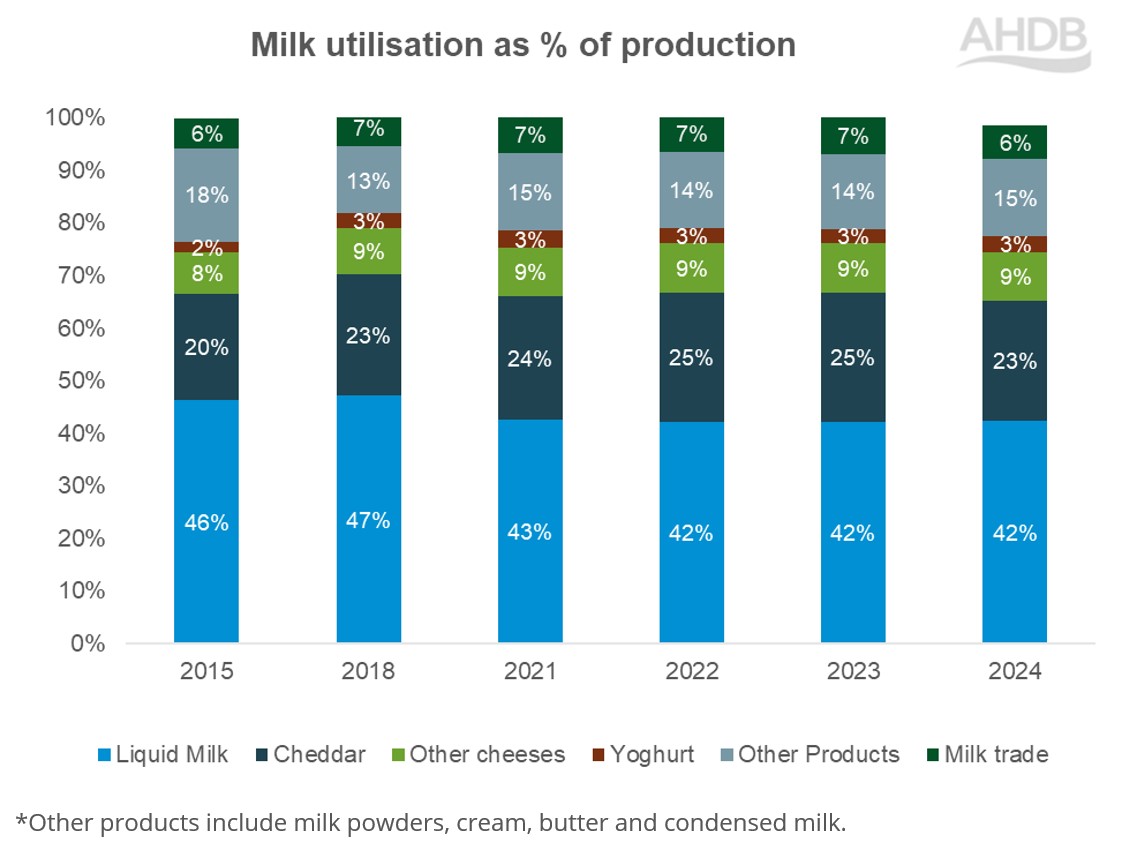

In 2024, 42% was processed into liquid milk, unchanged since last year, though there is an overall longer-term decline compared to 46% in 2015.

Just under a third (32%) was processed into cheese. Of this, cheddar is the largest variety produced at 23% of total milk utilisation. This was a small decline compared to 25% in 2023 whilst other cheese types remained stable at 9%. The cheddar category accounts for more than 70% of total cheese production.

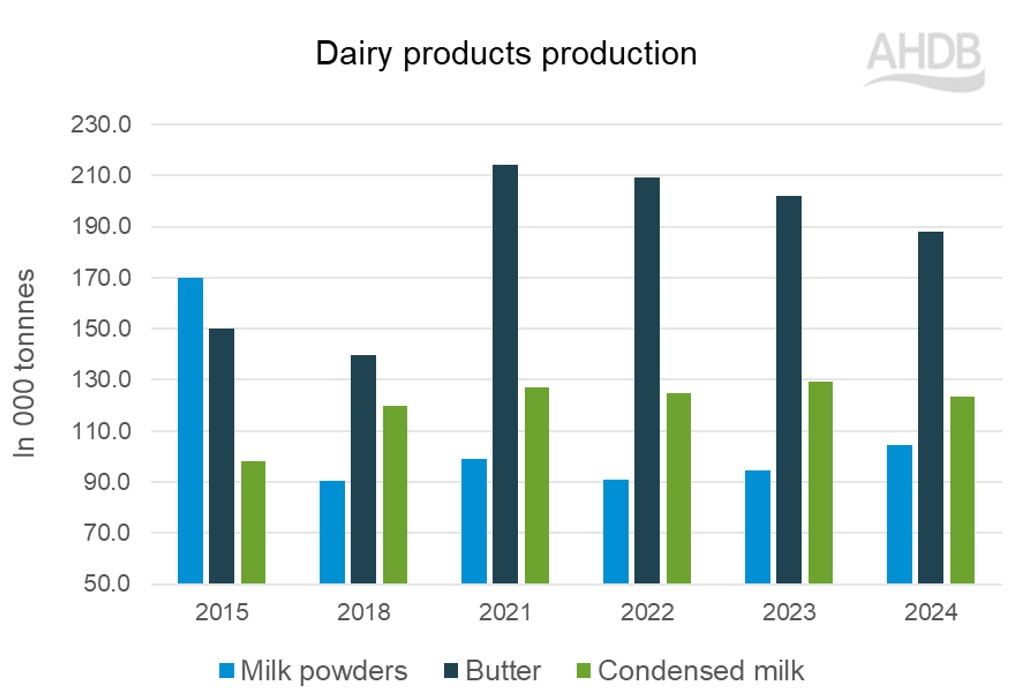

For other categories like yoghurt and milk trade year-on-year, milk utilisation remains unchanged at 3% and 6% in 2024. Other dairy products have seen a small increase to 15% in 2024, which includes milk powders, cream, butter and condensed milk. Milk powders and cream were the major contributors, increasing by 10.4% and 7.2% respectively compared to previous year. Milk utilisation for butter and condensed milk declined by 6.8% and 4.6% respectively during the period.

Factors driving these changes

In 2024, Milk utilisation for cheddar cheese declined to 23% compared to 25% in the previous year. Though milk volumes were higher on the year, less got diverted to cheddar cheese as more milk was made available for milk powders and cream. Record high prices of butter incentivised processors to produce more cream. Although butter prices were very high, at times cream demand on the continent (and value) was high enough to not warrant producing butter. Despite lower production, exports of cheddar cheese were recorded marginally higher by 23.6% in 2024. Surplus availability of milk diverted the usage towards milk powders, which have a higher shelf -life. The decline in milk utilisation of butter was in line with an overall declining trend in the EU.

With milk volumes forecast to record new highs in 2025/26, it will be interesting to watch, what will be the proportion of milk usage for different dairy products be in the coming year. New investment in processing facilities such as milk powders and mozzarella plants could support some changes and allow UK production to pivot towards global demand drivers.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.