Demand supports organic milk prices

Tuesday, 18 November 2025

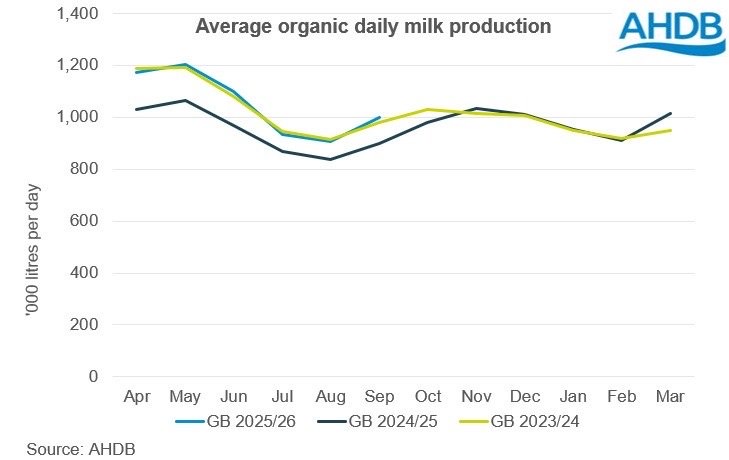

GB Organic milk deliveries have soared ahead alongside the strong growth in total GB milk deliveries volumes. Volumes have shown year-on-year growth since March 2025, with the latest GB organic delivery estimates (up to 8 November) showing a 11.6% year-on-year increase in the milk year to date. This is equivalent to an additional 24.6 million litres of organic milk.

However, in comparison to the previous 2023/24 milk year, volumes are up by a more modest +1.7%, showing that these are mostly recovery gains. Volumes remain significantly below (-7.8%) the 4 year average which was held up by the years prior.

Organic milk prices

Total milk volumes have been supported by favourable milk prices until recently. Milk price announcements in November have been strongly negative for the majority of processors as commodity prices have slumped. Conversely, organic milk prices have held, with no cuts announced so far. Again, this is reflective of industry pushing recovery back to normal levels, rather than oversupply.

The widening gap between conventional and organic milk prices suggests stronger demand for organic milk and need to maintain organic milk supplies – what is happening to retail sales?

Strong retail demand for organic supports prices

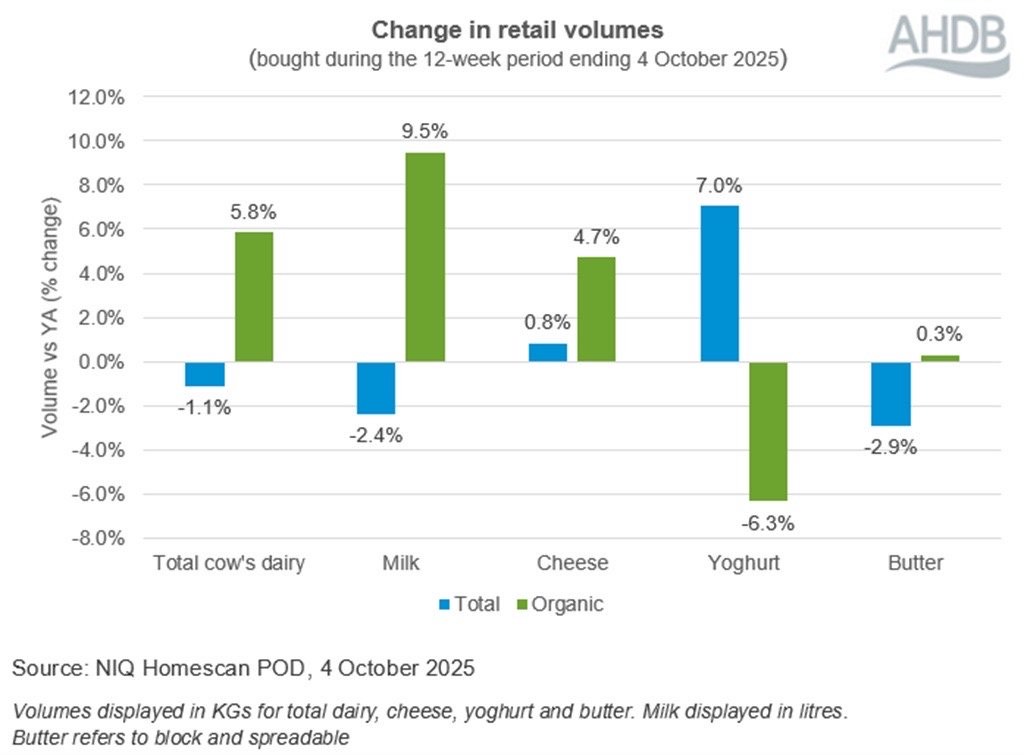

According to NIQ Panel on demand, in the 12-week period ending 4 October 2025, total cows’ dairy volume sales (including organic) fell by 1.1%, compared to the same period in 2024. Meanwhile, total cows’ dairy volumes with an organic claim saw an increase of 5.8%.

Within total organic cows’ dairy, significant volume gains were seen in the categories of milk (+9.5%) and cheese (+4.7%), while organic butter edged up slightly (+0.3%). Organic yoghurt was the only subcategory to decline, down by 6.3% during the period. In all categories but yogurt, organic significantly outperformed conventional.

Recent research highlights growing demand for products that deliver both quality and versatility, particularly in premium yoghurt and cheese, despite commanding a higher price showing opportunity for premium dairy products.

Looking at the 52-week period ending 4 October 2025, the overall total milk category declined 2.7% year-on-year. However, when splitting out by fat content options, whole milk grew by 2.3% year-on-year (equivalent to 26.5 million litres), due to an increase in shoppers. This could be linked to consumer concerns around ultra-processed foods gaining traction. We see a similar story in growing demand for block butter over spreads. The organic dairy category is likely to have benefitted from customers with similar priorities for health and naturalness.

According to the Soil Association annual market report, consumer support for the total organic category showed strong performance in 2024, despite the cost-of-living crisis. Total organic unit sales experienced four-times more growth than non-organic in major retail.

As consumers continue to evaluate the value for money of products, it is vital that the quality credentials of organic food are communicated to maintain strong demand.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.